WASHINGTON –It’s High Noon on Wall Street this Wednesday. And, at the moment at least, Wall Street’s bulls, who managed to mount a 450+ point morning snapback rally on the Dow, have either left for an extended lunch or have chickened out entirely after sober second thoughts about their a.m. buying spree. The Dow is still up as this High Noon column gets underway. But it’s up less than 80 25 15 points at the moment, having lost 320 375 385 points of irrational exuberance over the past 20 minutes or so. Some snapback rally. ##### Snapback rally has a hard time getting momentum. Why?

The reason, according to a CNBC report?

“Stocks and bond yields fell after Bloomberg News cited a Food and Drug Administration official saying the coronavirus was on the cusp of a pandemic.

“‘Unfortunately, I think this is going to turn into a full-blown correction,’ David Bianco, chief investment strategist for the Americas at DWS, told CNBC’s ‘Squawk Box.’ ‘It’s a material impact to our earnings outlook and it’s probably going to be another year of flat[t]ish earnings growth.’”

The recent – and perhaps ongoing – coronavirus- and Bernie Bros-inspired 3-day market crash (if you count last Friday) was, or still is, a whopper by recent standards. Many key stocks have already violated their 200-day moving averages on the downside. Which, for non-chart followers in the audience, means that these shares are potentially heading down further until they can find some buying support. Maybe the moneybags will decide to return to the battle this afternoon after consuming a few designer martinis. And getting their courage back up. But if the currently fizzled High Noon rally turns out to be all they can accomplish today, this could mean another big drop in the major averages later today and / or tomorrow as well. **

Also Read: COVID-19 menace and Bernie Bros = Selling panic on Wall Street

The tale of the charts

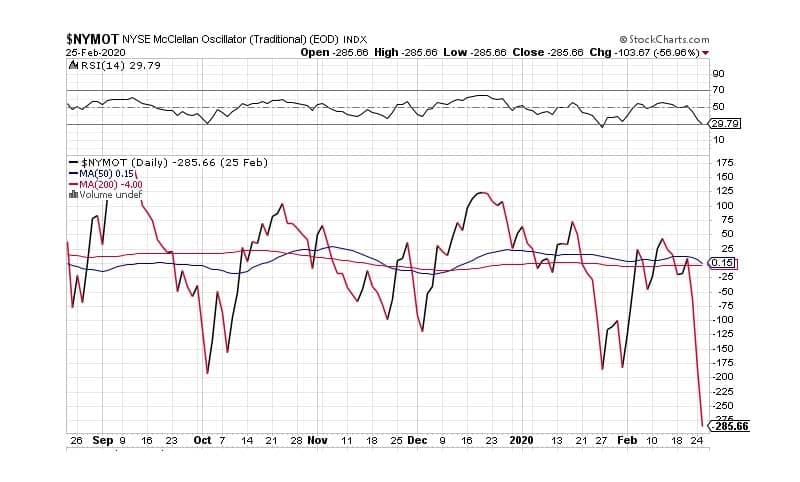

Although we perceived some false encouragement for a snapback rally from the extreme reaction displayed by Monday’s closing McClellan Oscillator chart, all we got Tuesday was another sickening, Wile E. Coyote cliff-dive-style drop in all 3 major averages. And pretty much every other average there is. As a result, the February 25 closing McClellan Oscillator chart (symbol: $NYMOT, headline image above) and closing VIX volatility index ($VIX, below) are so extreme that additional gallon bucket purchases of Maalox are encouraged. High volatility and extreme oversold conditions prevail, as vividly portrayed by these charts.

VIX volatility index ($VIX) as of COB Tuesday, February 25, 2020. Chart courtesy Stockcharts.com.

... And the worst is yet to come?

Add to the COVID-19 scare-fest last night’s Democrat debate clown show in Charleston, South Carolina. Any random batch of kindergarteners vying for the teacher’s attention still have more dignity than these low-lifes, all of whom fervently believe they can do a far better job than former President Barack Hussein Obama in “fundamentally transforming” America into another Venezuela- and Cuba-style Commie workers paradise economic and social failure. The very fact that one of these sub-100 IQ goofballs might actually bump off Donald Trump in this November’s crucial national election is enough to induce a stroke in many rational voters. And this, too, continues to unnerve a market that’s already greatly perturbed by the real or imagined implications of the Wuhan coronavirus threat. ##### In an attempt to engage reason for a moment, let’s agree on the following:

1. The spreading “novel coronavirus” has massively reduced international travel, commerce and supply chains, courtesy of both its suddenness and its outsized impact on companies that grew too dependent on cheap Chinese labor to supplant their own country’s workers. 2. As a result, any positive economic developments in Q1 2020 have been largely negated in any company that has significant international sales and / or operations. 3. Should the coronavirus epidemic – and the continued Democrat campaign lunacy – fail to abate prior to the beginning of Q2, Q2 will also suffer serious P&L damage. 4. Should Q2 activities and numbers prove poor, this will likely affect Q3 numbers as well. Which, for most accountants, could result in an official recession, if only one on paper. 5. Which could still defenestrate Trump in November. In which case this recent nasty crash would be only a dress rehearsal for the disaster we’d face in November.

Yellow lights continue to flash in US stock and bond markets

I’ve never been an alarmist, and I don’t think most of the above will happen. At least today I don’t. But life - and today's High Noon on Wall Street showdown - have taught me you have to prepare for the worst, just because. You have to keep your options open, in life as well as in stocks and bonds. For that reason, I, for one, am still cautious about re-investing newly-raised cash in this market until it settles down. If the bulls are really back and if the averages skyrocket once again, I might feel a bit irritated about missing the initial ride, which is always the biggest one. But, on the other hand, if the whole market goes straight to hell in one resounding crash, I’ll feel much better about having put away all that cash in order to buy some real bargain stocks. (Ignoring, for a moment, the Bernie Bros November Nightmare on Elm Street scenario.) ##### Modest moves, and avoiding panic. For now...

So today, I’m continuing to do a bit of portfolio window dressing. Goal: To remove a couple ill-advised oil patch investments. Energy, in general, has been a lousy investment for months, so that makes sense. I’m keeping investments in the tech, utilities and real estate sectors for now. But I’m also hanging on to a pair of financial REITs that fought off this week’s crash. Specifically, Pennymac Mortgage Investment Trust (PMT): 8.4% dividend yield; and New Residential Investment (NRZ): 11.98% (!) dividend yield. Yield is king right now. So I’m holding on to these and a large batch of high-yielding preferred stocks, at least today. We might be in a period where you can’t get much in the way of capital gains. So the next best thing is to scoop up relatively stable high-yield investments and get the quarterly dividends. I figure I can come back out of hiding later when we get an all-clear sign, which we’ll get eventually. Anyhow, this is what I’m doing at the moment to counter Mr Market’s shifty and near-lethal moves. Like the fact that we’re now down about 150 points on the Dow as I wrap this column up. These days, who even has the foggiest idea about where stocks will close today? I sure don’t. So caution is the watchword. It's always High Noon on Wall Street. Back tomorrow. Maybe for another High Noon thriller.

*– Headline image: Doom and Gloom. Where's that snapback rally this chart seemed to promise? The McClellan Oscillator ($NYMOT) as of COB Tuesday, February 25, 2020. Chart courtesy Stockcharts.com.*