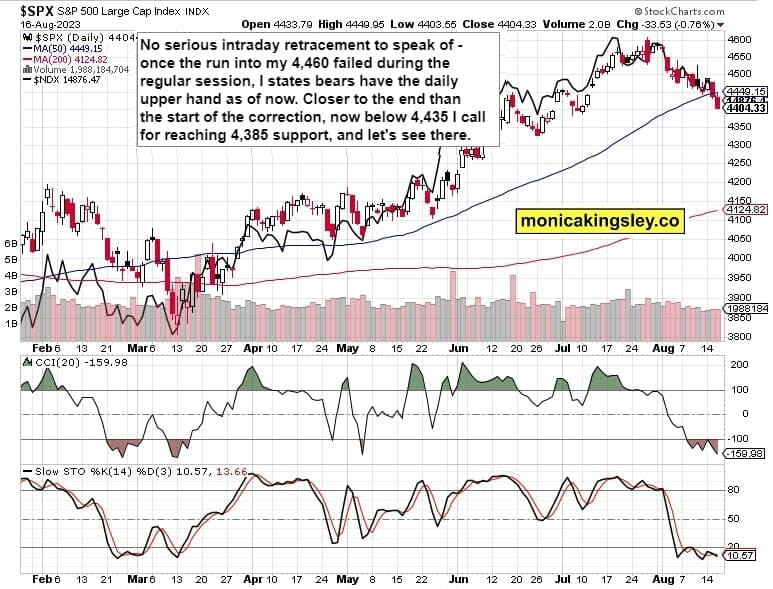

If anything, 10y proved it doesn‘t want to top yet at 4.28%, and all the relief rallies in S&P 500 and Nasdaq failed. Orderly day of selling is the proper conclusion when looking at the daily chart, with stocks having to go a bit lower, and 4,385 support may not be the end of it.

4,410 is a weak daily support only, and depending on whether long-dated yields stage a fakeout (10y markedly above 4.33%) and how long it holds before retreating on the no recession storyline being proven wrong by deteriorating economic data – today‘s unemployment claims and Philly Fed manufacturing mark good opportunities to show that while the real economy isn‘t crashing, it‘s not reaching escape velocity either as the proponents of “things whill sharply start turning better after the first 7+ months of 2023“ think.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 3 of them.

S&P 500 and Nasdaq Outlook

4,460 resistance is to hold today – the bulls don‘t stand a chance of a lasting reversal above that level. Probably my 4,435 – 4,440 would hold as well as stocks would be grappling with still high and slightly rising yields (most trouble relatively speaking today for XLK, XLC and XLY). The sellers have the tactical advantage as market breadth continues deteriorating with a nary a reprieve..

Gold, Silver and Miners

Gold took a dive late yesterday, a faster one than yields did. Of course a $5 – $10 washout isn‘t a real washout, but that $1,919 in Dec gold or $1,890 in XAUSUD may be it – especially if yields truly fail to stun in rising further (i.e. the 10y doesn‘t make it make above 4.33%. Thus far though miners haven‘t kicked in, let alone stabilized, which makes any bottom calls tentative.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.