Tailored Brands Inc (NYSE:TLRD) stockand bond analysis by Michael Roberson ofStrategy Chain.

Q1 2020 hedge fund letters, conferences and more

Tailored Brands: Long Idea

The idea in a nutshell:

- 7% 2022 Bonds at 26

- 27% current yield

- 3-4x upside potential

- Equity below 1x LFCF

- Likely to break leverage and fixed charge coverage covenants, but (in my view / looking to confirm this thinking) likely to be granted a waiver

- Likely to be able to pay interest through the COVID-19squeeze

- Currently at $0.90/sh down from $8.00/sh a year ago and $4.00/sh immediately before COVID-19

- Possibility of a buyout bid (Sycamore or George Zimmer)

Thesis

- Tailored Brands is priced for bankruptcy but is unlikely to file

- Financials suggest TLRD can operate for 6 months with no revenue

- P/E: 1.8x current; 0.6x normalized

- P/LFCF: 1.0x current; 0.5x normalized

- 2022 bonds at 26

- At under $50m in market capitalization, there is likely indiscriminate selling

- Further exacerbated by recent sales by Michael Burry, who trimmed his position from 8% to below 5% of shares outstanding

- TLRD is a classic Joel Greenblatt “stub stock” play

- $50m market capitalization

- $1,413m debt

Business Overview:

- Brands: Men’s Wearhouse, Jos. A. Bank, Moores, and K&G

- Products & Services

- Sell men’s suits, formalwear, and businesscasual (79% of GP)

- Rent tuxedos (21% of GP)

- Offer tailoring and other services (<1% of GP)

- Distribution

- 1,450 stores in the US and Canada

- Factory in Massachusetts

- eCommerce operations

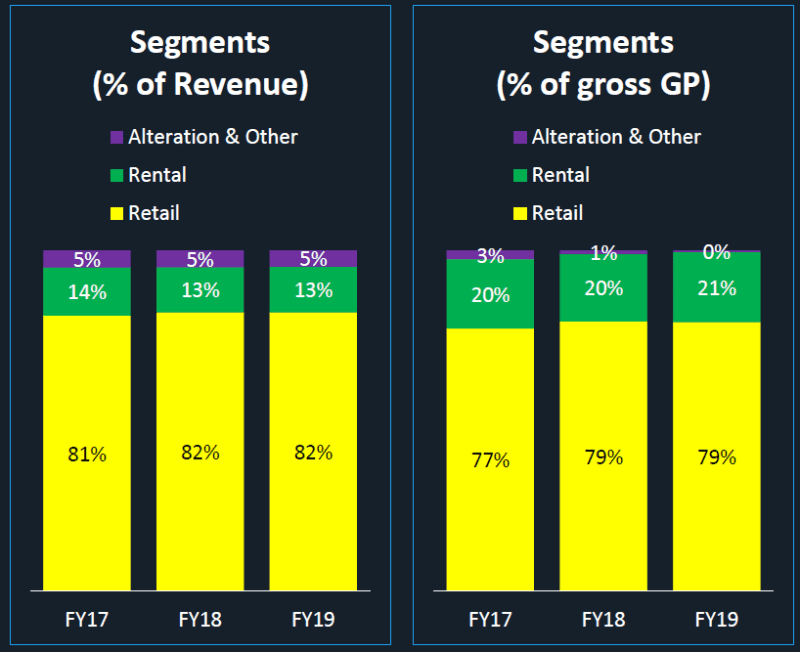

Segment Overview:

- Gross Margin Focus

- Roughly 78% Retail

- Roughly 20% Rental (high margin business)

