By Timothy J. Killeen

Gold is universally recognized as a form of money that has retained value over decades, centuries and millennia. Since it is non-corrosive and precious, approximately 95% of the gold mined since the dawn of civilization remains in circulation (~205 million tonnes). The largest share (~47%) is held as jewelry, which in addition to its sentimental value is an important store of family wealth. Governments hold ~17%, which was used historically to back the value of national currencies and, although this is no longer the case, these reserves are often used in times of political crisis to stabilize a national economy. As an elemental metal, gold has numerous uses: about ~10% has been incorporated into electronics, computer and aerospace components, as well as in dental applications and medical devices. The rest (~23%) is held by private investors as a financial asset to hedge against inflation and geopolitical instability. Often referred to as ‘goldbugs’, these individuals are ardent believers that the long-term trend in the price of gold is upward.

Only a small fraction of financial transactions is conducted using physical bullion. The overwhelming majority of trades are executed via derivative securities that track (and drive) the price of gold. Until recently, this mainly consisted of futures and option contracts, but increasingly traders speculate in exchange-traded funds (ETFs) that are essentially ‘derivatives of derivatives’. Buyers are wagering the price will rise, while sellers are betting the opposite, at least over the short term. Gold markets are an example of pure financial speculation.

The price of gold has nothing to do with supply and demand for jewelry or industrial uses; rather, it is driven by macro-economic phenomena linked to major economies. Prices above $US 750 per ounce are sufficient for mining companies to pursue billion dollar investments and inspire tens of thousands of men and women to strike out for the gold fields. Data sources: Indexmundi (2022) and Corporate Finance Institute / Inflation calculator (2022).

Corporate gold mines are money machines

The price of gold is (and always has been) greater than the cost of extracting it from the bowels of the earth and all the major mining companies have subsidiaries that specialize in gold. Large companies seldom spend money to look for gold, however, and instead rely on ‘junior’ companies that exist solely to discover and develop mining projects. Exploration and early development typically cost between tens and a hundred million dollars, while developing an industrial scale mine requires several hundred million to a couple of billion dollars. When a Junior verifies an exploitable resource, they sell themselves to a larger company with the financial capacity to mobilize the necessary capital resources.

The environmental and social impacts of corporate gold mines are similar to polymetallic industrial mines. Like those operations, the degree and type of impact depends on whether the mine is an underground or surface mine as well as on the chemical process used to concentrate the gold. Corporate mines use cyanide compounds to release mineralized gold from the ore body; this makes their operations even more toxic than their polymetallic cousins that rely on sulphuric acid. Cyanide poisoning can occur through inhalation, ingestion and skin or eye contact. Aquatic wildlife dies when cyanide concentrations exceed a few micrograms per liter, whereas bird and mammal deaths occur when concentrations reach over a few milligrams per liter.

There are two types of cyanide concentration: (1) tank-leach, which demands large quantities of water and (2) heap-leach, which uses less water but is less efficient in recovering gold. The tank-leaching technology creates a tailings pond that is isolated by a dike or dam, while the heap-leach technology creates an artificial hill permeated that is isolated from the environment by a membrane and internal drainage system that collects the runoff in a pool where it is recycled.

Heap leach technologies are used by corporate miners to extract minerals from pulverized ore using cyanide (gold) and sulfuric acid (copper, nickel, zinc). Although these solvents have their own environmental challenges, they dramatically reduce the demand for water and avoid the long-term liabilities associated with tailing ponds. Data source: 911metalurgist . 2023. (https://www.911metallurgist.com/blog/heap-leaching)

Each mine is unique and the environmental and social liabilities are dependent on the idiosyncrasies of each mine site, including the biodiversity and ecosystems that will be lost or compromised, as well as the willingness of the surrounding communities to accommodate an industrial enterprise in their neighborhood.

Corporations share gold production with small- and medium-scale gold miners, who cover approximately 20% of global annual production. Not infrequently, they are wildcat miners responding to a gold rush triggered by a new discovery that can motivate thousands of individuals to seek their fortunes in the wilderness. When war comes or inflation threatens, a spike in the price of gold can motivate individuals to strike out for the gold fields. Domestic politics also play a role: Governments recognize that the opportunity to strike it rich provides the illusion of economic opportunity for marginalized populations.

