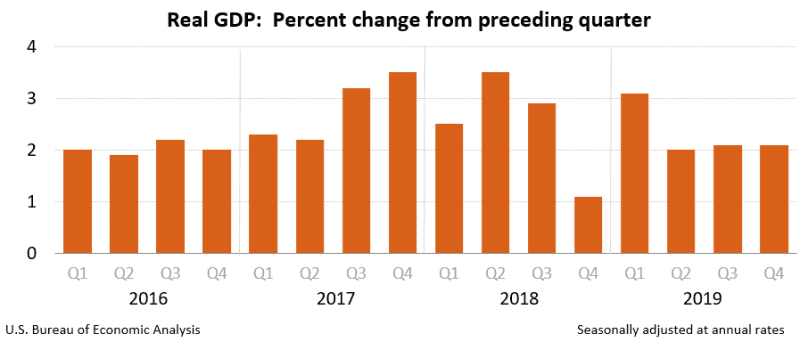

WASHINGTON — The US Bureau of Economic Analysis (BEA) just release the first estimate for GDP growth for the fourth quarter of last year. The 2.1% growth rate for the quarter means that the growth rate for the entire year 2019 was 2.3%. That’s below what President Trump promised. Clearly, Fed policy, not Trump's policies, led to slower growth in 2019. But 2020 looks much better. **

Also Read: Confused Fed, spreading virus, crazed Houthis hit Wednesday markets

Trump said that his policies would result in annual economic growth exceeding 3%, something not seen since 2005. He said that the combination of the elimination of counter-productive regulations and tax cuts for all Americans would be the policies that accelerated growth. So what happened?

Trump in control? Almost, but...

In 2017, through executive order, Trump was able to eliminate hundreds of regulations that serve to be a burden to economic growth. He did that in the early months of 2017. By June, the beginning of the third quarter, Trump’s actions were providing positive results, as growth increased to more than 3%. Growth remained in the 3% range for the next four quarters. Then at the end of 2018 growth slowed to just above 1%. Growth rebounded in the first quarter of 2019 but then slowed to just above 2% for the remainder of the year. ##### What Happened? Was Trump wrong?

It turns out that Trump did not hit his targets. But this was mostly to the Federal Reserve. The Fed raised interest rates eight times between Trump’s election victory and the end of 2018. Just as the economy was about to take off because of Trump’s policies, Fed policy choked growth because they clung to an unfounded fear of inflation. Making matters worse, the Fed also reduced its balance sheet. That meant the nation's central bank would sell hundreds of billions of dollars of bonds. These were the bonds they had purchased as part of the quantitative easing policy instituted after the 2008-2009 recession. That action reduced the amount of money in circulation by nearly half a trillion dollars which slows economic growth. In 2019, the Fed realized they had made a big mistake. Inflation continued to come in at less than their target range of 2%, and there didn’t seem to be any inflationary pressure on the horizon. So in July 2019, Fed policy changed. They began to cut interest rates. They cut rates again in September and again in October. Usually, it takes about six to nine months for Fed policy actions to be felt by the economy. That’s good news for this year. We should feel the effects of these cuts some time in the spring or early summer. ##### Fed inflation fears remain unwarranted.

The Fed’s inflation fears are instinctive. Historically, this tends to drive Fed policy. The central bank's inflation fears arise, essentially, from three sources: 1. Increasing labor costs; 2. Excess demand in the economy; and 3. Price shocks from commodities mostly in the energy sector.

This year, and going forward, none of those factors will cause any increases in inflation. That's due mostly to President Trump’s policies. Wage increases will add to the cost of production only when those increases exceed productivity. In other words, if a worker is paid 3% more but does not produce more, costs will increase. But if wages rise by 3% and, at the same time, the worker produces 3% more, then labor cost will stay constant. Because Trump’s tax cut resulted in capital formation, productivity is running just slightly less than wage increases, so there is little wage inflation. Excess demand puts increasing upward pressure on prices. But that occurs only if supply cannot increase to meet the excess demand. Again, because Trump cut the corporate tax rate, businesses have more new capital to deploy. And they can use it to increase their output to meet any increases in demand. That means excess demand will lead to higher growth, not more inflation. ##### Trump's drive for energy independence also helps

Because President Trump has set energy independence as a goal for the US, the production of oil and natural gas has rapidly increased. Although not completely energy independent, the US now produces sufficient amounts of energy to largely shield this country from geopolitical forces. As we see in past history, such forces cause inflationary price spikes due to increased energy cost. As a result of this forward motion, the economy is really poised for increased growth in 2020. That remains true even though the current consensus view asserts that economic growth will slow to 2% or less this year. But now, in addition to Trump's fiscal and energy policy, FED policy is now in a growth-friendly position. For now, both policies seem more in synch. And that's to the nation's advantage. In late 2019, President Trump also won the at least Round 1 of an ongoing trade war that previous administrations ignored. As a result, he signed new trade deals with Mexico, Canada, South Korea, Japan and China. He continues to negotiate new, growth-inducing deals with India and the European Union. Now that Brexit is a reality, England is next in line for a new bilateral trade agreement. All this will likely increase US exports, starting this year. ##### An increase in business confidence

Corporations that were hesitant to increase investments in new plants, equipment and employees in 2018 and 2019, now feel more confident when considering bolder moves. Consumers confidence remains at or near record high. American workers' incomes continue to rise and employment opportunities continue to increase. This likely means more growth in the current year and beyond. With administration and Fed policy in synch, at least for now, 2020 should see the best economic growth since 2005, likely exceeding 3% on an annual basis. Let's hope that Fed policy remains steady and accommodative to the substantial growth rate President Trump seeks to achieve or exceed.

*— Headline image: The US Federal Reserve. (U.S. government photo, in the public domain.)*