WASHINGTON – Gloom and Doom continues to pound Wall Street Friday, as more and more investors – and machines – steadily exit stocks and bonds. No, there’s nothing wrong with most American stocks and companies today. But given the apparently relentless spread of the Wuhan coronavirus, one could be forgiven for thinking that the coronavirus infects stocks and bonds as well as people. As of this writing, market averages are taking another big hit today and show little sign of recovering. The Dow tanked about 300 points after Friday's opening bell. It's down a negative 255 points at the moment (3:15 p.m. ET). It wouldn't be a surprise to see it tank once again at the 4 p.m. closing bell. **

Also read: Coronavirus epidemic hits Wall Street again, pancaking Mr Market

After a January of higher and higher highs, February seems to be the cruelest month, as Great Expectations turn to ashes. Also infected by the coronavirus, even irrational exuberance seems to have fled. Oddly, this reminds me of an old American baseball poem, Ernest Lawrence Thayer’s timeworn bit of doggerel about a slugger who chokes in the clutch. I’m talking about “Casey at the Bat,” of course. ##### Coronavirus at the bat?

Thayer’s final verse could easily be adapted to describe an investor’s feelings today after sustaining yet another round of coronavirus damage to his portfolio. Let’s give it a try.

Oh, somewhere in America the sun is shining bright, A band is playing somewhere, and somewhere hearts are light; And somewhere folks are laughing, as giddy kiddies shout, But there’s no joy on Wall Street—Mr Market has struck out.

With coronavirus rumors endlessly chasing fact and factoids like opponents in a cartoon whirlwind, we can look to America’s best-known and most highly regarded sage, Yogi Berra, to describe this nasty bug, which may or may not have been unleashed due to sloppy work in a Chi-com germ warfare facility. “It ain’t over ‘til it’s over.” ##### Where's the real information on this disease?

Well, that’s as good an assessment as anyone can get, given that most of the “concrete” info on this super-duper bug, made bigger and badder by the Fabulators of Beijing, for whom the “truth” is what the Party says it is. (Which is why this novel virus got out of control to begin with.) There’s a lesson in this. This is the kind of government you get when knee-jerk Marxists come into power. Hopefully, voting Americans will think about this when choosing between Donald Trump and the likes of Bernie Sanders this November. But it’s a long way to the Biggest Vote in the History of the World (at least according to the fast-fading MSM blowdries). Right now, we have a stock market that’s scared of itself and investors who are suddenly ready to bail at a moment’s notice. That's the result of the cosmic issue at hand as the coronavirus now infects stocks, bonds and whatever. Except, maybe, for precious metals, your momentary port in a storm. ##### As the coronavirus infects stocks, what's an investor to do with all this Gloom and Doom?

To be honest, I don’t have a clue. The media hypes up any real or imagined disaster, which makes it hard to figure out whether this week’s extended bout of Wall Street Gloom and Doom is the genuine article or a fake docudrama that helps to sell ads. So we'll have to resort to reason to puzzle this one out. I, for one, think that at least for now, the ballooning infection toll is mostly occurring in countries run by autocratic, self-interested government apparatchiks more interested in their own wealth and position than they are in the health of the millions and billions of Deplorables who fork over a high percentage of their paychecks for zero return. The most affected countries at the moment also lack the ability to provide decent medical care for the Great Unwashed, particularly when some kind of novel epidemic is on the move. Clearly, the coronavirus will gradually spread anywhere it wants to. But it’s likely to run out of control mostly in backward countries with thin or unresponsive medical personnel and facilities. If the coronavirus peaks in these countries and then subsides, while more advanced countries and governments mostly keep it at bay, this creeping threat may end sooner rather than later. ##### Fine. But what if the coronavirus goes wild in advanced Western countries?

But if countries like the US and the UK sustain a hit like the damage we’re now seeing in China and South Korea (and probably North Korea, too, which will stifle all statistics), then we’ll have real trouble, both on the medical front and on Wall Street as well. More Gloom and Doom = more selling. Already, the virus continues to spread, hitting tech stocks the hardest at the moment. That’s due to the ongoing massive hits and disruptions unfolding in China. Which, unfortunately, is where a foolish majority of tech products and supply chains currently reside. Seems our current tech geniuses forgot about putting all their eggs in one basket. Now they may pay the price. Even Apple (trading symbol: AAPL) and mighty Microsoft (MSFT) are taking a real beating this work for precisely this reason. Calling supply chain genius, Tim Cook. Tim? Tim? But if such a scenario persists, materials and industrials will get clobbered, too, along with energy stocks, which have already taken quite a shellacking over the last 6 weeks or so due to declining fuel sales. Which follow declining cruise ship and airline traffic, much of which has, for now, exited the Chinese mainland altogether. ##### Coronavirus infects tech and energy stocks: Falling dominoes? Banks too?

Should financial pressure keep rising, the world’s fattest international banking giants could be next on the Coronavirus Hit List, due both to a lack of business, and, perhaps, a growing number of defaults. The Gloom and Doom ripple effect could continue, engulfing nearly every business, every line of work, every production line and sales floor. Scary stuff. And investors, always nervous about their money anyway, have been jamming all the exits this week. Which means we’re either going to get hosed if we hold onto our portfolios. Or we might be seeing one of the greatest buying opportunities in memory. Problem is, we’re still largely depending on information from those totalitarian Chi-coms. They’re about as reliable as the fake reporters and commentators at CNN. So this info won’t be much help as we all try to decide whether to play another exciting round. Or head for the exits and light out for the territories. ##### Holding for now...

It’s a fine mess we’ve got ourselves in now. At the moment, personally speaking, I’m pretty much holding on, having dumped some small holdings that exceeded my loss limits. As for everyone else, it’s time to reassess your risk tolerance. Investing is no fun if you hate everything you’re in. So, if you’re more miserable every day about your portfolio, most veteran investors would advise selling down to the point where you can once again sleep well at night. That's one way to get the Gloom and Doom out of your head. Have a great weekend, notwithstanding. I’ll be back next week, I think. And hopefully with cheerier news.

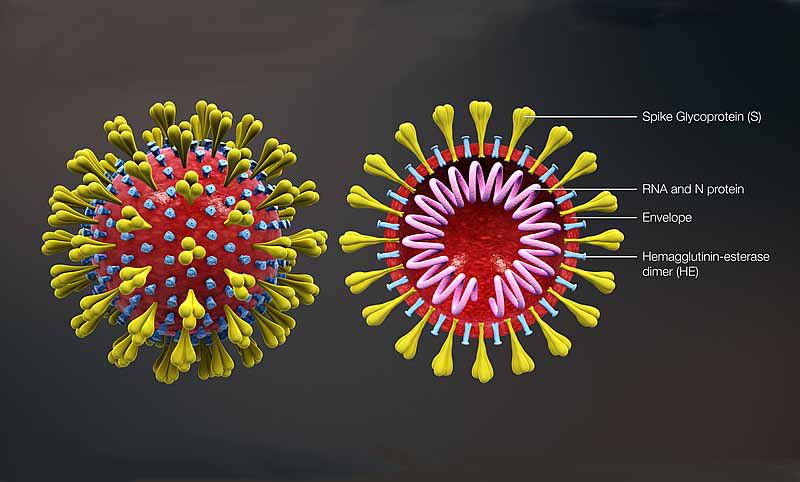

*– Headline image: Cross-sectional model of a coronavirus. Via Wikipedia entry on the coronavirus, CC 4.0 share and share alike license.*