These are the latest stock market news for July 1, 2020.

"Dow Jones Industrial Average falls 77 points

The Dow fell 77.91 points, or 0.30%, to close at 25,734.97. The S&P 500 advanced 0.50% to 3,115.86. The Nasdaq Composite gained 0.95% to end the day at 10,164.63. Stocks traded higher for most of the session amid positive news on a potential coronavirus vaccine.

Vaccine data lifts sentiment

A study of a coronavirus vaccine candidate being developed by Pfizer and BioNTech showed the drug created neutralizing antibodies. The results were released online, but have not been reviewed by a medical journal yet. The company also said that, if the vaccine gets regulatory approval, it expects to make up to 100 million doses by year-end and “potentially” more than 1.2 billion by the end of 2021.

Pfizer jumps, Amazon and Netflix gain

Pfizer shares jumped 3.18% on the vaccine data released Wednesday. Amazon and Netflix gained 4.35% and 6.72%, respectively."

Stock market source:

Stock market close on July 1, 2020

S&P 500: 3,115.86,+15.57(+0.50%)

Dow 30: 25,734.97,-77.91(-0.30%)

Nasdaq:v10,154.63,+95.86(+0.95%)

Russell 2000: 1,432.83,-8.54(-0.59%)

Stock market volatility

The CBOE Volatility Index (VIX) closed lower at 28.62-1.81 (-5.95%).

Stock movers

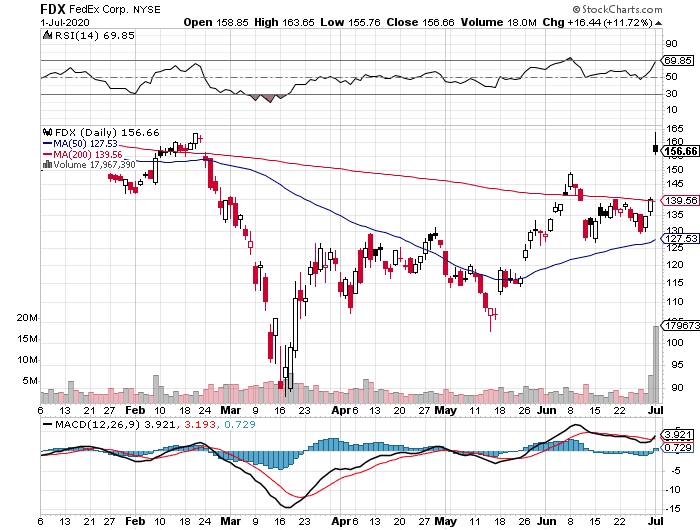

FedEx Corporation (FDX) stock closed higher more than 11% at 156.66+16.44 (+11.72%).

FDX stock news

"For the fiscal 2020 fourth quarter ended May 31, the company reported revenue of $17.4 billion, down from $17.8 billion a year earlier. But the latest number easily topped FactSet’s analyst consensus of $16.4 billion.

Still, that wasn’t enough to create profits. FedEx suffered a loss of $334 million in the latest quarter, or $1.28 per share, shrinking from a loss of $1.97 billion, or $7.56 per share, a year ago. Analysts expected earnings per share of $1.33 for the latest quarter.

Adjusted EPS totaled $2.53 in the latest quarter, blowing away analysts’ prediction of $1.58."

Stock market source: https://www.thestreet.com/investing/fedex-stronger-than-expected-revenue-adjusted-profi

FDX stock chart

FDX stock chart

Source: Stockscharts

Stock gainers

Liminal BioSciences Inc. (LMNL): 22.79,+ 11.99 +111.02%

89bio Inc. (ETNB): 28.17 +8.24 +41.34%

Akero Therapeutics Inc. (AKRO): 33.37 +8.45 +33.91%

Stock losers

Polar Power Inc. (POLA): 3.13, -1.83 -36.90%

Inovio Pharmaceuticals Inc. (INO): 19.73, -7.22 -26.79%

CPS Technologies Corp. (CPSH): 1.82, -0.60 -24.79%

Most active stocks

Workhorse Group Inc. (WKHS): 19.18,+ 1.79 +10.29%

General Electric Co. (GE): 6.74, -0.09 -1.32%

American Airlines Group Inc. (AAL): 12.81, -0.26 -1.99%

Stock market source: https://www.wsj.com/market-data/stocks

Stock Market, U.S. Sectors & Industries Performance

The Real Estate sector was the best performing sector +2.57%, the Energy sector was the worst-performing sector -2.49%.

U.S. Sectors & Industries Performance for July 1, 2020

Source: Fidelity

Stock market news, economic news

The ADP National Employment Report came in at 2369K, lower than the forecast of 3000K, but still being positive for a second consecutive month.

Stock market update

All data about the stock market, stocks, stock investing, stock trading is taken from Yahoo Finance, Fidelity, and stockcharts.com.

Investing

Check this link for stock trading. Subscribe to our stock market newsletter, with stocks to buy, stocks to sell, investing.