Before investing, you must know that stocks can crash 70% anytime and 50% of individual stocks will likely deliver negative returns or below 2% while 75% will under perform the market. If you are not ready for that, better don’t invest in stocks! It is that simple!

Q1 2020 hedge fund letters, conferences and more

It is not about whether there is going to be a crash next, it is about what are you going to do when a crash comes and are you ready if stocks don't crash.

I have looked at research that shows how investors under perform the market by trying to time a stock market crash and about how difficult it is to time it. The key is that you see how does the possibility and magnitude of a crash fit your tolerance. Stocks can crash 70% anytime and stay down for decades - are you ready for that?

When it comes to individual stocks, the situation gets uglier. 30% of individual stocks will crash and actually deliver negative returns. Only 4% of stocks will do really great and compound! Can you handle the pain of investing in stocks? If you can't, I don't know, buy a house!

Stock Market Crash - Your Decision And Numbers

Transcript

Good day fellow investors. So there is so much talk about stock market crashes and individual stocks crashing, what will survive, what not. But we can talk as much as you want about that, there are three core fundamentals that are not discussed as much, but are even more important than whether stocks will crash or not. And these are the fundamentals that lead the average investor to strongly underperform the market.

Over the last 20 years, the average investor achieved a return of 2.5%, while the S&P 500 achieved a return of 6.1%. That's a huge difference. And this is something we have to address, analyse and prevent. And in this video, I want to share three core things that each of you have to know before investing in stocks, and it will give you a clear perspective so that you don't make the mistakes the average investor usually does that leads to those very, very bad returns.

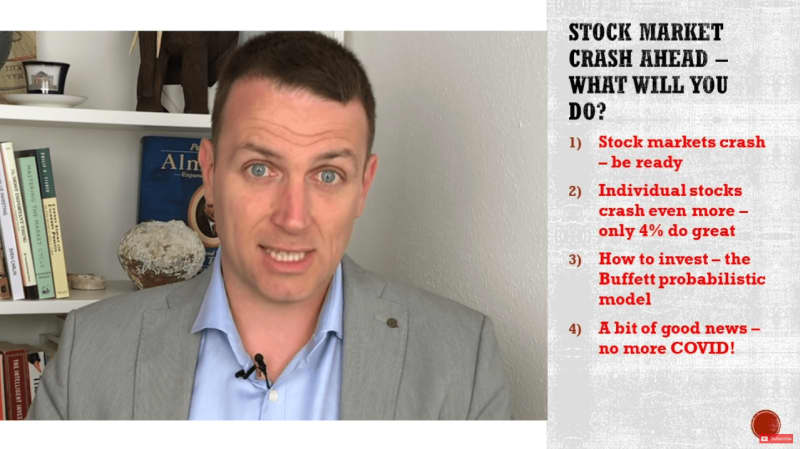

Apart from doing the right things when stock markets crash, I want to discuss also investing in individual stocks, mistakes there, and how many stocks perform well, and how many performed bad from a statistical perspective. Then how to approach investing from a probabilistic way, the Warren Buffett way of probabilities of gains and losses. And we'll discuss in another video, the Kelly formula to discuss how much you should invest given a certain probabilistic outcome. And then I'll finish the video with some good news.

Let's start with the content and if you enjoy this content, please at any moment in time, click that like button or if you have any questions, please comment. So I said the average investor achieved a very poor return over the last 20 years compared to the S&P 500. Why did that happen? Well, we have seen ups and downs in the stock market we have had two bear markets of 50% big declines one bull market up 100% from 2002 to 2007. And then the huge bull market over the last 10 years.

Why did investors do so badly? Well, because they did the wrong thing at the wrong moment in time, because they didn't have a clear perspective on what investing is and how to be ready for whatever can happen when it comes to investing. And this is exactly what this video is all about. How to be ready for whatever can happen when it comes to investing.