- Alteration is negligible because of its low margins

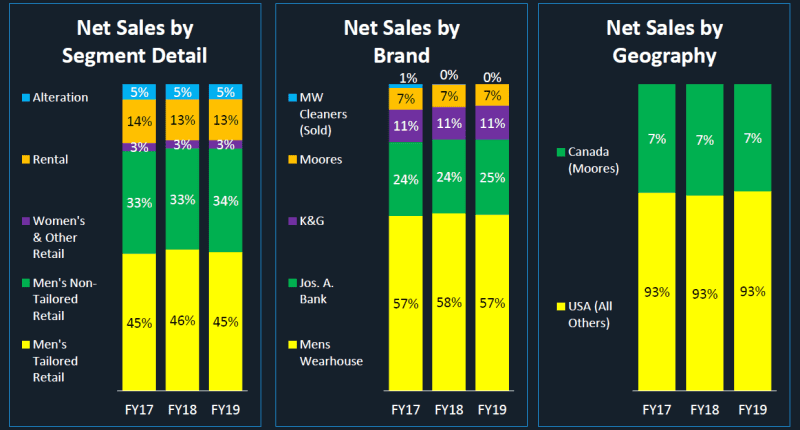

Tailored Brands Net Sales Details

- Segment Details

- 45% Men’s Tailored Clothing

- 33% Men’s Non Tailored Clothing

- 14% Rental (but this business is high margin)

- Brands

- Dominated by Men’s Wearhouse and Jos. A. Bank

- Geography

- Mainly USA

- Moores is the Canadian portion

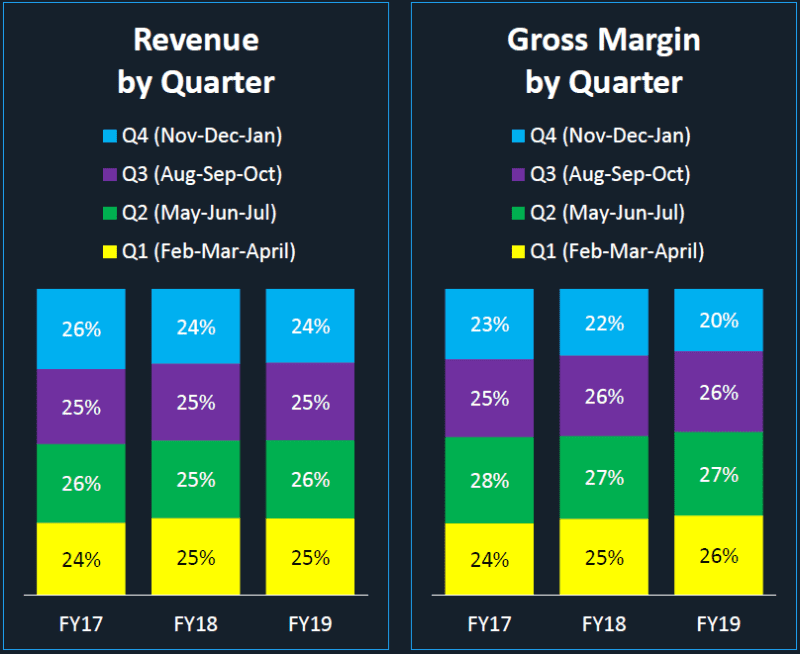

Tailored Brands: Mild Seasonality (Unlike Most Retail)

- Q2 and Q3 contribute about 53% of gross margin

- Q2 (May Jul): Prom Season

- Q3 (Aug Oct): Wedding Season

- Q4 is the seasonal low point

- Most of the seasonality has to do with rental products, which are in high demand during Prom and Wedding seasons

- 2020’s Prom and Wedding seasons are likely to be hurt by COVID 19

- But, as we can see at left, Tailored Brands' Q2 and Q3 don’t dominate the year’s results like you might expect from a typical retailer’s Q4

Disclosure: Currently long equity and bonds but may be closing those positions as they both appreciated in price.

See the full report here.

Any content on this site is NOT investment, trading, legal, or tax advice, and none of the information available through this blog is intended to provide tax, legal, investmentor trading advice. Nothing provided through these articles, whether by the owner or posted by other writers, constitutes a solicitation of the purchase or sale of securities/futures. THE DATA AND INFORMATION PRESENTED ON THIS WEB SITE IS BELIEVED TO BE ACCURATE BUT SHOULD NOT BE RELIED UPON BY THE USER FOR ANY PURPOSE. ANY AND ALL LIABILITY FOR THE CONTENT OR ANY OMISSIONS FROM THIS WEB SITE, INCLUDING ANY INACCURACIES, ERRORS, OR MISSTATEMENTS IN SUCH DATA OR INFORMATION IS EXPRESSLY DISCLAIMED.