By Kaisar Andrabi

For the past three days, Aakash Yadav, a 22-year-old resident of the Vasai area of Palghar Mumbai, has been desperately attempting to call the cyber helpline number 1930 to complaint about the harassment calls he has been getting.

His calls went unanswered and all that he heard was an automated response: “Welcome to the cyber helpline number…” before the call dropped once again.

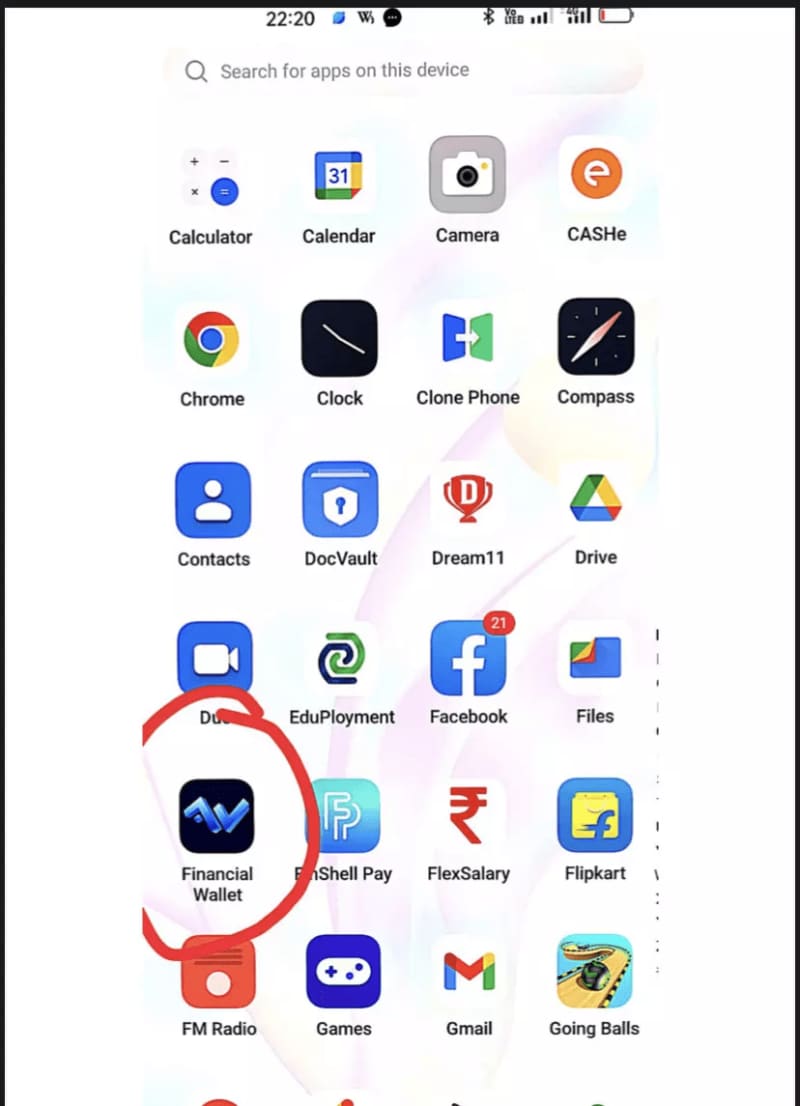

On March 8, Yadav was checking his eligibility criteria to avail short-term loans. On Instagram, he stumbled upon an app - Financial Wallet. He clicked on the post which took him to Playstore from where he downloaded the app. As soon as he entered his phone number, his account was credited with Rs 3,250. Before he could comprehend what was happening, an additional amount of Rs 2,275 was credited to his Union Bank account.

While Yadav didn’t check the source of the money, a total sum of Rs 5,525 was sent to his account. And then on March 11, he received a call from an unknown number demanding a repayment of Rs 14,000 against the loan he had ‘supposedly’ availed.

Yadav, who used to work at a glass company as a technician, told the caller that he had not taken any loan. But the unknown caller insisted that he took the loan on March 8 and need to return the amount. “I clarified that I was unaware of any such loan and would return the credited amount,” Yadav told BOOM.

The caller warned him of dire consequences in case he refused to transfer the ‘loan’ amount. Yadav said that the scammers had hacked into his mobile phone and stolen all of his contacts and data. They even called on his aunt's phone in an attempt to extort more money, he said.

“I immediately returned the money they had credited to me, but their calls didn't stop. I became anxious and deleted all my contacts and WhatsApp, and kept my phone switched off for the entire day,” he said.

When he switched on his phone again, he received more calls. Yadav said the caller used the choicest of abuses in a threatening tone.

A Helpline Number 1930- Does It Work?

A National Cyber Crime Reporting Portal- 1930- was launched in August 2019 following a rising number of cybercrime cases. In less than two years the portal received over three lakh cases.

The helpline number is supposed to prevent financial fraud via cyber means and also to track down the fraudsters who deploy devious means to cheat gullible consumers. The service was revamped last year following an increase in cyber-related crimes in India. This was to ensure that victims don’t keep running from pillar to post to get their complaints registered and also to recover their stolen money.

