By Timothy J. Killeen

The Pan Amazon is a significant source of several key industrial commodities. Global markets are not overly dependent on the region; nonetheless, production from Amazonian mines is not insignificant. Development of mineral resources is a decades-long process and, if the extractive sector were to abandon the region, as proposed by some environmental advocates, the global economy would find other geographies to supply these essential minerals. Oil and gas production is insignificant at the global scale (< 0.1%) and production could be wound down without difficulty. In purely financial terms, the Amazonian minerals sector is minuscule, with a total GDP of ~US$20 billion in a global economy estimated at US$85 trillion in 2020, of which about 3% was attributed to oil and gas (US$2.1 trillion) and 1% to industrial minerals (US$850 billion). The global economy could easily adapt to an Amazon that did not include an extractive sector. The same cannot be said for the Amazonian countries.

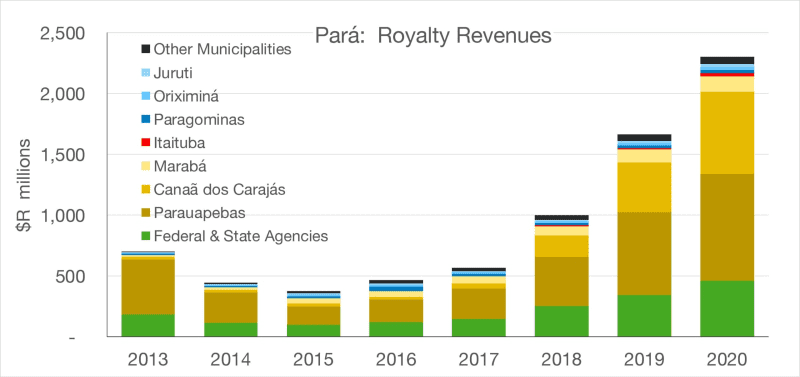

Royalty income from the mineral sector in Pará, Brazil. The municipality of Parauapebas received the lion’s share of royalties due to the mines at Carajás Serra Norte (iron ore) and Salobo (copper). After 2018, operations at the S11D (iron ore) and Sossego (copper) mines started generating revenues for the municipality of Canaã do Carajás. Data source: CGA (2022).

The net revenues from minerals extracted from the Pan Amazon in 2017 were equivalent to about 8% of regional GDP. If all extraction were to stop, the impact would be even greater, however, due to the heavy reliance of the finance and service sectors upon economic activity linked to the extractive sector. Brazil would suffer significant economic dislocation of mineral revenues, but the impact would be catastrophic for Peru, Ecuador and Bolivia. The strategic importance of the mineral sector is evidenced by the current state of the Venezuelan economy that has destroyed its oil sector and a once thriving mining industry based on iron ore and bauxite.

The mineral sector is of less importance to the actual residents of the Amazon, in part because the lion’s share of that revenue is exported from the region. The per capita GDP for all minerals in 2019 was about US$800 per Amazonian inhabitant, but only about 6% of this amount is returned to local and regional governments. Even this number is deceptive, however, because of the uneven distribution of revenues among jurisdictions.

For example, the state of Pará received a total of about 2.3 billion reais (about $480 million) in royalties in 2020; however, only three municipalities (Parauapebas, Marabá and Canaã dos Carajás), home to nine massive open-pit mines, captured more than half of that amount (1.7 billion reais). They were followed by five municipalities (Paragominas, Oriximiná, Terra Santa, Juruti and Barcarena) that received ]81 million reais in royalties from the bauxite industry and another fifteen municipalities that host legal (and quasi-legal) gold mines, which paid another 81 million reais. Fifty-three local governments split about 1.3 million reais linked to construction materials or in compensation for indirect impacts generated by logistical infrastructure. Seventy-three municipalities received no royalty income of any kind, presumably because they are not home to any type of extractive industry.

The state government of Pará receives 15% (345 million reais in 2020) plus another 230 million reais from a tax rebate linked to export income, which sum to about 3% of the total state budget. The mining industry enjoys the fulsome support of the state government and its regulatory agencies that oversee the industry. The state of Pará is responsible for about 90% of the mining activity in the Legal Amazon, so the royalty revenues from mining provide few benefits to the inhabitants of the other five Amazonian states. Similarly, the distribution of royalties from the exploitation of oil and gas production is concentrated in only a few municipalities; however, the distribution of oil and gas royalties favors state governments. In 2020, Amazonas state received 224 million reais in royalty revenues with 67 million reais allocated to the sparsely populated municipality of Coari in Amazonas state, home to the largest natural gas field in the Brazilian Amazon.

