WASHINGTON – Today’s headline says it all. After a rollicking, tech-led Recovery Monday rally, Mr Market succumbed to a largely predictable Coronavirus Tuesday. Up a few hundred Dow points Monday, down a few hundred Dow points today, and there we have it. We’ll likely be dealing with a summer market whose happy days and weeks will find themselves canceled again and again by successive coronavirus and riot-driven counter headlines.

Remember: Every Recovery Monday needs a Coronavirus Tuesday in today's headline-driven, stock market-manipulated investment climate. The main casualty today is truth.

CNBC adds some color to the Coronavirus Tuesday story.

“Stocks fell on Tuesday as a rally in mega-cap tech shares lost steam and concerns about the coronavirus outbreak dampened investor sentiment…

“Both the Nasdaq and S&P 500 were ris[k]ing five-day winning streaks before Tuesday’s losses…

“‘This market is way overbought,’ said Peter Cardillo, chief market economist at Spartan Capital Securities. ‘This market has been ignoring the potential problems that are going to arise from the coronavirus…’

“‘With the increasing virus cases, people are playing the stay-at-home stocks,’ said Brent Schutte, chief investment strategist for Northwestern Mutual Wealth Management. ‘One thing I will say is the probability of returning to a nationwide lockdown is incredibly slim. So I wouldn’t be surprised to see more of a rolling, back-and-forth market rather than one that goes straight up like we’ve seen the past few months.’”

More on today's Coronavirus Tuesday market hammering

None of this Coronavirus Tuesday terrorism has anything to do with either the still somewhat hesitant but surprisingly robust US economic recovery. That will continue. So will the Soros-funded riots whose paid thugs have no intention of quitting the field until President Trump is banished to Siberia in November.

That’s why negative, coronavirus-driven and Antifa / BLM-driven headlines will promptly surface to cancel each Recovery Monday style rally out until the media can’t hide the truth any longer. It’s all a vicious, violent endgame ploy to deny President Trump a second term this November, and nothing more.

So the hell with the fall school semesters, the hell with investors. And, frankly, the hell with the health of individual Americans. It’s all about defeating Trump. And, as a result, markets will continue to overreact one way or another until this latest coup attempt fails. If it does. But that’s for the speculators to worry about, not me. I’m just dealing with present reality here. Which, as I’ve said ad nauseam, is a country and a stock market driven by crazed rumors, lies and innuendo, not reality.

Recovery Monday action found tech (as usual) taking the lead

Monday found big tech players dominating, with Amazon (trading symbol: AMZN) burning up the virtual Wall Street tape by marking a huge gain that made the NASDAQ go way positive. Other tech stocks helped as well, including Alphabet (Google, GOOGL), which also posted impressive gains.

Of course, both stocks got hit on Coronavirus Tuesday, primarily Amazon. And this actually had nothing to do with Covid-19. The story here turned out to be an interesting surprise. Walmart (WMT) announced that company intended to begin – soon – an answer to Amazon Prime, offering deals and (purportedly) additional services to Walmart shoppers who fork over $98 per year for a membership. I’m fuzzy on the details, but I’ll lay them out for you as soon as I get them.

That news juiced Walmart shares, of course, which is a good thing. The stock has floundered in recent weeks. Our accounts came out more or less even on this news as we hold both Walmart and Amazon. So what Amazon gave away Tuesday, Walmart earned back for us, leaving our portfolios almost flat on the day after big gains on Monday. I wish it always worked this way.

As for this coronavirus thing…

It’s all a crock. Or at least most of it is. The media continues to flog the narrative meant to freak us out over the “rapidly rising” increase in cases, particularly (wouldn’t ya know?) in those previously coronavirus-impervious Red States, “proving” what utter fools their governors were and are. Murderous Blue State governators like Andrew Cuomo, however, are geniuses.

Problem is, the number of reported cases in states and nationwide is a whole lot of BS. If you get tested, have never had the disease, but show coronavirus antibodies in your system, you’re logged in as a “case” whether you actually came down with the disease or just shucked it off without incident. Which a LOT of people do.

The real gauge here is death, or deaths. Which, interestingly, have continued to trend way down even as those “cases” increase.

Related Article: Unemployment drop vs coronavirus spike roils pre-holiday stock markets

Digging deeper into the coronavirus rumor mill

Something fishy here, eh?

Well, that’s what the Tylers over at ZeroHedge think. (Bold text via ZH.)

