COVID-19 puts artificial intelligence AI M&A in the spotlight on the back of record deal volumes in 2019, says Hampleton Partners’ report

Q1 2020 hedge fund letters, conferences and more

- AI-driven remote security and monitoring of social distancing and mask-wearing, plus fever detection technology is in play

- AI technology is adding value across all sectors with healthcare, automotive, finance, education and security benefitting most in current conditions

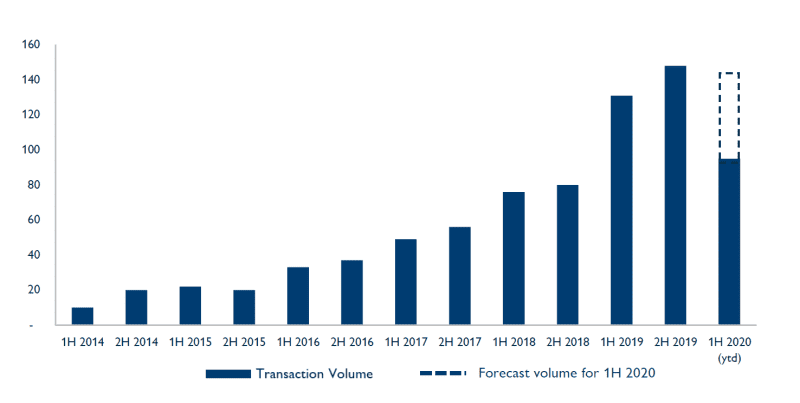

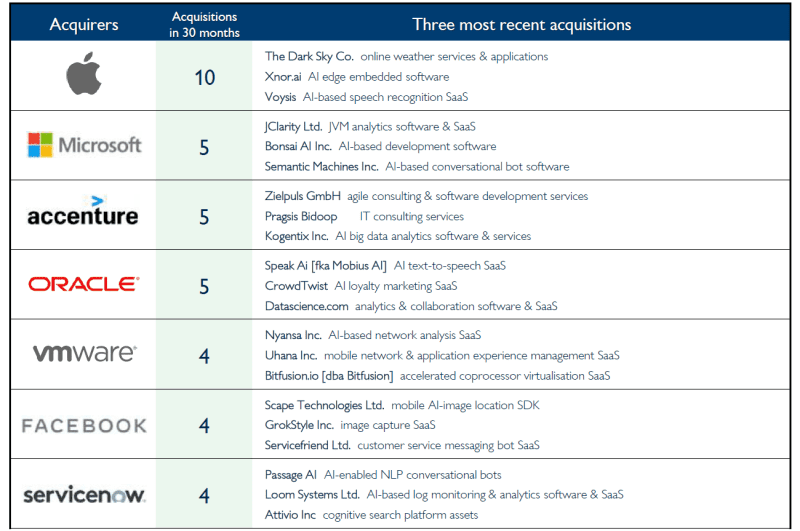

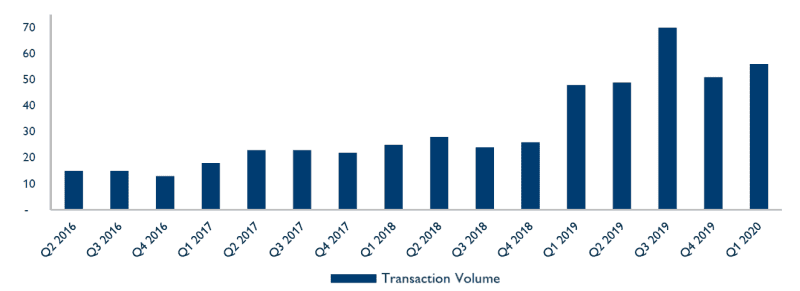

London, UK – 4 June 2020.The AI M&A market report from Hampleton Partners, the international technology mergers and acquisitions advisor, reveals the year 2019 saw a total of 279 deals – more than the 261 AI deals recorded across 2017 and 2018 combined. The first quarter of 2020 recorded a promising 95 deals.

Heiko Garrelfs, Sector Principal, Hampleton Partners, said: “On the back of record AI deal volumes in 2019 the arrival of Covid-19 is putting artificial intelligence innovators and companies further in the spotlight for strategic buyers.

“New norms such as health checks and social distancing at work are driving AI adoption and adaptation. Companies are having to find new ways of automating processes and drive cost-efficiency as, in many sectors, their profits are coming under pressure.

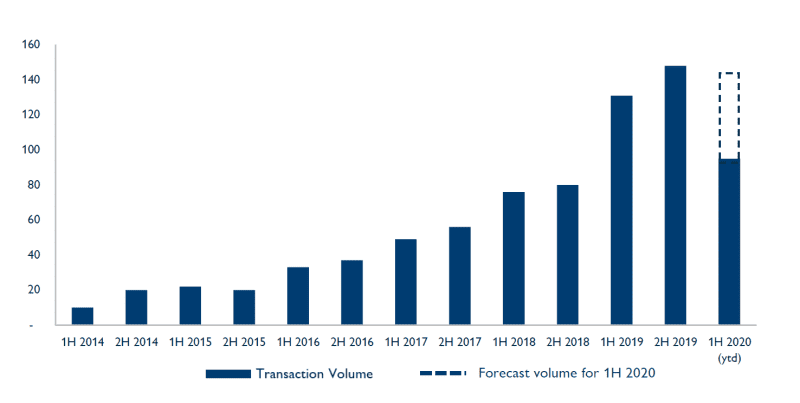

“On the home front, if ‘stay at home’ and ‘shelter in place’ orders continue, we expect to see more language analysis, chatbot and personal assistant AI deals beyond the usual suspects of Apple, Amazon and Google.”

Hampleton’s Artificial Intelligence M&A report analyses transactions, trends and activity across the quantitative analysis, vision, and language analysis segments. It also features interviews with two of the sector’s pioneers: Albert Stepanyan, founder and CEO, Scylla.ai, the AI-based protective intelligence suite that enhances security operations; and Artem Rodichev, Head of AI, Replika, which has created an AI-friend experience chatbot, proving popular with those under 25 years of age.

Most Active Sector And Largest Deals

AI used for the purpose of quantitative analysis represented 70 per cent of all AI deals between May 2019 and May 2020. It remains the technology of choice for acquirers seeking to capitalise on efficient ways of processing, automating and augmenting large amounts of data.

The segment also saw the largest AI deals, courtesy of both financial and strategic buyers. These included Thoma Bravo’s take-private of security and antimalware giant Sophos for $3.8 billion; Prudential Financial’s acquisition of Assurance IQ’s machine learning-enabled direct-to-consumer insurance search service for $2.4 billion; and Hewlett Packard’s acquisition of Cray’s high-performance computing tech for $1.4 billion.

AI M&A 2020

Heiko Garrelfs continued: “AI is a key source of transformation and disruption. Segments such as Vision and Language Analysis are seeing high growth as tech giants are making their AI models available and democratising the sector, giving companies and startups the chance to develop top-class technical products and develop their niche.

“Ultimately, this all-round momentum for AI is set to continue, given the unwavering interest from strategic acquirers looking to capitalise on the added-value AI can bring to all processes.”

About Hampleton Partners

Hampleton Partners is at the forefront of international mergers and acquisitions and corporate finance advisory for companies with technology at their core.

For more information visit https://www.hampletonpartners.com