What’s New In Activism – Salesforce Not Out Of Trouble Yet

Elliott Management welcomed Salesforce Inc (NYSE:CRM)’s strong fourth-quarter results but said the cloud-software giant needs to do more on the governance front to ensure “proper” oversight.

Wednesday afternoon, Salesforce posted better than expected revenue and adjusted operating profit for the fiscal fourth quarter ended January in an earnings report that also announced a doubling of the company’s share buyback plan to $20 billion.

Q4 2022 hedge fund letters, conferences and more

Shortly after, Elliott put out a statement saying the Salesforce report "represents progress towards regaining investor trust." The activist hailed the company's decision to disband its M&A committee, which CEO Marc Benioff said was part of a transformation effort focused on boosting profitability.

Still, Elliott said "much work" remains to be done, arguing Salesforce "needs a sustainable leadership plan and a board that demonstrates it can provide accountability through proper oversight." The activist's comments came hours after news broke that it had nominated a director slate at Salesforce.

Activism chart of the week

So far this year (as of March 2, 2023), 23 Korea-based companies have been publicly subjected to governance-related demands. That is compared to nine in the same period last year.

Source: Insightia |Activism

What’s New In Proxy Voting - Australian Greenwashing

The lack of mandatory corporate climate reporting standards in Australia has resulted in most companies voluntarily reporting on their ESG commitments in an unstandardized manner that investors have long argued is difficult to analyze and compare with peers.

Voting chart of the week

In the 12 months to June 30, 2022, investors voted in favour of environmental and social shareholder proposals 46.5% of the time, globally. That is down from 49.2% in the previous 12 months.

Source: Insightia |Voting

What’s New In Activist Shorts - J Capital v Marathon Digital Holdings

J Capital Research issued a short report on Marathon Digital Holdings Inc (NASDAQ:MARA), accusing crypto-mining company's management of enriching themselves at the expense of shareholders.

In its report, J Capital alleged management may have taken $250 million out of the company via overstated purchases of miners. It also claimed Marathon awarded shares to a company that appears not to exist and paid $35.5 million to a related party company without disclosing that company's business.

It also noted that stock-based compensation awarded to just 10 employees in 2021 totaled $161 million, while the company lost $13 million on a pre-tax basis that year.

"Massive share compensation and dilution indicate that shareholders are extremely unlikely to make money from this stock," J Capital wrote.

Shorts chart of the week

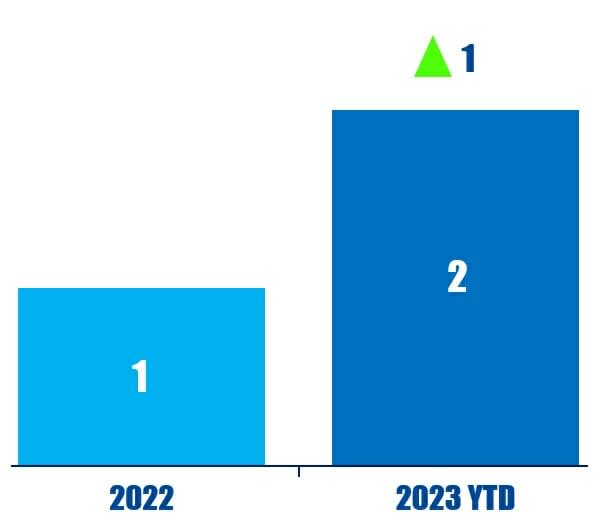

So far this year (as of March 3, 2023), Wolfpack Research has publicly subjected two companies to an activist short campaign, up from one in the whole of 2022.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from ZTO Express as it refuted Grizzly Research's short report. Read our coverage here.

“The company believes the report is without merit and contains numerous errors, unsupported speculations, and misleading conclusions and interpretations. It also shows a lack of basic understanding of the company’s business model and financial reporting structure.” - ZTO Express