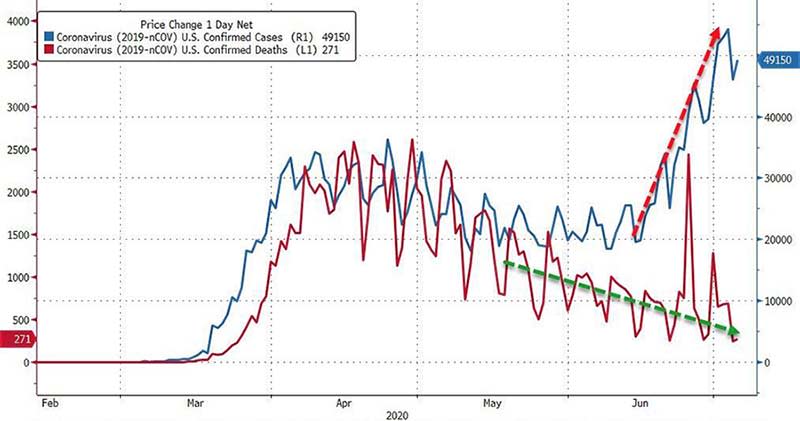

“One week ago, when looking at the growing divergence between the number of new coronavirus cases in the US and shrinking number of fatalities, we referred to Nordea's strategist Andreas Steno Larsen, who observed that ‘we are entering “crunch time” on fatalities since they should start to rise in early July given the lead/lag structure versus new cases.’

“’As Larsen further predicted, ‘if fatalities don’t spike early in July, then people will conclude that it’s probably spreading amongst a part of the population that is not as sensitive, or that it is a resulted of increased testing or that the virus has become less deadly as we move into the summer months. Governors in Texas, California and Florida seem to have concluded that the below correlation holds, but the jury is still out.’

“His conclusion was that ‘the next 6-10 days will be crucial.’

“Well, one week later, we decided to follow up on the current status and... there is still no spike in fatalities at either the federal level... or even state level…”

A tale of Two Charts

To prove the point, ZH first offers a Covid-19 national chart.

Coronavirus cases vs deaths. (Chart via ZeroHedge)

Note that the slotted green line, which highlights the number of confirmed US coronavirus deaths in just one recent day, except for one quick blip, trends massively down. That's as opposed to the confirmed case line (highlighted by the slotted red line) trends massively higher. Which number do you think the media runs with?

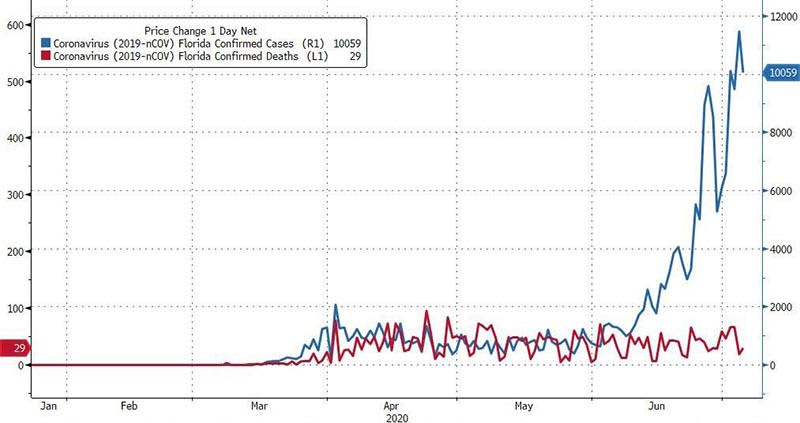

Then, they follow with a Florida-only chart. You know, the stupid, GOP-led Red State full of yahoos who are now all going to die. Oh, wait…

Recent coronavirus cases vs deaths in Florida. (Chart courtesy ZeroHedge.)

Yep. The soaring blue line equals the one-day net increase in confirmed cases, while the unimpressive, squiggly red line indicates the flat-to-down trend in confirmed deaths. Note the huge discrepancy between the number of cases vs confirmed deaths. Umm, which number does the media choose to report?

"Meanwhile, as cases appear to be plateauing in several states, not only are deaths not inflecting [sic] higher but are at the lowest level since March."

Seeing is believing

The “case” number increases charted above are media BS. US Covid-19 deaths continue to trend down, likely because:

- At least for the younger (under 60) demographic, this 21stcentury answer to the Black Death isn’t very lethal.

- The US has already perfected enough ways to combat the more serious version of the disease to drastically increase the death rate among the old and the infirm. All before we’ve even discovered a vaccine for the damned thing.

Ah, but following this logical thread would mean that Blue State governators might no longer be able to justify their arbitrary lockdowns and re-lockdowns. All meant to badly damage Trump’s massively successful pro-business, pro-employment economy and make voters forget all about it when going into the voting booth in November. (Or, sending out 2 dozen apiece mail-order ballots in Blue States.) Which is why Recovery Monday is always followed by Coronavirus Tuesday. Or its equivalent.

On this intentional serendipity Mr Market tries to find a balance. But he seems to slip off the high wire every day or three. In so doing, he squishes his happier rally days like yesterday's Recovery Monday. Which then puts market averages into permanent stasis, limiting profit potential.

That’s not a bug, but a pro-Democrat, pro-SJW feature. And we’ll keep seeing this until President Trump, et. al.,finish draining The Swamp in November, God willin’ and the creek don’t rise.

Problem is, if he does, what happens next will make the anti-Vietnam and post-King assassination riots look like a walk in the park.

We do live in interesting times. And markets.

*– Headline image: Cartoon by Branco. Reproduced with permission and by arrangement with Legal Insurrection.*