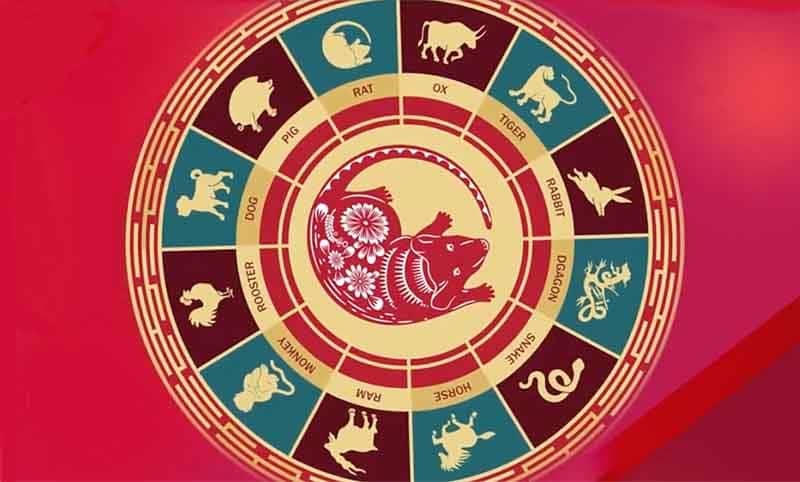

WASHINGTON – January 25 marks the start of the Chinese New Year, and this year is the Year of the Rat. Chinatowns across the US will be celebrating this Saturday, blowing off fireworks and parading traditional giant, human-inhabited dragons. But it appears that, due to the spreading “Wuhan coronavirus,” a number of cities won’t be celebrating the Year of the Rat in China itself. And for investors, this developing coronavirus pandemic is killing stocks as well as people. ##### Wuhan coronavirus haunts the incoming Year of the Rat

Lockdowns like this one are occurring because the coronavirus is killing people in China. That, in turn, is causing some local governments to pull back on celebrations as one way of preventing the spread of this disease. But investors, too, are now worried. Because this potent, flu-like illness is killing stocks as well as people, as we've already said and as ZeroHedge duly notes.

“Dow is down 200 points...

“The 'Year of the Rat' is starting not with a bang, but with a whimper. Thanks to the rapid spread of a deadly coronavirus that has confounded China's public health officials and triggered massive quarantine operations intended to seal off at least three cities from the rest of the country (and world), Beijing has joined three other Chinese cities in cancelling Lunar New Year celebrations.”

Potential economic consequences of Wuhan coronavirus increase by the day

Blogger and commentator Bill Blain elaborates further on the economic consequences of the coronavirus outbreak.

"The big news this morning is the frighteningly rapid escalation of the Wuhan Plague – the SARs like Coronavirus has now killed 17 (doubling overnight) and is spreading. Wuhan is in lockdown with trains and planes closed down, apparently overflowing hospitals, and restrictions being placed on citizens. It sounds scary, but 'horse and stable door' springs to mind. Chinese stocks took a thumping – down 3.5%. It's all about uncertainty. Thus far it looks like the virus is most dangerous to the elderly and infirm, but until everything is known about the source and contagion, we really don’t know.”

Worldwide consequences

Things aren’t getting any better worldwide. Airlines transporting residents from coronavirus-infected areas of China are already transporting the disease across the globe, and there is talk of quarantining individuals on such flights or canceling them altogether. But simultaneously, scientists and researchers are scrambling to get to the bottom of how the disease is spreading so rapidly. As the carnage rises, the Tylers of ZeroHedge explore some potential exotic carriers. They cite theories, as yet unproven, that claim this particular flavor of the coronavirus might be due to a “species jump.”

"As the total number of confirmed coronavirus cases nears 650, scientists inside and outside China have speculated that the Wuhan coronavirus was first passed to humans via snakes, badgers, bats or rats.

"Some preliminary research that has been picked up by the Western press, including CNN, claims the virus may have been passed to humans by snakes, with the Chinese krait and the Chinese cobra the primary suspects…It's also apparently among the species of snakes that are sometimes consumed by humans."