Unfortunately, most wildcat miners make no effort to conform to the social and environmental standards required by law. Very few pay either royalties or income taxes. Critics often refer to them as illegal miners or, if they seek to engage them in a constructive dialogue, use the less pejorative term informal miner. Since there is a massive international market for gold, they can launder their proceeds via multiple legitimate and illegitimate supply chains. All the governments in the Pan Amazon are complicit in the trade of so-called illegal gold – in part due to social pressure, but also because they need (or appreciate) the contribution of gold exports to the balance of payments.

In Brazil, wildcat miners are known as garimpeiros, a term derived from the word garimpo, which is a landscape where people mine alluvial gold using rudimentary mining technology. The term garimpeiro conjures an image of a solitary individual searching for gold using a pick, a shovel and a gold pan, but modern garimpeiros include small or medium-sized enterprises with access to a range of technologies. They are relatively numerous and form associations, cooperatives and syndicates, which allow them to exert political influence with state and municipal governments. Their special status is recognized in the Brazilian constitution of 1988 and subsequent laws established a special regulatory system to facilitate their activities. The Temer administration decentralized this system in 2018, and now mining permits are approved by state or local authorities.

Garimpeiros have enjoyed the unbridled support of Jair Bolsonaro, whose father worked as one in the 1980s and who himself participated in gold-mining ventures in the 1990s. One of the most controversial policies of the Bolsonaro government was a proposal to open Indigenous territories to both industrial and artisanal mining. Although legislative changes to the regulatory regime were not successful, the administration defunded actions to combat illegal mining within Indigenous territories.

Men play a traditional flute in the village of Aramirã, in the Wajãpi Indigenous Land. The indigenous peoples of Amapá have suffered from the invasion of gold miners in recent years. Image by Christiane Peres.

Placer gold and the legacy of the garimpo

Wildcat miners are the source of the two most insidious environmental and social impacts associated with the extractive industries in the Pan Amazon: floodplain destruction and mercury pollution. Both are associated with a centuries-old technique that collects and concentrates gold deposit, which mining engineers refer to as a ‘placer’, a sub-surface alluvial strata composed of silt, sand and gravel accumulating heavy gold particles (nuggets and dust).

A placer is a source of ‘free gold’ that has accumulated over thousands of years by erosion from the veins and lodes associated with mineralized ore bodies, which are the target of industrial mines. Placer technology is used on some upland landscapes where free gold is located within the soil profile (e.g., colluvium and saprolite), which include some of the richest gold strikes in the Amazon, including Serra Pelada (Pará, Brazil) and Claritas (Bolivar, Venezuela). In its simplest manifestation, a placer mine is nothing more than a pick, shovel and gold-pan, but more often includes specialized equipment to collect, shake and separate gold from the sand and gravel. Water is central to the entire process.

