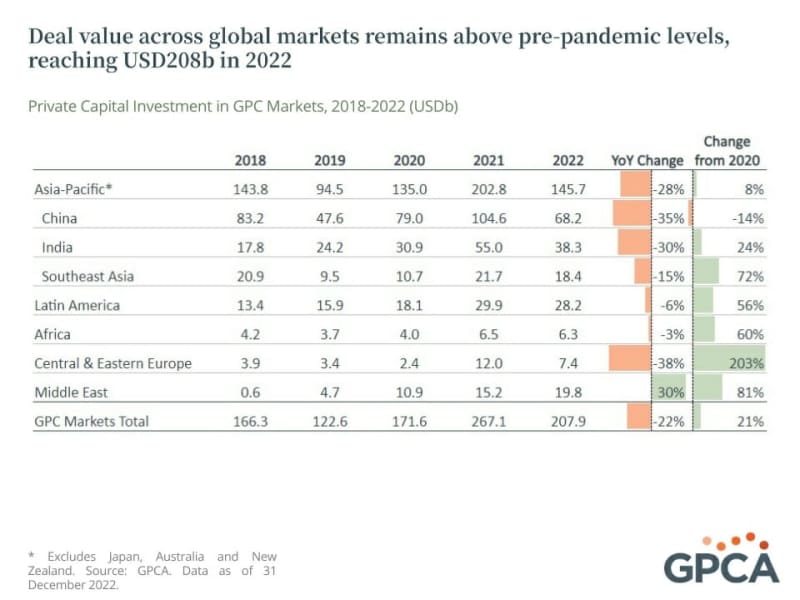

Private capital investment activity across GPCA’s markets remained strong by historical standards in 2022, with fund managers deploying USD208b.

Private Capital Investment Activity Remains Strong

- Overall deal value declined 22% from 2021, yet 2022 was still the second highest on record.

- The drop-off over 2022 was concentrated in late-stage VC and growth PE rounds, with public markets volatility, inflation and energy crises damping optimism around tech-enabled consumer platforms, fueling the runup in 2021.

Q4 2022 hedge fund letters, conferences and more

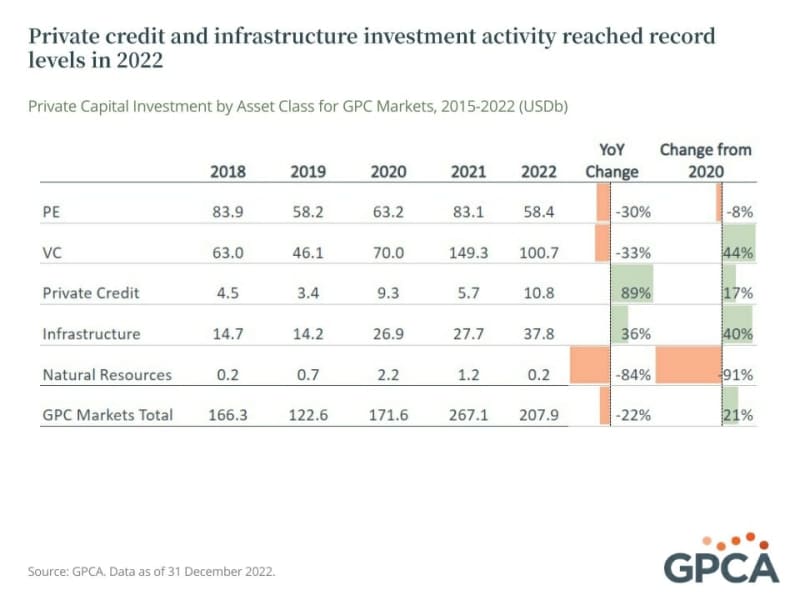

In contrast to PE and VC, private credit and infrastructure activity accelerated in 2022.

- Private credit and infrastructure deal value increased 89% and 36%, respectively, year over year, reaching the highest levels on record.