The distribution of royalty revenues from the oil and gas sector favors the state over municipalities. The Fundo Social, an autonomous federal entity, invests in education and health infrastructure. Data source: ANM (2022).

Peru is the most generous of the Amazonian countries in returning mineral taxes back to the producing region. The centerpiece of this policy is the Canon, which allocates 50% of the corporate income tax to local and regional governments, as well as the traditional royalty tax. Of the total amount returned, 10% is allocated to the district that hosts the mine, 25% goes to the corresponding province, while 40% is distributed to all of the district-level governments within the region (department); 25% is allocated to the regional government and its associated public university. A slightly different regime is used for hydrocarbons, which reflects the geographic idiosyncrasies of the Peruvian Amazon.

Most other states in the Pan Amazon return only the royalty portion of the revenues to local jurisdictions and corporate income taxes are appropriated by the central government. This generates a level of dissatisfaction based on the perception that the central state does not invest enough resources in the development of their Amazonian hinterlands. Nonetheless, the extractive industries are strongly supported by local governments. Although the majority of revenues are exported from the region, those allocated to capital expenditures and operations support thousands of direct jobs, while the service sector and commerce generate tens of thousands of indirect jobs that enormously amplify the impact of the mineral sector. Importantly, the development of a mine or oil field ensures that improvements are made to health and educational systems, as well as significant improvements to transportation infrastructure.

Most of the residents of the Amazon, particularly the economic elites, hold conventional views about development and the importance of infrastructure is paramount in their list of priorities. The current legal framework for spending royalty revenues reinforces this bias. For example, the Impuesto Directo a los Hidrocarburos in Bolivia and the Canon Minera in Peru obligate the local governments to ‘invest’ this money, rather than to pay salaries or other forms of fixed operating costs. Conspicuously absent from any of the regulations concerning the disposition of the royalty or tax revenues from mineral extraction is the environment. None of this money is allocated to conservation, nor is any allocated to the remediation of the environmental impacts linked to its exploitation.

Presumably, the lack of funding for conservation initiatives is compensated by the environmental action plans that accompany all large-scale initiatives within the mineral sector. Essentially, all mitigation and remediation are considered to be the responsibility of the enterprise that is organizing the investment. This is appropriate, but it also tends to focus these actions locally, to the landscapes in the immediate vicinity of the mine or oil field; in that sense, private actions are similar to the distribution of royalty income.

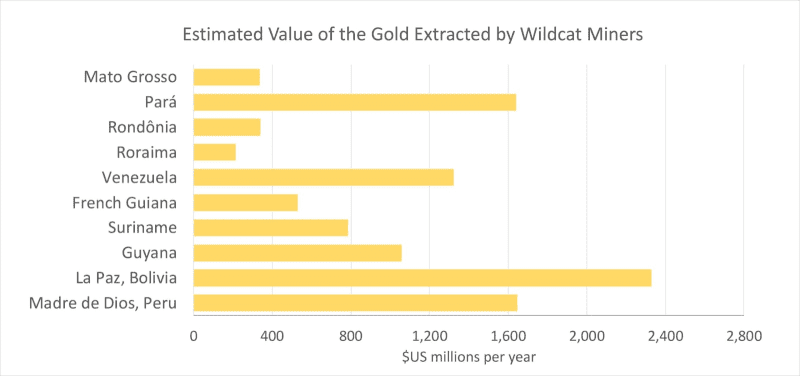

Wildcat gold miners, sometimes referred to as ‘artisanal small-scale gold miners’ (ASGM), mostly operate in violation of tax, labor and environmental laws, while a large subset infringe upon Indigenous lands and protected areas. In 2021, they exported gold worth an estimated $8.5 billion. Data sources: WGC (2002) modified by the subtraction of legal gold production reported by government ministries and other independent sources, being OAS-DTOC (2021), planetGOLD (2022) and Reuters (2022).

The social and economic impact of the informal gold mining sector (wildcat gold miners) is deeply embedded in the Amazonian economy, in part because the distribution of its economic benefits is extraordinarily democratic. By almost any standard, even the largest so-called ‘artisanal’ miner is a small businessman and it is common for them to organise as cooperatives. Many adopt a business model where the net revenues (and risks) are shared among participants.

