Hedge funds have now had three consecutive quarters of gains, going back to Q4 2022, as investors continue to benefit from their exposure to alternatives, with almost 70% of all funds delivering positive performance in the latest three-month period.

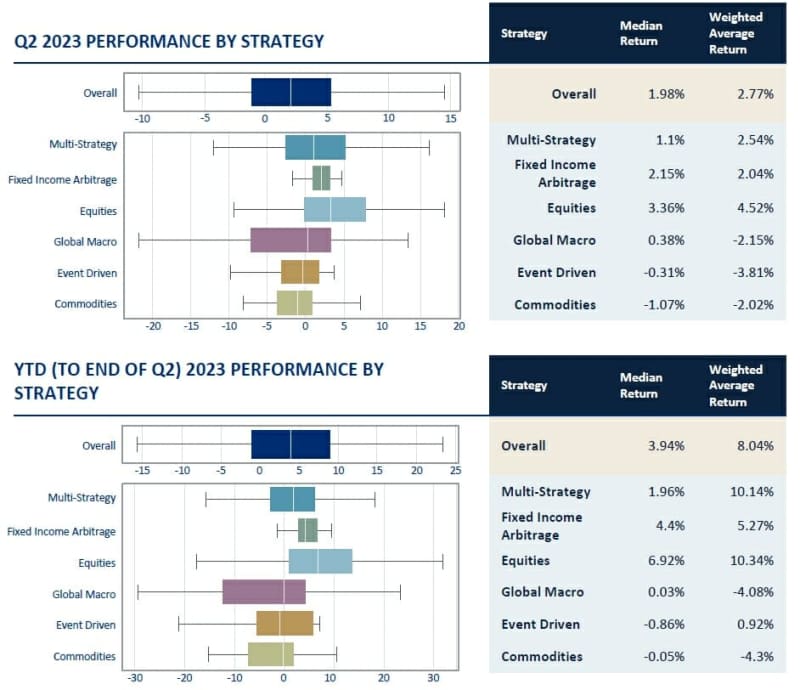

Equities and Multi-Strategy funds were the best performers in the second quarter, with weighted average returns of 4.52% and 2.54% respectively, taking their YTD returns to 10.34% and 10.14%. Funds with between $1-3B of assets were the top performer in Q2, with a weighted average return of 3.3%, followed by the $200M-$500M category at 3.08%.

Equities And Multi-Strategy Help Drive Hedge Funds To Positive Q2

- Equities and Multi-Strategy funds reach double-digit returns YTD

- Funds saw an overall weighted average return of 2.77% in Q2

- Commodities and Global Macro strategies see another quarter of negative returns

New York/London, July 24, 2023: The hedge fund resurgence continued in the second quarter, driven once again by Equities and Multi-Strategy funds, to take YTD weighted average returns for hedge funds near to double-digit figures.

Hedge funds administered by the Citco group of companies (Citco), the asset servicer with over $1.8T in assets under administration (AUA), achieved a weighted average return of 2.77% overall in the second quarter, to give them a YTD return of 8.04%.

Equities and Multi-Strategy funds were the best performers in the second quarter, with weighted average returns of 4.52% and 2.54% respectively, taking their YTD returns to 10.34% and 10.14%. Not all funds rose however, with Commodities and Global Macro funds seeing negative returns of -2.02% and -2.15% to take their YTD returns to -4.3% and -4.08% respectively.

All AUA categories once again generated positive weighted average returns for the second quarter in a row in 2023. Funds with between $1-3B of assets were the top performer in Q2, with a weighted average return of 3.3%, followed by the $200M-$500M category at 3.08%. Funds with more than $3B of assets were next, at 2.8%, edging out the $500M-$1B funds which delivered 2.4%. The smallest funds with assets below $200M rounded it off with a return of 0.55%. The gains over the most recent quarter meant the largest funds with more than $3B of assets had a YTD return of 10.63%, with the other categories all up as well, although by smaller amounts.

Capital flows were negative in Q2, with net redemptions of $7B. Much of this was focused on Equities funds that saw net outflows of $6.5B in Q2. However, both Multi-Strategy and Hybrid funds enjoyed a positive quarter in terms of flows. Multi-Strategy funds saw overall net inflows of $0.8B, despite a jump in outflows in June. Meanwhile, Hybrid funds were once again the standout success story with $2B of net inflows in total in Q2 as they continue to attract investor capital.

Trade volumes were close to flat quarter on quarter, just 2% lower than Q1, but this was against a steady and linear drop in volatility throughout the quarter. The second quarter also saw trading in interest rate and credit default swaps, rates and index derivatives rise the most.

Meanwhile, Treasury volumes continued to see solid year-on-year growth in Q2, increasing by more than 10%. Citco has seen hedge funds increasingly turn to cash as an asset class to generate returns following a concentrated effort by central banks to raise rates.

Declan Quilligan, Head of Hedge Fund Services, Citco Fund Services (Ireland) Limited, said:

“Hedge funds have now had three consecutive quarters of gains, going back to Q4 2022, as investors continue to benefit from their exposure to alternatives, with almost 70% of all funds delivering positive performance in the latest three month period. We once again saw capital flows turn negative at the end of Q2 as investors rebalance their positions or lock-in gains, particularly around equities after their strong performance so far this year.

“Nonetheless, certain funds – such as Hybrids – continue to attract inflows as investors look to different strategies to diversify their portfolios.

“As we have seen in previous quarters, Treasury activity also continued to climb sharply, driven by renewed interest in cash as an asset class following the rapid series of rate rises in the US – and further afield – since last March.”