- Private credit fund managers are funding a diverse array of opportunities as companies seek creative financing solutions, such as:

- Infrastructure loans (Concesionaria Unión del Sur, Mumbai International Airport, Genser Energy)

- Non-performing and distressed opportunities, concentrated in Asia and Latin America (YES Bank, Subic Bay Shipyard, Grupo Aeromexico), as well as

- Senior and mezzanine financing for middle-market businesses, such as BluePeak Private Capital’s USD20m investment in Ghana’s ieng.

- Beyond renewable energy assets (see below), telecom and digital continue to be a focus for infrastructure investors in global markets, including listed platforms seeking private financing, such as China’s GDS Holdings and Indonesia’s Tower Bersama Infrastructure.

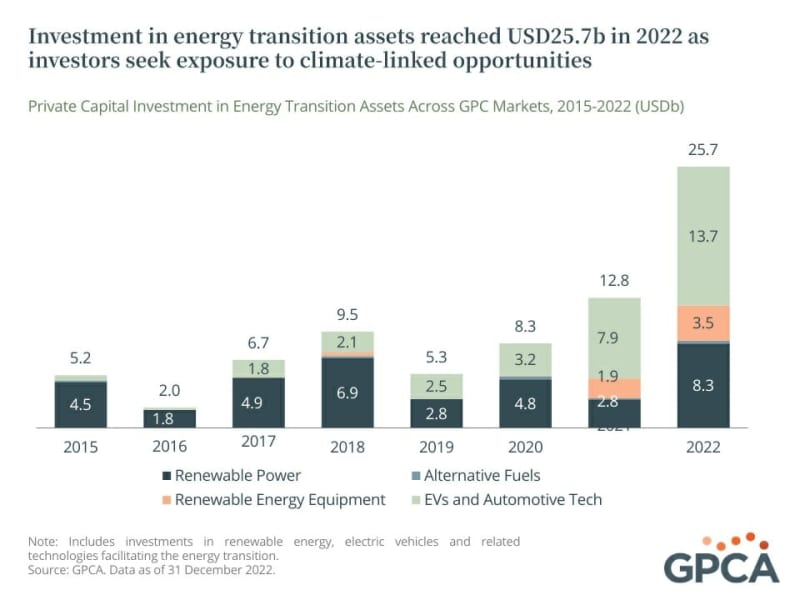

Investment in energy transition assets doubled in 2022, even amidst the broader market uncertainty.

- Climate change mitigation and adaptation have been driving forces behind a surge of capital into renewable energy infrastructure assets and new electric vehicle startups.

- After a slow 2021, renewable power investments accelerated in 2022 to USD8.3b, including GIP’s USD2b buyout of Latin America-focused Atlas Renewables, Actis’ India-based BluPine Energy (USD800m) and CEE-focused Rezolv (USD509m) platforms and KKR’s USD400m investment in India-based Serentica Renewables.

- EV and automotive tech companies across a record 15 countries received private capital backing in 2022, including Brazil (Leoparda Electric, Voltbras, Origem), Egypt (Shift EV) and Poland (Ekoenergetyka).

Following a record-setting 2021, VC deal value declined over the course of 2022 as tech valuations undergo a correction and many startups streamline operations. Yet not all sectors were affected equally.

- In addition to unparalleled EV and cleantech interest (see above), computer hardware, gaming/media and agtech all posted year-over-year gains in VC investment value and deal count.

- Many startups have opted to raise non-dilutive capital to support operations, with venture debt financing growing across all GPC markets except India and CEE in 2022. Notable venture debt rounds included LatAm's Keo World (USD500m), Indonesia's Traveloka (USD300m) and Kredivo (USD145m), India's Stashfin (USD200m) and UAE-based Tabby (USD150m).

- Overall VC deal count actually increased year over year, as local GPs continue to back new businesses even as the pace of deployment in highly valued late-stage startups slows.

About Global Private Capital Association

The Global Private Capital Association (GPCA), formerly the Emerging Markets Private Equity Association (EMPEA), is a non-profit, independent membership organization representing private capital investors who manage more than USD2t in assets across Asia, Latin America, Africa, Central & Eastern Europe and the Middle East.