For many, it is a rare opportunity to escape from poverty.

Wherever gold is discovered, it creates an influential constituency that tends to dominate local political institutions. Wildcat miners are influential, because their activities are economically significant. For example, the public prosecutor’s office in Brazil (Ministerio Público Federal – MPF) estimated that 58% of the gold in Pará reported to the government between 2019 and 2020 (30.5 tonnes) was mined by artisanal miners. Bolivia and Peru likewise tolerate a large cohort of small to medium-scale miners who ignore environmental regulations and evade taxes, but who avoid oversight due to their raw political power.

The natural resource curse

A popular refrain used to disparage the extractive industries is the argument that export revenues distort the economies of countries that rely on them as a major source of GDP. This critique stems from the observation that certain resource-poor countries have enjoyed sustained levels of economic growth, while many resource-rich countries suffer from boom-and-bust commodity cycles that impede their long-term development. This hypothesis triggered a policy debate in the late 1990s as the concepts of sustainable development were being incorporated into strategic frameworks in both the public and private sector. The critique was controversial, in part, because it questioned the lending practices of multilateral development agencies, such as The World Bank, but it was overly reliant on statistical correlations that included numerous obvious exceptions.

Like all correlation-based suppositions, the relationship between resource dependence and economic stagnation could be a ‘cause and effect’ type of phenomenon – or a manifestation of other factors that impede or foster sustainable growth across the entire economy. Regardless, developing countries in the twentieth century had few options, because they needed financial resources to grow their economies and fight poverty. Those that were successful used their ‘natural resource endowment’ to diversify their economies and improve the wellbeing of their citizens.

The cooperative miners of Bolivia completely dominate that nation’s gold mining sector. They have supported the socialist governments of Evo Morales and Luis Arce, who have formalised mining claims and collected a significant share of royalty taxes since about 2015. In November 2022, miners organized street protests until the government agreed to exempt the sector from income and value added taxes.

Most economists tested the natural resource curse/endowment hypothesis using their favorite metric, gross domestic production (GDP); however, an alternative approach relies on the human development index (HDI), a metric that combines data on income, health and education. At the global scale, those analyses show that the monetisation of mineral wealth is positively correlated with human development. In Latin America, however, that benefit is neither strong nor uniform. The inability of the region’s nations to ‘graduate’ from developing or emerging economies into advanced economies is perplexing, but there is no overriding evidence that it is caused by an over-dependence on mineral-based production systems.

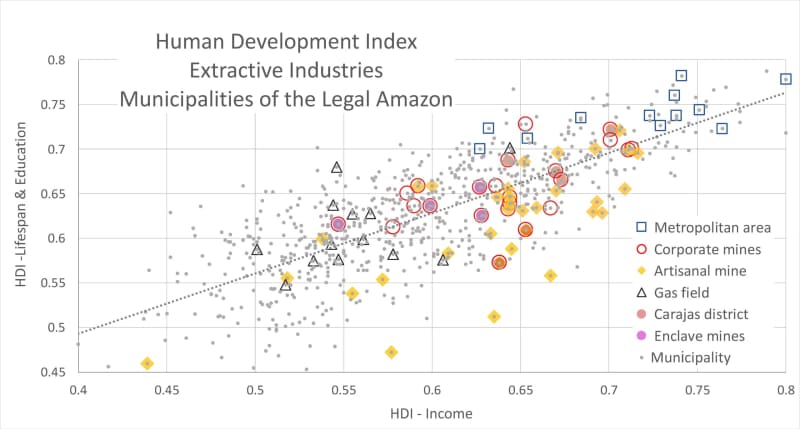

In the context of the Pan Amazon, where the cost and benefits of the extractive industries is even more germane, the results are similarly ambiguous. When the HDI is used as a measurement of progress within subnational jurisdictions, there is an obvious correlation between per-capita income and human wellbeing, but the presence of an extractive enterprise has no recognisable impact – either positive nor negative – on the development status of the region’s inhabitants. A closer look at individual jurisdictions illuminates why the benefits are illusory and the costs difficult to alleviate.

