- $1bn+ global discretionary funds produced notable excess returns over sub-$1bn funds during the past two years.

- Systematic macro has outperformed discretionary approaches on average over the same period.

Macro hedge funds have enjoyed a renaissance in recent years with the biggest funds showing significant outperformance.

Haidar Capital, for example, stormed to a 193% blockbuster annual return, its best ever. And Rokos Capital rebounded from its worst-performing year in 2021 (-26%) with a record 51% gain.

This performance was well ahead of the overall hedge fund universe, which lost 5%, as well as stocks and bonds, which had their worst year since 2008. The typical 60/40 portfolio dropped more than 15%.

Significant recent shifts in the global economy, that have driven big moves in bonds, currencies and commodities, have renewed opportunities for macro trading.

And With Intelligence data reveals that in macro, scale matters, as $1bn+ global discretionary funds such as such as Brevan Howard and Haidar, showed in producing significant excess returns over sub-$1bn funds during the past two years.

Billion-dollar funds averaged a 14.9% gain in 2022, their first double-digit gains since 2013. Smaller macro funds lost money on average last year.

Excess Return Of $1bn+ Over Sub-$1bn Global Discretionary Macro Hedge Funds

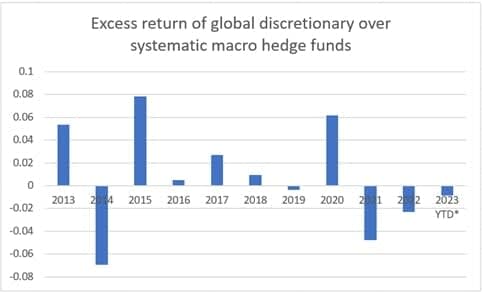

The past two years have also seen impressive excess returns from systematic over discretionary approaches in macro.

Discretionary global macro had outperformed systematic macro in 2020 by the widest margin since 2015, with billion-dollar funds averaging 14%. But systematic macro has outperformed in the past two calendar years.

Excess Return Of Global Discretionary Over Systematic Macro Hedge Funds

This year has seen a reversal in fortunes for larger funds, which were hardest hit by the banking crisis in March and the sharp reversal in US government bonds.

More recently, uncertainty around the US debt ceiling negotiations led to lower risk levels and a more cautious trading approach that has muted some returns.

Billion-dollar macro funds were down nearly 3% on average YTD through May, with heavier losses at some firms. Smaller funds are broadly flat this year.

While banking crisis of Q1 was a setback for many larger macro funds who suffered some significant losses, their three and five-year return statistics remain compelling.