The difference between 2.5 and 6.5% in returns is staggering. And that is why this is so important. What happens usually the average investor looks at the news, they predict the stock market crash they predict the world coming to an end, and then they usually sell at the wrong moment in time. Let's say they sold in 2008, and then said okay, we are out of the market and then when things get better 2015 then they get back into the market.

That is a 50% opportunity cost for the portfolio, which is why you can't really time the market and which is why you can't really predict the stock market crash and you're playing a very dangerous game.

If you start to listen to all those news about crashes about how stocks will crash, etc, etc. Even if you let's say, prevent one crash, and then come in later when the situation normalises even then you don't do much better than the market actually, in this case, with the seven year break, avoiding the 2009 great crash, you are still below market performance. And this is the likely process that happens when people start thinking about stock market pressures and doing the wrong thing at the wrong moment in time.

When stocks are down 10% okay, it's a quarter It will likely pass and that's correct statistically. When stocks are down 20%, okay, this is a bear market, perhaps we'll see a recession. There will be a recovery. I'm okay. Stocks dropped 30% Hmm, this is getting dangerous. What should I do? I just lost 30% of my portfolio, I can't risk my retirement. What should I do? Then stocks are down 40%. Oh, this is really bad news. This will get worse, the world as we know it will never be the same. I better sell and I protect what I have. Consequently, stocks let's say go down 41%. That's the market bottom and we have bull market ahead.

These are the behaviour on mistakes that many make and one should be very careful to avoid such mistakes. And to avoid such mistakes. You need to have a clear perspective on what can happen when it comes to investing. And what can happen when it comes to investing, what's the certainty? Is that each asset class you own will drop 70% or more, once or twice in your lifetime, that's a given. That's the likelihood of what will happen.

So once or twice in your lifetime stocks, bonds, cash, real estate or something like that will drop hugely. And that's something you have to see whether you are ready, whether you can survive that only those who survive and accumulate wealth in the meantime during those crashes, only those do very, very good. So this is not something whether there will be a crash or not. This is something you have to know crashes will come. The key is what am I going to do about it when it happens. Can I handle it? Can I tolerate it or not? You can't really predict a crash. You never know when it will happen. And you never know what's the opportunity cost. So the only option we have is to be ready.

Also when it comes to investing This is the Dow borrowed from Mohnish Pabrai. So there can easily be 22, 25, 17, 20, 15, 20 years where stocks returns are zero. And that is something also you have to keep in mind. We don't know what will the future look like. But we have to keep in mind all the possible scenarios, if you can tolerate stocks going nowhere over the next 10-15 years, especially at current high, relatively high valuations.

And if you can tolerate the 50% market crash, you should not be investing in stocks and you should look at other options. That is the simple truth. Even the stock of Berkshire Hathaway since 1968, went down more than 40% about five times that's a huge drop. Even for such a big business, such a great business as Berkshire is. Thus, we have to tolerate that we have to allow for that and give that flexibility within our investing, within our lifestyle, within our financial portfolios.

That's the key. If you can accept that flexibility, then you can be an investor into the stock market, because then you'll be happier when something bad happens. Because you can accumulate more at much lower prices, that will actually give you a great return in the long run. That's the key. If you can't tolerate that, then you have to adjust your strategy so that you can tolerate those things. And this was about the stock market.

Now it gets really ugly. Let's talk about individual stocks and the probabilities of outcomes when it comes to investing into individual stocks. And if you can't tolerate the stock market dropping 50% then you should really be careful about tolerating, investing into individual businesses. So this is the S&P 500 returns over the last 20 years from 1997 to 2017. Okay over 20 years, and you can see that 50% of stocks have a return that is lower than 50% over 20 years, that's below a 2% return. So 14% of the S&P 500 stocks delivered a return of -100 to -50% over 20 years. Another 15% went from -50 to zero. So 29-30% of stocks of the S&P 500 delivered negative returns over 20 years.