The most conspicuous example of a ‘successful’ development outcome is the Carajás mining district in Pará, where vast mineral wealth is still driving expansion fifty years after the first mine was opened in the 1980s. Investment and royalty revenues have been concentrated in three municipalities (Parauapebas, Canaã dos Carajás and Marabá), with lesser but still significant levels of mineral development in two adjacent municipalities (Ourilândia do Norte do Norte and São Felix do Xingu) and a metallurgical manufacturing complex in Açailândia (Maranhão). All six jurisdictions score well according to the HDI, but three are above and three below the trend line; only one (Parauapebas) has values that approach those of the region’s metropolitan centres.

It is difficult to attribute Parauapebas’s relative prosperity to the mining industry, however, because its development was preceded by investments in transportation infrastructure and a land-distribution programme, both of which triggered a migratory wave that cleared the forest and created an agrarian economy. The combination of policies, which were synergistic by design, caused environmental and social impacts far beyond what might be attributable solely to the mining venture.

Indigenous natives in the Carajás mining district retreated into newly created reserves, which, although large, are a fraction of the size of ancestral lands. The new inhabitants are culturally committed to the conventional economy and have elected representatives that support the expansion of the mining industry. Nonetheless, as the frontier society matured, officials have begun to question the new status quo with demands for greater levels of royalty-based compensation and development initiatives that ‘add value’ to raw mineral commodities. Although citizens accept the role of the mineral sector in their communities, they also voice concern about environmental degradation and petition authorities for more sustainable options.

Similar intensive mining districts include the Pasco, Yauli, Cajamarca and Pataz provinces in Peru and the coastal plain of the Guyana and Suriname, all which have been mining centres for more than a century. None of these landscapes could be described as ‘prosperous’ by any objective observer, and all have only middling HDI values despite decades of investment, economic activity and royalty revenues. Their mining legacy includes significant environmental liabilities in the form of abandoned tailing ponds and denuded landscapes destroyed by strip mines. In Ecuador, the nascent development of the copper and gold mines in the Cordillera del Condor would appear to be following a similar development paradigm, with one industrial-scale mine operating, one under construction and seven in various stages of planning.

Other mining ventures have demanded a different approach, either because they were too remote or were not (yet) incorporated into an infrastructure initiative that might have subsidised their development. Referred to as ‘enclave mines’, these rely on waterways (hidrovias) as a cost-effective commodity-transport system; they include investments in roads and railways, but only to connect the mine site to the river port. Migration is not expressly prohibited, but private investors have little incentive to open adjacent landscapes to settlement that might expose their operations to social conflict. Not infrequently, existing (non-indigenous) communities are amenable to the project, particularly if it includes a compensation package that precedes potential revenues from a royalty tax.

The enclave model was pioneered in the 1950s with the magnesium mine at Serra de Navio (Amapá) and the iron ore mines at El Pao (Bolivar, Venezuela). Subsequently, the model was deployed for additional iron ore and bauxite mines in Bolivar in the late 1970s, the Trombetas bauxite mine in Oriximiná (Pará) in 1979 and the Pitinga cassiterite mines (Amazonas) and, most recently, the bauxite mine near Juruti (Pará) in 2010. None of those mines have noticeably improved human wellbeing as exemplified by their HDI values, which are located near the trend line that tracks the correlation between family income versus health and education. In the near future, this type of development model may prevail in the potash mine being planned for the Autazes municipality at the mouth of the Rio Madeira (Amazonas).

Hydrocarbons are commonly used as an example of the natural resource curse and the pejorative is frequently used to describe the history of the oil and gas industry in Bolivia, Colombia, Ecuador and Venezuela. Within the Amazon, these countries have pursued a range of investment strategies that are not unlike the intensive and enclave models used to describe industrial mines.