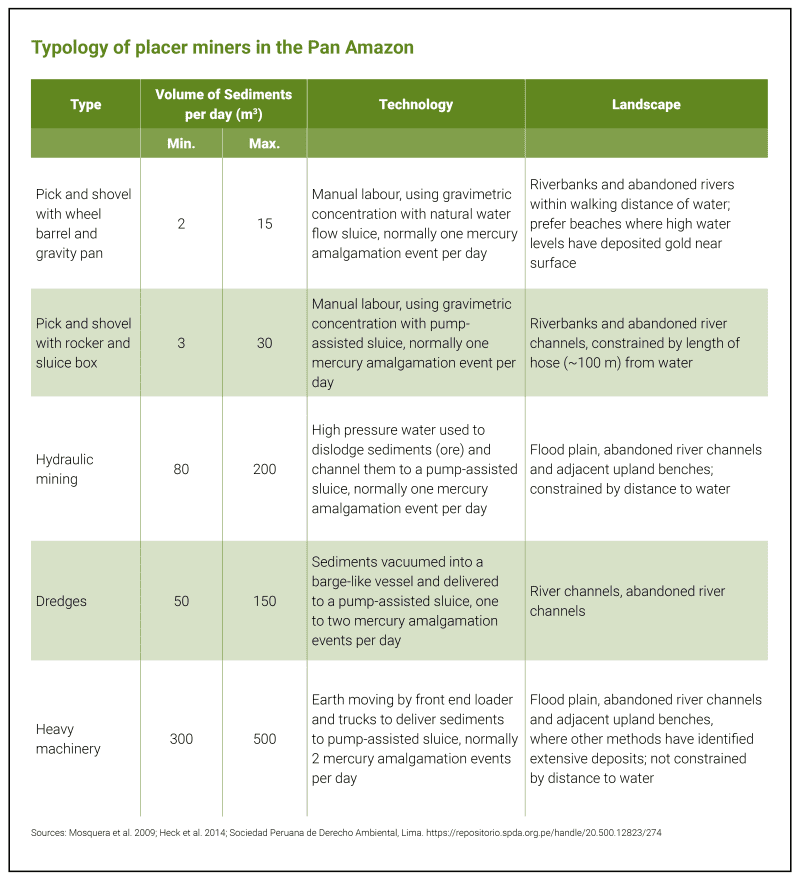

Typically, the first miners at a site use rudimentary technology, but these are followed by an increasingly sophisticated cohort that excavate placers at greater depth, while processing larger volumes of sediment. A placer mining landscape will contain a mixture of mining types with the least sophisticated miners operating around the margins, or at the leading edge of an expanding mining frontier.

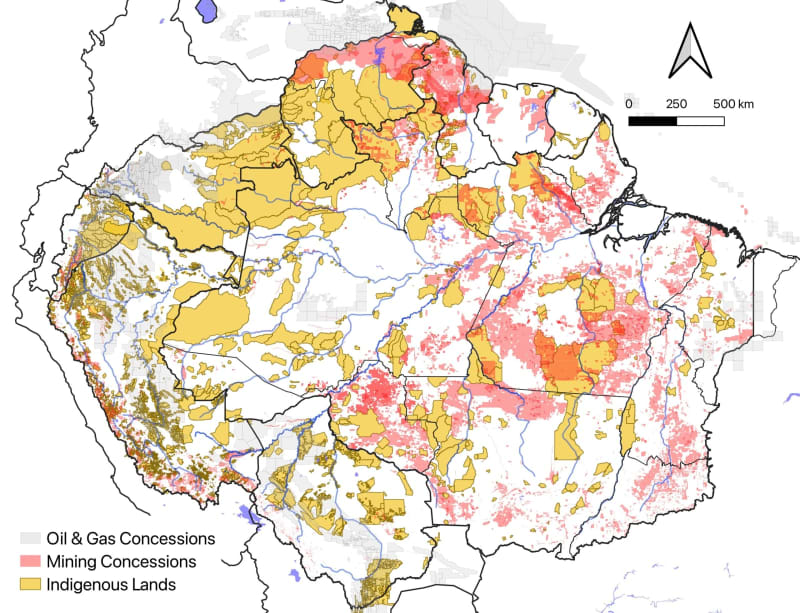

One of the most controversial policies of the Bolsonaro government was a proposal to open indigenous lands to both corporate and wildcat mining. In the Andean Amazon, a similar conflict revolves around the production of oil and gas. In all Amazonian countries, the state retains ownership of all below-ground mineral resources, including under indigenous territories and landholdings. Exploitation is theoretically dependent upon the developer and the state obtaining the ‘free prior and informed consent’ of indigenous communities, but governments have been reluctant to surrender control of what they view as strategic national resources. Data source: RAISG (2022).

“A Perfect Storm in the Amazon” is a book by Timothy Killeen and contains the author’s viewpoints and analysis. The second edition was published by The White Horse in 2021, under the terms of a Creative Commons license (CC BY 4.0 license).

To read earlier chapters of the book, find Chapter One here, Chapter Two here, Chapter Three here and Chapter Four here.

Chapter 5. Mineral commodities: a small footprint, a large impact and a great deal of money

This article was originally published on Mongabay