Summary:

- For Q2 2023, equity funds (+4.36% on average) posted their third quarterly gain in a row.

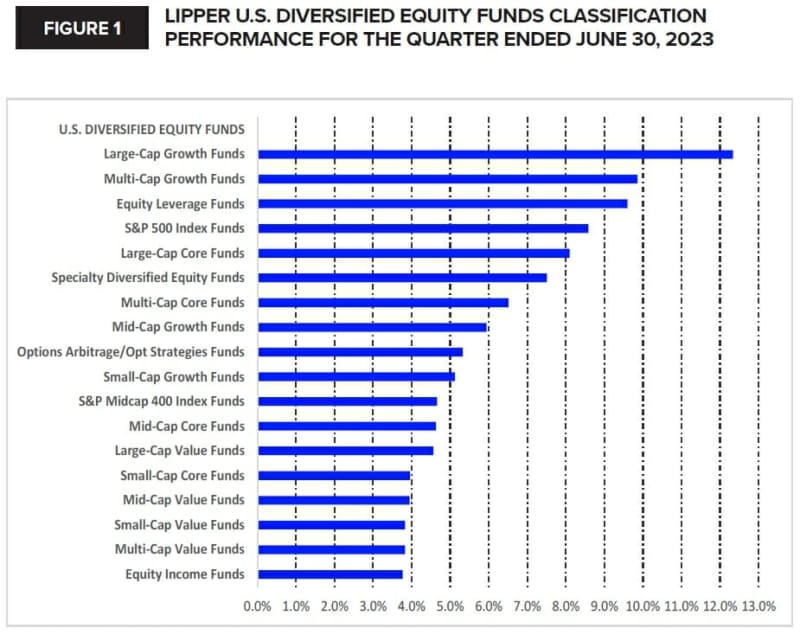

- Lipper’s U.S. Diversified Equity Funds macro-classification (+6.25%) outpaced the other six broad-based equity groups, followed by Domestic Sector Equity Funds (+3.79%) and Mixed-Assets Funds (+3.22%).

- Latin American Funds (+15.85%) posted the strongest return in the equity universe for Q2.

- China Region Funds chalked up the largest losses in the equity universe, declining 10.36% for the quarter.

- For June, the average equity fund rose 5.67%.

Executive Summary

Gaining solace from a slightly more dovish Federal Reserve Board, minor declines in inflation figures, and a final resolution to the debt ceiling impasse on Capitol Hill, investors drove equity mutual funds and ETFs to their third consecutive quarterly plus-side return—with the average equity fund posting a 4.36% gain in Q2. For the quarter, LSEG Lipper’s U.S. Diversified Equity Fund macro-classification (+6.25%) outpaced the other six major equity groups for the first quarter in six.

U.S. markets started on an up note in the beginning of June, with the tech-heavy Nasdaq posting its sixth consecutive weekly gain—its longest winning streak since January 2000—after the U.S. Senate passed the debt ceiling bill. Adding to the rally, the Department of Labor reported the U.S. economy added 339,000 new jobs in May, beating expectations of 190,000. However, the unemployment rate rose to 3.7%.

The Bureau of Labor Statistics reported that wage growth rose to 0.3%, in line with analysts’ expectations. Fed-funds futures traders priced in a 77.1% chance that the Fed would pause its interest rate hiking campaign later in the month, according to the CME FedWatch tool. The 10-year Treasury yield still rose five basis points (bps) on the last trading day of the week to settle at 3.69%, while the two-year Treasury yield rose 12 bps to 4.50%.

U.S. stocks extended their winning streak the following week, with the S&P 500 booking its longest weekly winning streak since August 2022—climbing for the fourth straight week and exiting bear market territory (closing 20% above its October 2022 bottom) as investors awaited the Fed’s policy decision on interest rates.

Investors breathed a small sigh of relief earlier in the week after learning firsttime jobless claims for the prior week rose 28,000 to 261,000 (a 21-month high), with investors believing that might give Federal Reserve officials more fodder to skip a rate hike at its next FOMC policy-setting meeting. The 10-year Treasury yield still rose six bps for the week to settle at 3.75%.

U.S. stocks finished the following week higher after investors learned that the U.S. May consumer price index rose 0.1%, with the year-over-year rate of inflation slowing to 4% from April’s 4.99%—its lowest level since March 2021, supporting the concept of a temporary pause in rate hikes. The Fed held interest rates steady at the close of its policy-setting meeting but left the door open for more increases this year.

In the FOMC statement, committee members said, “Holding the target rate steady at this meeting allows the FOMC to assess additional information and its implications for monetary policy.” However, Fed Chair Jerome Powell said, “nearly all policymakers view further hikes this year appropriate.” As a result, fed-fund futures traders pushed the probability of a 25-bps hike in July to 64.5%, according to the CME FedWatch tool.