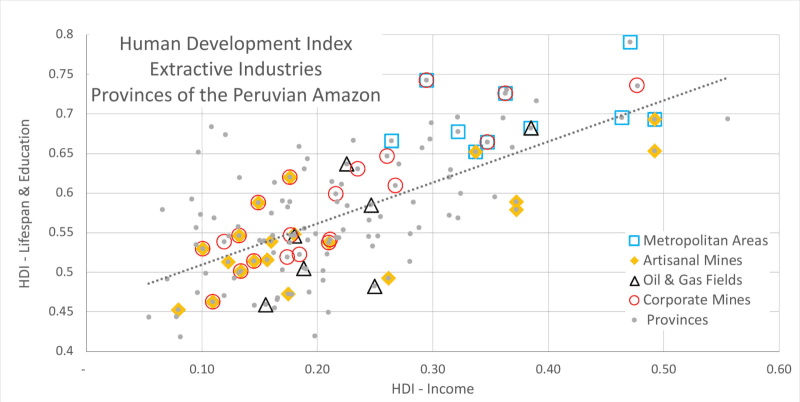

Ecuador pursued an intensive approach when it developed the oil fields of Succumbios and Orellana in the 1960s, which was accompanied by parallel investments in a regional road network, a land distribution programme and extension programmes promoting agroforestry. Despite the vast wealth extracted from its petroleum reserves, the Ecuadorian Amazon remains the poorest region in the country.

In contrast, Peru developed its reserves of oil (Marañón) and gas (Camisea) using an enclave-like model where production fields are compared to an offshore oil platform. Equipment is transported by waterways, while personnel and supplies are ferried to and from the platform by light aircraft and helicopter. This system has ensured that secondary impacts, such as the road building, migration and deforestation, were largely avoided. Peru has the most generous royalty and tax regime in the Pan Amazon, but there is no evidence the local populations, which are for the most part Indigenous, have experienced any measurable enhancement of their wellbeing, at least when compared to the rest of the provinces in the Peruvian Amazon.

The presence of a corporate mine, wildcat mining activity or the production of hydrocarbons confers no systemic cost or benefit on human well-being as measured by the components of the human development index (HDI). Index components are positively correlated across all jurisdictions, but those with extractive enterprises are distributed across both gradients, as well as above and below the trend line. Data sources: Atlas do Desenvolvimento Humano no Brasil (2020) and Instituto Peruano de Economía (2020).

Both the Ecuadorian and Peruvian systems have been plagued with oil spills that have polluted the soils and waterways surrounding the oil fields. For more than two decades, indigenous organisations have campaigned to drive the hydrocarbon industry out of their territories. Support for the industry is still strong in urban centres, such as Iquitos and Lago Agrio, where administrative and logistical facilities are economically important, but urban inhabitants have started to question the cost–benefit calculation in the light of serious environmental liabilities. In contrast, the Camisea gas field and associated facilities have been relatively conflict free. This may reflect the benefits of a revenue-sharing scheme that favours local over regional governments but, more likely, it is a pipeline system that has avoided large-scale spills.

Brazil used the offshore development model to develop the Urucú gas fields in Coari (Amazonas), a municipality in the geographic centre of the Amazon that is uncharacteristically devoid of Indigenous populations. Most inhabitants live in the urban centre (~75%), a river port and logistical centre for the liquids terminal and gas pipeline; the rest are largely ribeirinho communities living on the banks of the Rio Solimões. The municipality has the third highest GDP per capita in Amazonas state but scores poorly for the HDI metric, ranking well below Tefé, a neighbouring municipality that is similar in most respects but which does not receive gas royalties.

A high-profile corruption scandal in 2008 (Operação Votrax) led to the prosecution of twenty municipal functionaries for defrauding the state of about 40 million reais. Corruption is a recurring problem and an investigation in 2019 led to similar charges that implicated the son of the previous ringleader, the former mayor of Coari.

“A Perfect Storm in the Amazon” is a book by Timothy Killeen and contains the author’s viewpoints and analysis. The second edition was published by The White Horse in 2021, under the terms of a Creative Commons license (CC BY 4.0 license).

To read earlier chapters of the book, find Chapter One here, Chapter Two here, Chapter Three here and Chapter Four here.

Chapter 5. Mineral commodities: a small footprint, a large impact and a great deal of money

- Mineral commodities: the wealth that generates most impacts in the Pan Amazon | Introduction March 21st, 2024

- The environmental and social liabilities of the extractive sector March 26th, 2024

- Mining in the Pan Amazon in pursuit of the world’s most precious metal April 4th, 2024

- Illegal mining in the Pan Amazon: an ecological disaster for floodplains and local communities April, 9th

- The environmental mismanagement of enduring oil industry impacts in the Pan Amazon April, 17th

- Outdated infrastructure and oil spills: the cases of Colombia, Peru and Ecuador April, 25th

- State management and regulation of extractive industries in the Pan Amazon May 2nd, 2024

This article was originally published on Mongabay