Q4 2022 hedge fund letters, conferences and more

This is shortly followed by finance industry professionals, who have an average retirement savings fund of between $710,418 and $1.3 million.

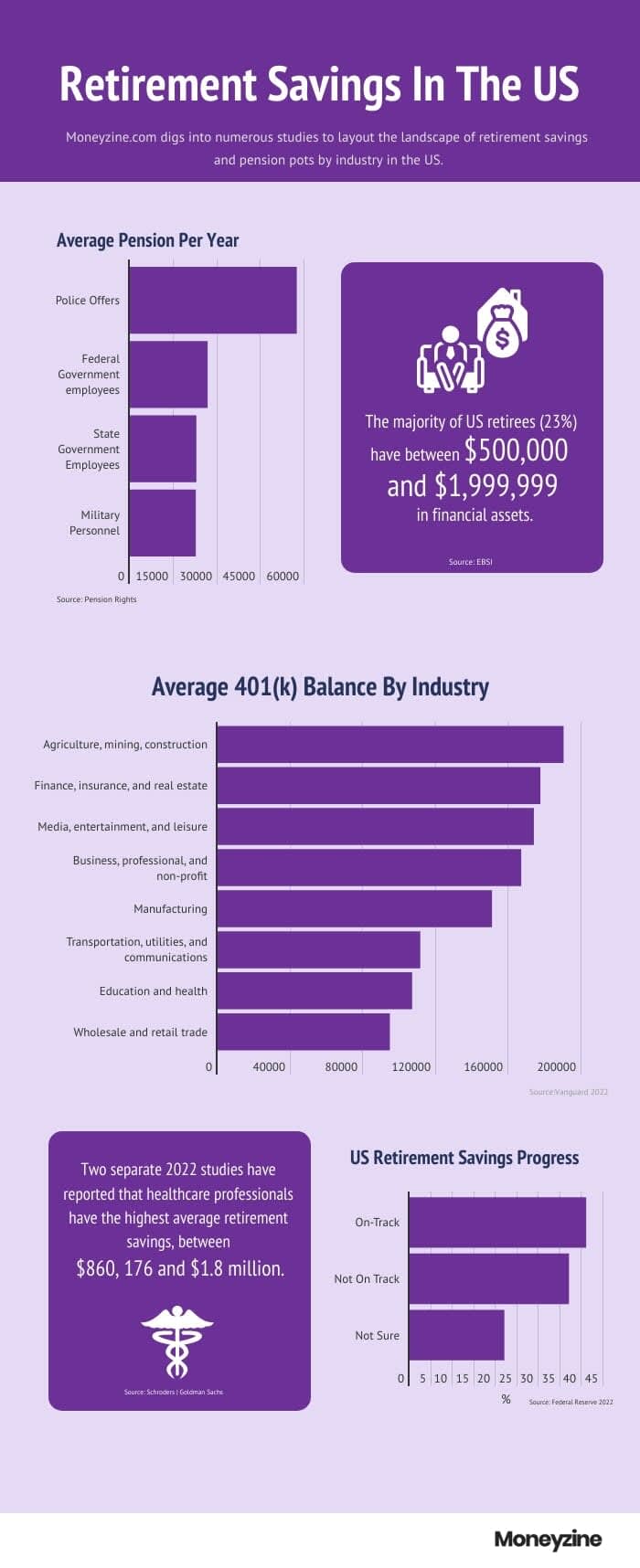

Our research found that the majority of retirees have between $500,000 and $1,999,999 in existing financial assets - but the average private pension in the US is just $10,788, demonstrating how greatly many individuals rely on other retirement income, such as social security income and 401(k)s.

1 In 4 Non-Retired Adults Have No Retirement Savings

Jonathan Merry, CEO of Moneyzine, comments:

“The below findings only highlight how diverse retirement planning can be in the US, with very few clear figures to show to non-retirees who may not be prioritizing their retirement at this point in time. With an estimated 1 in 4 non-retired adults having no retirement savings to their name, it’s clear that more transparency and education is needed on this issue across all industries.”

401(k) Balances Across Industries

Our research further highlighted the average 401(k) balance of professionals across industries, with the following findings:

Other key findings:

- Baby boomers have the highest average retirement savings at $708,125, Gen X an average of $415,828, and Millennials $198,634

- 41% of non-retired US adults feel that they are on-track with their retirement savings - but over 1 in 3 feel they are not

- Just 25% of US adults surveyed are confident in their ability to achieve their retirement savings goals