30% of stocks, 3 out of 10 negative returns, add another 20%. So 50% of stocks included in the S&P 500 give you terrible returns. On the average, so this is the average return, the average return is much better, because you have these companies, the 4% that become more than 10 baggers that justify all these bad, let's say, or especially is 50% of bad returns. And then these companies save for those companies, and especially the 4% here. So 40% of stocks delivered negative returns, 15% between negative 50% and 0%, 20% up to 50% over 20 years.

That's 50% of the S&P 500 delivered returns below 2% per year. These are staggering statistics and something to keep in mind. 24% of the winners that outperform the market will cover for all the losers. Thus, you have to be happy if you have less than 7.6 losers out of 10 investments. Do you comprehend this? I invest in 10 stocks 7.6 of those underperformed the market. Are losers, are investing mistakes, I should have stick to the S&P 500. And that's something we as individual investors, individual stocks have to accept and comprehend. That's as simple as that.

Further going deeper found a nice research report from Bessembinder and only 4% of the stocks since 1926 explain all the positive returns, the stock market delivered since then. So only these 4% of stocks is what gives you the return. So 4 out of 100 is what you have to focus on for the great long term returns. The other 96% of stocks since 1926, deliver the same similar return to Treasury bills. So $1 became $21, $1 invested in stocks became between 7000 and 36000 for amazing investing returns, but you have to understand the numbers game there that it will be ugly for many, many stocks out there.

So if you do 7 out of 10 mistakes, you will be an OK investor. If you have 6 out of 10 mistakes, you will be a really good investor and you will outperform the market. If you do 5 out of 10, you will be at Buffett level investing. And if you do 4 mistakes out of 10, then you will be a genius. Thus, as I have an investing channel and I talk often about stock and stock analysis. And whenever I do a stock and then it goes down, then the comment is usually. oh what an idiot. Oh, you should give back your PhD, oh this stupid PhD, you dumb ass, you whatever, you this you did. And there is plenty of comments.

But as investors, we have to understand the numbers behind investing in individual stocks. If I do, let's say 5 mistakes out of 10 and 5 are good investments. After 15-20 years, you put my golden statue in your bedroom, and another in your home when you enter your huge Villa, because that is how much money you will make. That is investing. 5 out of 10 of those 5, some become great businesses, and you just need four compounders 4% of the investments to be the great compounders over the long term, then you are a wonderful, you're a great investor. If you have more than 4% of the investments, doing really, really good.

And that's what we do on this channel. We try to improve the odds of investing. We don't try to be right on every stock. There will be mistakes. I can guarantee you I'll make a lot of mistakes. But we are trying to improve the long term odds by selecting those stocks that have the best probabilities the best outcomes regarding the risk and reward and then you say okay Sven you often discuss very strange emerging market stocks etc. We focus on the best stocks, then the risks should be much lower. Look at this, this is the top 10 S&P 500 components for 2005. Top company General Electric, Exxon, Microsoft, Citigroup, Banks, P&G, Walmart, etc.

Let's see how those fared. General Electric is down what 85% since 2005, Exxon down 20 something percent covered up by the dividends, but still a pretty negative return especially compared to the market. I don't even have to mention the banks and the return there. So it's not about the S&P 500, etc, or emerging markets. It's about finding quality businesses and understanding the risk and reward and trying to improve the odds in your favour.

How to Improve the odds in your favour. Well, 1989 shareholder meeting Warren Buffett said the following take the probability of loss, times the amount of possible loss from the probability of gain, times the amount of possible gain. That is what we're trying to do. It's imperfect, but that's what it's all about. And here I made the small table explaining Buffett's calculation. So we have in this case, I took my gut feeling for the S&P 500. Let's say that over the next 10 years, the S&P 500 will go to 6000 points, and I give a 70% chance for that happening because of inflationary pressures. Inflation, money printing, fed buying ETFs likely in the future, so S&P 500 goes to 6000.

