New York (AFP) - Global stocks finished mixed on Thursday as investors weighed the latest back and forth on US-China trade talks and the impeachment push against US President Donald Trump.

US and Chinese negotiators are working to finalize a preliminary trade deal announced in October that would block new tariffs expected to take effect this month. Officials have sent mixed signals on the talks, sending shares gyrating this week.

Thursday's session on Wall Street avoided major swings.

Art Hogan, chief market strategist at National Securities, described Thursday's session as "pretty fair and balanced" after the market's "Pavlovian" moves in recent days on trade news.

The S&P 500 scraped out a 0.2 percent gain. Earlier, Frankfurt and London fell while Paris was flat.

Besides trade, investors are keeping an eye on Democratic efforts in Congress to impeach Trump over his dealings with Ukraine.

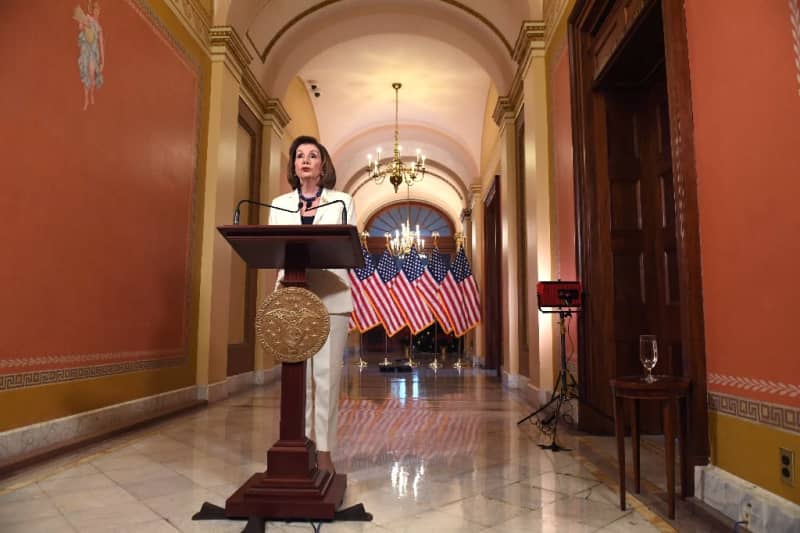

Top Democrat Nancy Pelosi gave the green light to draft articles of impeachment against Trump on Thursday, saying the president's alleged abuse of power "leaves us no choice but to act."

British stocks were pressured by a rise in the pound's value against other major currencies, which limits profits at companies that earn substantial amounts of their revenues in US dollars.

The pound was in demand as polls suggest that Prime Minister Boris Johnson's Conservatives should win a majority at next week's general election, giving him a mandate to push through his Brexit agreement and avert a no-deal divorce.

Deeper OPEC cut?

In commodity markets, Brent oil prices edged higher after surging Wednesday on reports that OPEC and other major producers were ready to announce fresh output cuts. US benchmark contract West Texas Intermediate was flat.

Faced with slowing global economic growth and abundant reserves putting pressure on oil prices, OPEC and its partners could seek to deepen output cuts when they meet in Vienna on Thursday and Friday.

The cuts of 1.2 million barrels per day from October 2018 levels were originally fixed in December last year and were already extended at OPEC's last meeting in July.

But before OPEC members began their delayed main meeting, Russian Energy Minister Alexander Novak said a preliminary gathering of ministers had recommended an additional cut of 500,000 barrels per day be considered for the first quarter of 2020.

Some observers say fresh production cuts and a boost to prices might suit Saudi Arabia as it launched the landmark IPO of its national oil company Aramco.

The initial stock offering was the largest ever, raising $25.6 billion, two sources told AFP.

- Key figures around 2200 GMT -

New York - Dow: UP 0.1 percent at 27,677.79 (close)

New York - S&P 500: UP 0.2 percent at 3,117.43 (close)

New York - Nasdaq: UP 0.1 percent at 8,570.70 (close)

London - FTSE 100: DOWN 0.7 percent at 7,137.85 (close)

Frankfurt - DAX 30: DOWN 0.7 percent at 13,054.80 (close)

Paris - CAC 40: FLAT at 5,801.55 (close)

EURO STOXX 50: DOWN 0.3 percent at 3,648.13 (close)

Tokyo - Nikkei 225: UP 0.7 percent at 23,300.09 (close)

Hong Kong - Hang Seng: UP 0.6 percent at 26,217.04 (close)

Shanghai - Composite: UP 0.7 percent at 2,899.47 (close)

Pound/dollar: UP at $1.3161 from $1.3104 at 2200 GMT

Euro/pound: DOWN at 84.38 pence from 84.54

Euro/dollar: UP at $1.1106 from $1.1078

Dollar/yen: DOWN at 108.74 from 108.86 yen

Brent North Sea crude: UP 0.6 percent at $63.39 per barrel

West Texas Intermediate: FLAT at $58.43 per barrel

burs-jmb/dg