However, victims of online fraud that BOOM spoke to complain that the helpline service has remained unavailable when they needed help.

According to the National Crime Records Bureau (NCRB) data, India reported 52,974 incidents of cyber crimes in 2021, an increase of nearly six percent from the previous year. In 2020, 50,035 cases were reported and 44,735 cases were reported in 2019.

Even though cyber and legal experts have been pressing for data protection law after several cases of data breaches and cyber-related crimes, India is yet to provide data protection law to its more than 140 crore population.

Days after the threatening calls began, and Yadav failed to get through the helpline number he registered a complaint online at www.cybercrime.gov.in

The local police has assured him that the cybercrime department will look into it and advised him to keep his phone switched off.

Yadav’s ordeal didn’t end there. On March 13, Yadav’s morphed photos were sent to his father’s WhatsApp number. Obviously, the objective was to shame and blackmail him. It left him scared.

“The morphed photos can ruin my life. This can impact my relationship with my family and jeopardize my prospects as a groom,” Yadav told BOOM, adding that he believes all his private details are available to the fraudsters. “There is no privacy at all. I am helpless. I am silent because I think about my family,” he said.

The 22-year-old Mumbai resident thinks that his mistake was to upload his identification details on a website called - Upwards - another loan app. “I uploaded my Aadhar and PAN card details and put in my current and permanent address. I added whatever other details they asked for,” he added. A jobless Yadav was desperately trying to get a loan with the aim to fly abroad to search for work. But before he got the loan, he started getting threatening calls for the loan.

What’s The ‘Golden Time’ To Report Fraud?

Speaking to BOOM, Ritesh Bhatia, a cyber security expert said that if the victims report online fraud during the ‘golden time’ – within thirty minutes of the fraud – there are high chances of recovery of the stolen money.

“If the victim senses immediately that they have been scammed, the helpline experts with the help of advanced software can trace where the money went and can contact the bank quickly to freeze the amount. They are basically able to block the transaction,” he explained.

Bhatia added that generally, the service has been effective in saving people from getting duped. However, he said that on the weekends and also during late night hours, the chances of recovering money diminish for the lack of human resources which include cyber cops, engineers, etc.

Moreover, even after reporting online fraud, the victims are directed to visit nearby police stations to register their complaints. “In such a situation, the victim gets deprived of the facility that could save their money well in time,” he said.

Rahul Jha, an autorickshaw driver in Delhi’s Khanpur area is one among them. He was scammed by an unknown caller, purportedly from his bank State Bank of India, who got him to transfer money for a policy that would give him high returns within six months.

He was asked to confirm his account number and share the OTP he received to check the eligibility. Rupees 32,000 was wiped off in seconds from his bank account.

“When I enquired about the money, the caller assured me that it will be deposited to his account and dropped the call in haste. When I told my friend about it, he made me realise that I was duped. He told me to call 1930 and inform them,” he told BOOM.

But after multiple attempts to the 1930 helpline number, his calls got connected. The person on the other end of the helpline asked him to go to the nearby police station and file a complaint.

Jha filed a complaint, but his hopes of getting his money back were shattered when the police told him, “We try our best to trace the culprit but not everyone is lucky enough to get their money back.”

How Does The Cyber Helpline Work?

Once a caller registers a complaint with the cyber helpline, they reach out to the respective bank to freeze the transactions. However, victims and experts say that the helpline, although supposed to function 24x7, is not responsive on weekends and late hours of the night.

A senior cyber security police officer, on the condition of anonymity, told BOOM that complaints of fraud that come on weekends and late evenings are difficult to resolve because bank officials are unavailable at those times.

“Even if we track where the money went, we cannot block or freeze the payments of the fraudsters unless the banks won’t do it. Unfortunately, on weekends or late evenings, they remain unavailable. What can we do in such a situation? We are there as a conduit,” the officer explained.

Whenever a cyber victim calls on the helpline, it has to go through a process – receiving the translation number, finding the payment receiver, informing the nodal officer and the bank, the cyber security officer explained. “Despite having strong tech helpers, and engineers present on the service, the fraudsters get the victory by taking the money when the bank service remains unavailable,” he said.

Bhatia explained that If the helpline number is unavailable, the victim of fraud can report to the online cyber help provided by the government at www.cybercrime.gov.in and should immediately rush to the nearby police station.

He explained that even if a person contacts their bank immediately after the fraud, the bank can only block the account to prevent further loss. However, since cyber fraud is a criminal offense, it must also be reported to the cyber police for the recovery of money.

“If the government really wants to make this service more effective, then the RBI, which regulates all the payments, should provide 24/7 solutions between the bank and cyber police. It will definitely reduce cyber frauds and peoples’ money can be saved,” the cyber security officer said.

Meanwhile, 22-year-old Yadav is still hoping that the threatening calls disappear. He says he will keep his phone switched off till that happens.