There is a 20% chance that it goes just to 3000 points, okay? Then I multiply that times the 20% chance and I have a value. Goes down to 1500 points, let's give it a 10% chance. And this is the value of the sum of values is the value of the s&p 500 in the next 10 years should be 4950. If in case we have an economic depression for the next 5-10 years, it can be much lower. That would give a return of 6.2% per year which is in line with current valuations. If I look at the return, total return is at 83% up, 6.2% yearly return over 10 years.

And something also more important here. Okay, this is the outcome. Okay, Sven says 6.2% return, I should put all my money in the S&P 500 wait another very important thing before doing that. What if this materialises? What if the 10% scenario materialises and in 10 years the value of the S&P 500 is 1500 points not 6000, 1500. This is where it is about you and saying, Okay, can I tolerate this, okay, I will have to work a little bit more, save a little bit more, invest and take advantage of the situation. And then I can tolerate this.

But if you can tolerate this, then you have to be very careful or at least know exactly what you're doing in order to prevent finding yourself in a bad financial situations because each of these scenarios can happen. These probabilities that don't matter much when those scenarios happen. And then asset stocks can go down 50%, can crash all the time and can stay down for a long period of time. And that's something you have to see whether you can tolerate it or survive it.

So to sum up, stocks can fall 70% anytime. Keep that in mind when investing in the position so that if it happens, when it happens, you can survive it and go on with your life. If you can survive it. If you can't tolerate, then you have to rethink everything and make sure the fundamentals are strong. And then you can invest peacefully, whatever happens you are okay, that's the core of investing. That's the first core of investing.

The second core of investing. Well, if I invest in individual stocks, there will be many, many mistakes. That's something I have to tolerate. I have to weed the flowers and cut the weeds. It's a simple as that. And then in a probabilistic way, I have to improve the odds of succeeding, and you improve the odds of succeeding by being emotionally disattached from the mistakes, from the downturns.

That's why you have to make sure that it doesn't have an impact on your personal finances, on your decision making. And this is a game that few think about, oh, we are going to listen to the news. stock market crash. stocks up 3% .down 2%. No, it's about how you feel, what action you make when you lose your job, when you have to pay your mortgage, when you divorce your spouse, when your kid needs to go to college, when you need surprising money, and the stock market is crashing or when you are not reaching that target. That is when you have to make rational decisions. And this is what investing is all about.

Plus, knowing that 76% of the individual investments will not outperform the market and we look like mistakes. Can you invest into something where most of what you do will be looked like mistakes and then every loss that we have psychologically hurt 2.5 times more than a similar gain. Therefore those losses and that's why investing is so difficult, and so few succeed over the long term.

And this is investing. Keep that in mind. There is also a report that I wrote 15 page report if you want to read this statistics, look at the links at the sources, it's on my free stock market course, I have put the link to the course and to the PDF where you can enjoy it. Read it calmly and see how this investing probabilities fit you. Also if you like this video, please subscribe. Click that notification bell so that you get notified when a video comes out.

And now to end up with very, very good news. Let me share this. So I live in a small country in Europe bordering Italy called Slovenia. I live here in the mountains and we have very good news today. We have eliminated the Coronavirus. No more Coronavirus in Slovenia. So we went into lockdown in March. And we had about 50 cases, 50 new cases each day and then declining over April. And let's say since the end of April, we have had one or two cases or just one few days ago so no more cases of Coronavirus after two months lockdown. So it is possible to get rid of it. It is possible to solve the situation.

And with that positive note, I want to wish you the same that you get rid of Corona wherever you are, that we get rid of this nasty virus and that we can go on with life as we knew it. Tomorrow, we're visiting the capital going for a pizza and enjoying our life. I wish you the same. If you want to check my book, whatever I do, other stock investments, analysis, my research platform with my mistakes, where I'll make many and see how those mistakes fit you. Please also check my research platform. Thank you and I'll see you in the next video.