The following week all three broad-based indices witnessed declines, with the Nasdaq Composite snapping its eight-week winning streak on global recessionary concerns. Casting a pall over the market, Powell stated that senior Fed officials expect the Fed to hike interest rates “a couple of times” later this year.

Earlier that day, the Bank of England, Norway’s central bank, and the Swiss National Bank hiked their interest rates, causing investors to speculate on how rate hikes might impact global economic growth. In other news, the S&P Global U.S. services index declined to 54.1 from 54.9 in May.

In the last trading week of the month, U.S. markets were choppy after Powell reiterated that the Fed is likely to raise rates twice more in 2023 to combat inflation and after investors learned that the Biden administration is considering a new ban on sales of artificial intelligence chips to China—stalling the recent rally in select megacap tech stocks. Fed-fund futures traders pushed the probability of a 25-bps hike in July to 82%, according to the CME FedWatch tool.

On the last trading day of the month, stocks ended higher following a better-than-expected inflation report. The personal consumption expenditures price index eased to 3.8% in May on a year-over-year basis—its slowest increase since April 2021. The PCE report showed consumer spending rose just 0.1% in May, which was lower than analyst forecasts. In other news, the University of Michigan said the final reading of its June consumer sentiment index rose to 64.4, a four-month high. The 10-year Treasury yield rose 17 bps to 3.81% for the month.

Lipper’s preliminary Q2 2023 fund-flow numbers showed mutual fund investors were net purchasers of fund assets for the quarter, injecting an estimated $38.9 billion into the conventional funds business (excluding ETFs). However, the headline numbers continue to be a bit misleading. Investors were net sellers of equity funds for the twenty-first consecutive quarter (-$101.1 billion for Q2 2023), shunning domestic equity funds (-$82.3 billion), and to a lesser extent nondomestic equity funds (-$18.8 billion).

As a result of ongoing interest rate hike concerns, for the sixth quarter in a row investors were net sellers of taxable bond funds, redeeming $5.9 billion. Municipal bond funds witnessed net outflows for the fifth quarter in six, handing back $6.5 billion for Q2. However, given the flight to safety caused by the ongoing uncertainty and inflationary concerns, for the fourth quarter in a row investors were net purchasers of money market funds, injecting $152.4 billion.

ETF investors (authorized participants [APs]) were net purchasers for Q2 (+$78.1 billion), injecting $42.4 billion into equity ETFs (their twenty-ninth consecutive quarter of net inflows) and $34.6 billion into taxable fixed income ETFs (their thirty-eighth consecutive quarter of net inflows) while being net purchasers of municipal bond ETFs (+$1.1 billion).

For Q2, all of the often-followed broad-based indices posted plusside returns. The Nasdaq Composite (+12.81%) posted the strongest returns of the U.S. indices, followed by the S&P 500 (+8.30%) and the Russell 2000 (+4.79%). The Dow Jones Industrial Average (+3.41%) was the relative laggard of the subgroup. Overseas, the Nikkei 225 (+8.98%) chalked up the best returns of the oft-followed global indices for the quarter, followed by the Xetra DAX Total Return Index (+3.76%) and FTSE 100 (+1.47%), while the Shanghai Composite (-7.45%) suffered the largest decline of the group.

The broad-based indices finished the month of June generally on the plus side, with the Russell 2000 (+7.95%) outpacing the other U.S. indices, followed by the Nasdaq Composite (+6.59%) and the S&P 500 (+6.47%), while the Dow Jones Industrial Average (+4.56%) was the relative laggard. The Xetra DAX (+5.50%) posted the strongest returns of the other oft-followed overseas indices, while the Shanghai Composite was at the bottom of the pile (-2.27%), posting the weakest return for June.

For the quarter, 87 of Lipper’s 104 equity and mixed-assets fund classifications posted positive returns. For the first quarter in six, the U.S. Diversified Equity (USDE) Funds macro-classification (+6.25%) outpaced Lipper’s other six broad equity groupings. Domestic Sector Equity Funds (+3.79%) took the runner-up position for the quarter, followed by Mixed-Assets Funds (+3.22%), World Equity Funds (+2.85%), World Sector Equity Funds (+1.34%), Alternative Equity Funds (+0.83%), and Commodities Funds (-3.27%). In total, 90.52% of all individual equity and mixed-assets funds posted plus-side returns for the quarter.

During Q2, the dollar strengthened against the yen (+8.83%) but weakened against the euro (-0.42%) and the pound (-2.68%). Commodity prices declined, with near-month crude oil prices falling 6.65% to close the quarter at $70.64/bbl and with gold prices declining 2.43% to end the quarter at $1,921.10/oz. The 10-year Treasury yield rose 33 bps for the quarter, settling at 3.81% on June 30 after hitting a quarterly high of 3.85% on June 29. The two-year Treasury yield rose 81 bps for Q2, settling at 4.87% at month end.

Sources:

Data/Charts – “Refinitiv Lipper, an LSEG Business”

Commentary – “Tom Roseen, Head of Research Services, Refinitiv Lipper”