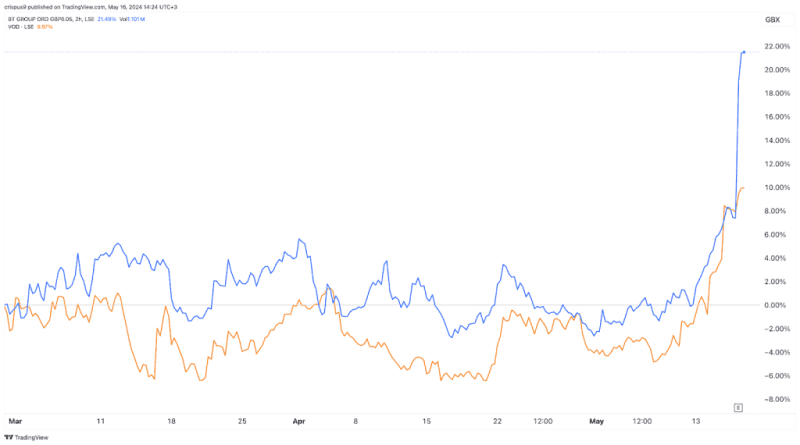

BT Group (LON: BT.A) and Vodafone (LON: VOD) share prices jumped sharply this week after the two companies published their financial results. Vodafone’s stock jumped by over 5% on Wednesday and continued the trend on Thursday. It jumped to a high of 77.50p, its highest level since September last year. It has soared by over 23% from its lowest point this year.

BT Group, on the other hand, spiked by over 12% on Thursday, reaching a high of 128p, its highest level since December 14th. It has surged by over 25% from its lowest level this year.

BT Group vs Vodafone stocks

Vodafone and BT reported relatively encouraging results even as their revenue and profitability growth remained under pressure. Vodafone’s revenue dropped by 2.5% in FY21 to 36.7 billion euros.

Its profit for the year came in at 1.5 billion euros, a big drop from the 12.2 billion it made a year earlier. That drop is because the company decided to sell its operations in Spain and Italy to simplify its business.

The main reason why its stock jumped is that the company’s business in Germany is making progress. Its service revenue rose by 0.2% for the full year and 0.4% for the final quarter of the financial year.

The management believes that its German operations will continue doing well in the current financial year. Germany is a core part of Vodafone’s business, accounting for over 30% of its total revenue.

BT Group, on the other hand, published mixed financial results, which revealed that its profits retreated during the year. Total revenue rose by just 1% to $20.7 billion while its profit after tax fell by 55% to £855 million.

As I wrote earlier this week, a key concern for BT Group is that its business division is facing intense pressure. Its full year adjusted revenue dropped by 2% to £8.1 billion while consumer and Openreach rose by 4% and 7%.

The stock jumped after the company announced a plan to increase its dividends and save additional costs in the next few years. In her statement, Allison Kirkby, the CEO, said:

“This enhanced cash flow allows us to increase our dividend for FY24 by 3.9% to 8.0 pence per share. We’re also setting a further £3bn of gross annualised cost savings to be reached by the end of FY29.”

In addition to earnings, Vodafone and BT Group shares surged because they are seen as bargains since the FTSE 100 index has soared to a record high. BT has been trading near its lowest level since 2020 while Vodafone was hovering near its lowest point in over a decade.

The post Here’s why BT and Vodafone share prices spiked after earnings appeared first on Invezz