Well, that’s a relief. I can’t recall the last time I handled a Chinese krait. Can you? ##### The infection rapidly spreads to international stock markets

But elsewhere in today’s ZeroHedge, we note that the contagion is rapidly spreading to US and international stock markets as well. As a confirmed capitalist tool, I’m bound to look just as seriously at the economic and market pin action. It's all starting to happen as a result of the Wuhan coronavirus’ rapid international spread as the Year of the Rat approaches. Initially, many declined to speculate about the impact of the coronavirus on global GDP. But the quarantines and cancellations have virtually guaranteed that China's already-slowing economic growth is about to take another hit.

"Analysts at SocGen [Société Générale] write 'Markets have become concerned about the outbreak of the coronavirus in Wuhan. Clearly, there is still considerable uncertainty as to how the situation will evolve. However, the SARS epidemic in 2003, which lasted for nine months and infected over 5,000 people in China, should be a useful reference for the potential economic impact this time. Drawing from the SARS lesson, if the situation has failed to stabilise by March, 1Q GDP growth will likely fall below 6%, compared with our current forecast of 6.1%. Undoubtedly, consumption and tourism-related sectors would be most affected.'"

For those who can't find info on coronaviruses in the fake news media

In case you’re curious, the Centers for Disease Control (CDC) and Prevention provide details on the general symptoms and complications caused by known coronaviruses.

“Human coronaviruses can sometimes cause lower-respiratory tract illnesses, such as pneumonia or bronchitis. This is more common in people with cardiopulmonary disease, people with weakened immune systems, infants, and older adults.

“Two other human coronaviruses, MERS-CoV and SARS-CoV have been known to frequently cause severe symptoms. MERS symptoms usually include fever, cough, and shortness of breath which often progress to pneumonia. About 3 or 4 out of every 10 patients reported with MERS have died.”

In other words, this is a flu-like virus. One that conjures up fears of the 1918-1920 "Spanish flu" pandemic that killed 50 million or more worldwide. ##### The MERS and / or SARS angle

Additionally, what scientists worry about is the MERS and SARS angle of this “Wuhan” coronavirus strain and the fact that many sufferers of the virus can develop fatal pneumonia. Breitbart provides greater detail.

“The Wuhan coronavirus is in the same family as severe acute respiratory syndrome, or SARS, which killed more than 700 people in 2002 and 2003, and Middle East respiratory syndrome, or MERS.

“To date, the Wuhan coronavirus has infected more than 300 people and killed six in an outbreak that has struck China, Thailand, South Korea, Japan and now the US.”

Mr Market got the chills this week as the coronavirus rapidly spread

All this leads us back to Mr Market. For much of this week, he seems to be suffering from some kind of virus as well. With the Chinese trade and tariff storm now temporarily in the background, the continuing impeachment kabuki on Capitol Hill and now, a potential coronavirus pandemic dominate the confusing environment for many traders and investors. Indoctrinated by the media, many still remain fearful of an imminent recession during this fateful Year of the Rat. The Wuhan coronavirus is throwing a severe chill into stocks, particularly the big internationals that populate the Dow. Likewise, the oil and gas, entertainment, casino, airline and vacation industries (cruise lines, etc.) are starting to suffer from coronavirus pin action. Imagine if large numbers of people suddenly cancelled vacations and were afraid to travel anywhere. If if this only happens for a few weeks, the resulting pullback could clobber travel-related companies. Not to mention their P&L numbers for the current quarter. Add the numerous industries that support these sectors – hospitality (hotels, restaurants, food service, adult beverages and credit cards, for example). And you can easily see how US and international economies and corporate shares could take a hir. You can see the multiplier effect unfold. It could get ugly. Or uglier. ##### Time to start building a cash position?

All of which confirms my intention to selectively pare stocks from our portfolios as the Year of the Rat begins. Weak areas like the Financials, Energy, and now, perhaps, travel pretty much need to go. Many of these companies have violated their support lines. The charts look bad, earnings are in decline. So these stocks are no longer a good place to be. The healthcare sector still looks good for the most part. And some analysts are seeing a potential uptick in the new Communications sector. But until some of the market’s imponderables get solved, cash may be our best friend for now. And investors get cash by cashing out of their iffier investments.

*– Headline image: Year of the Rat, Chinese Zodiac symbols. Screen capture of YouTube video clip via The List.*