By Nidhi Jacob

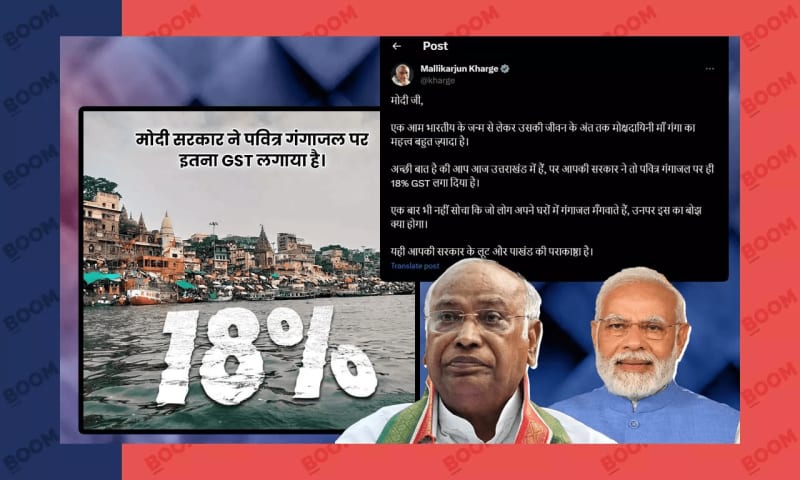

Indian National Congress President Mallikarjun Kharge recently claimed that the Uttarakhand government has imposed an 18% GST (Good and Services Tax) on the Ganga water. However, the Finance Ministry's Department of Revenue dismissed his claim.

This came after PM Narendra Modi’s day-long visit to Uttarakhand on October 12. He had performed religious ceremonies at Parvati Kund and had also visited the Pithoragarh district for the inauguration of various development projects worth around Rs 4200 crore.

Criticising the Bharatiya Janata Party (BJP)-led government, Kharge, in a post on X (formerly Twitter) said, “ The importance of Mother Ganga, the provider of salvation for a common Indian, from birth till the end of his life is very high. It is good that you are in Uttarakhand today, but your government has imposed 18% GST on the holy Ganga water itself. Not even once did I think what would be the burden on those who order Ganga water in their homes. This is the height of plunder and hypocrisy of your government.”

Kharge’s statement triggered a row on X between the Congress and the BJP. BJP’s in-charge of IT cell, Amit Malviya, accused the Congress of “misrepresenting facts” and called it a “deliberate propaganda” to mislead people. He said that it is clearly mentioned under entry number 99 of Notification 2/2017 that water does not attract GST.

He referred to the Central Board of Indirect Taxes and Customs’ (CBIC) circular which states that “treated sewage water attracts a Nil rate of GST”.

According to the document, “Water, falling under heading 2201, with certain specified exclusions, is exempt from GST vide entry at S. No. 99 of notification No. 2/2017-Central Tax (Rate), dated the 28th June, 2017. 5.3. Accordingly, it is hereby clarified that supply of treated sewage water, falling under heading 2201, is exempt under GST. “

What did the CBIC Say?

The Union government’s CBIC, on October 12, clarified that Gangajal was exempt under GST. “Gangajal used in puja by households across the country and puja samagri is exempt under GST. GST on puja samagri was discussed in detail in the 14th and 15th meetings of the GST Council held in 2017 and decided to keep them in the exempt list. Therefore, all these items have been exempt since the introduction of GST,” the CBIC said on X.

The GST rates and exemptions are prescribed based on the recommendations of the GST Council, which is a constitutional body comprising of members from both the Union and all State.

However, after CBIC’s clarification, social media users shared screenshots of the charges of Gangajal on India Post that levied a tax of 18%.

However, as per India Post's website on October 13, there are no GST charges on Gangajal.