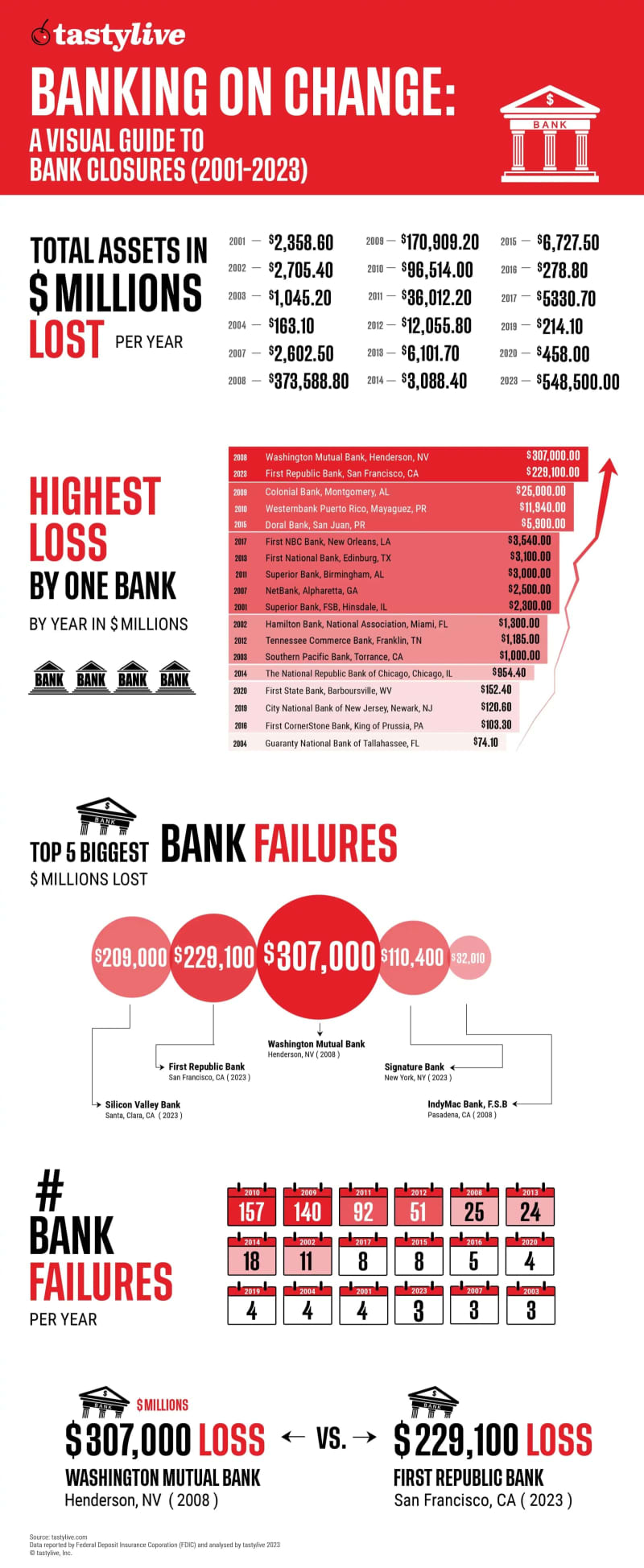

Tastylive, one of the fastest growing online global financial networks, today unveils a comprehensive infographic charting Federal Deposit Insurance Corporation (FDIC) data on bank closures and asset losses, from 2001 – 2023.

The information presented is based on reliable FDIC data and has been analyzed and visualized by tastylive experts.

A Visual Guide To Bank Closures

tastylive Head of Macro, Ilya Spivak says:

“This data makes crystal clear that this year’s banking sector woes are the most remarkable since the global financial crisis over a decade ago, yet the environment they speak to is quite different. While the size of the failures suffered so far in 2023 has been shocking, the breadth of contagion has been much more limited, at least for now.

The second-, third-, and fourth-largest failures on record have occurred in recent months. Still, the pain has been localized to just a handful of lenders, marking a stark contrast from the sweeping collapses of the 2008-2014 period.

This calls on investors to be particularly vigilant even as it warns against over-extrapolating parallels with the past. It is neither the number nor the size of bank failures each year that is most important, but the economic conditions that they speak to.”

As conversations continue to ricochet around the trustworthiness of the financial industry sector, a crucial cornerstone of our economy.

About tastylive

tastylive launched in 2011 to provide contextual financial information on investment strategies and entertainment related to the stock market with an emphasis on options trading. tastylive was a bold experiment as the first live online network for active retail options traders.