The buzzy AI stock takes a plunge following allegations of ‘serious accounting and disclosure issues’ by short-seller Kerrisdale Capital

Kerrisdale claims that C3’s business is built on outdated analytics models and that its customer traction and sales partnerships are failing. Kerrisdale also expressed concerns about the company’s accounting practices, alleging that it has used “highly aggressive accounting” to inflate its income statement metrics.

Q1 2023 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

C3.ai's stock fell 26.3% to $24.95 at the close in New York on Tuesday and a slipped further 5.4% in extended trading.

Buzzy Evolution

The firm was originally founded as C3 Energy in 2009 to develop analytics solutions for public utilities preparing for the emergence of cap-and-trade and smart grids. The company pivoted in 2016 to become C3 IoT, capitalizing on that buzzy opportunity. Three years later, the company rebranded as the even-buzzier C3.ai and went public with the "AI" ticker.

However, Kerrisdale claims that C3 is a minor, cash-burning consulting and services business masquerading as a software company, and that its true value is a fraction of its current market capitalization.

Kerrisdale claims that generative AI, represented by media obsession ChatGPT, will do nothing to change the business or financial trajectory of C3 which is facing more serious near-term challenges. The report highlights that C3 “sells an expensive, trailing edge, and difficult-to-implement solution that is losing out to a plethora of alternative solutions.”

The short-seller pointed out that high salesforce turnover indicates significant problems with leadership, and C3's major sales partnership with Baker Hughes Company (NASDAQ:BKR) is also unraveling.

The report accuses management of recent adjustments in pricing and accounting that have been used by management to divert attention from the company's declining performance which will ultimately be revealed in the future from weakening fundamentals.

Fundamental Misunderstanding

C3 responded to the report, calling it a "highly creative and transparent attempt" to diminish the stock price. The company said that Kerrisdale's allegation that C3's financial disclosures regarding Baker Hughes are somehow incorrect manifests a fundamental misunderstanding of US GAAP accounting practices and principles. The accounting disclosures and financial statements referenced in the letter have been reviewed by C3's independent audit firm.

C3's stock had benefited from a recent spike in investor interest in artificial intelligence, and its stock had more than doubled this year before the plunge. However, Kerrisdale claims that C3 was egregiously overvalued even before its shares caught the generative AI hype wave, which added an unjustified $2 billion to its market capitalization in just a few short weeks.

Kerrisdale believes that C3's shares should return from whence they came, approximately $12 per share, or almost 60% below current levels. The company's high mix of lower-margin professional services, challenged growth, and industry worst cash flow profile suggests the downside could be even greater.

Upbeat Analysts

Following C3’s recent investor day in mid-March several analysts updated thoughts on the outlook for the company.

JMP Securities analyst Patrick Walravens maintained his market outperform recommendation on the stock and bumped up AI’s target price by a dollar to $28 following the meeting. The analyst highlighted that the stock is trading on a valuation premium vs peers that is justified by C3’s strategic value and the scarcity of purple, scaled AI-ML software companies.

Fintel’s consensus target price of $20.74 suggests analysts think the stock is about 38% overvalued currently and could retreat again this year.

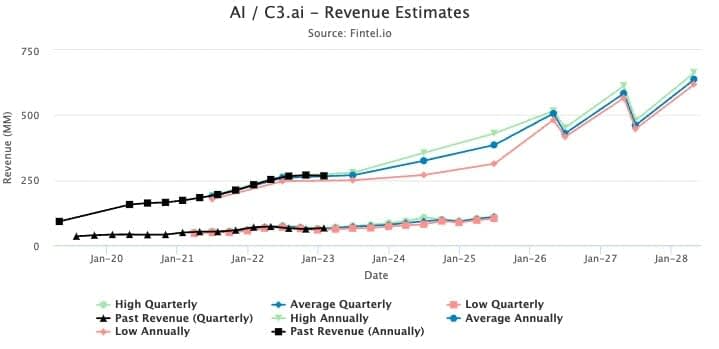

Despite the weak consensus target, analysts still foresee revenue growth in the coming years as highlighted in the forecast chart below.

Insider Action

The Fintel Insider Sentiment Score, at 34.92, is bearish on AI, indicating the company has weak insider trading activity.

This score is based on C3 having two net insiders that have sold company shares in the last 90 days. The insiders have sold shares equating to 0.065% of the total float.

C3’s CFO Juho Parkkinen has been consistently selling shares during the quarter along with board member Richard Levin who has sold shares in two tranches.

Funds Benefit

Some funds have benefitted by the fall in AI’s share price on Tuesday.

Acap Strategic Fund has a net short position of $16 million in the fund from directly borrowed stock.

Advantage Advisers Xanthus Fund is also short with a $4.5 million borrowed stock position.

Walleye Trading LLC has a minor $344,000 short position made up of direct equity, call options and primarily put options.

The post "C3.ai's 2023 Rally Comes To A Grinding Halt As Kerrisdale Short Report Spooks Investors" first appeared on Fintel.