OMV stock is one not to buy despite the 5.6% dividend yield! Why not to buy OMV stock? Here are the reasons:

Q2 2020 hedge fund letters, conferences and more

- high competition

- small shareholder reward

- government owned – other priorities?

- internal transactions

- leave it to pension funds!

If it falls again 50% sometimes in the next 5 to 10 years, you still need 5 to 7 dividends to cover for your loss and you end up with nothing.

OMV Stock Analysis - A 5.6% Dividend Stock NOT TO BUY

Transcript

Austrian stocks

Good day fellow investors. As you probably know, I have been going through all the stocks listed in Austria. And the stock I want to discuss today is OMV. I don't know how it's pronounced correctly, but OMV, integrated oil producer distributor is a stock that I want to discuss for those hardcore fans that are interested in learning about investing. Because I have five key investing points on there is not a stock, I would buy actually stock I would not buy. And that's exactly what I want to discuss with those who are interested in such ideas, because that's how investing is, investing is a process of elimination. And in this article, in this video, you can also read the article on my blog, of course, in this video, I want to discuss the process wire eliminated on there for consideration. We're going to discuss high competition, small shareholder reward in total government owned so there are other priorities, internal transactions inside related parties transactions, so better to leave such stocks to pension funds.

OMV Stock price

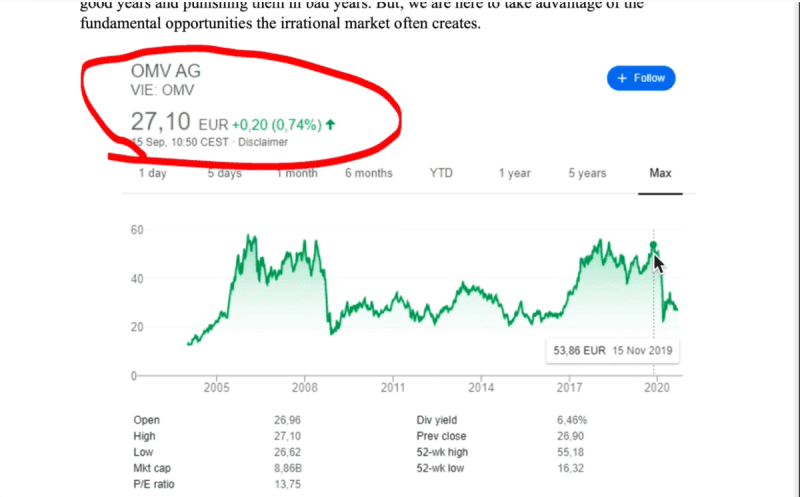

Let's start with the analysis, the stock price, stock overview, fundamentals likely dividend and then you'll see okay, some stocks, especially we as retail investors, we can find better then, what is one of the most traded stocks in Europe most looked for, especially in Austria, even by retail investors. So that's also a reason why I wanted to really do this video to warn and to, I hope teach something. If we look at the stock price over the last decade in more actually from peak to peak OMV that didn't do anything for shareholders except for the dividend.

Those that bought here, hoping for a high dividend will need, what 15 years of dividends to cover for the decline from November 2019. To now know that bought here a little bit better. But still, if I look at long term returns, those aren't great. Yes, the dividend yield now is 6%. The price earnings ratio is 14 so relatively low. And they have just announced proposed a new dividend of 1.75 euro, which is Okay, interesting. But is it enough? That's something we really have to discuss here. First, let me start with the shareholder structure.

Osterreichische Beteiligungs, Austrian state holding company that's there to promote investment, the economy etc. in Austria, probably also employment, then another owner, Mubadala Petroleum, that's also owning Borealis and OMV and then they sell this, their stake in Borealis to OMV at a pretty high price. So these guys might not have the interest of small shareholders. And that's also something you have to always look at, okay, is the interest of the owner aligned with my interest. This is something I really want to discuss. And this is something that might not give you value immediately, but will give you immense value over the long term.

OMV acquisitions

Let's start with the business overview. It's an integrated company. So from production, refining, and then of course you can buy OMV at the gas station. If you're from Central Europe, you probably did it like I did it many times. But there is no real competitive advantage when it comes to OMV. They don't have something special. They are price takers. Therefore there depend on what the market gives them. And therefore also the margins, the growth, the investments are all with limited upside and also one reason why the stock didn't go anywhere over the last decade when you ask them why to invest. They are focusing on growth perspective pipelines, top European refiner position in Abu Dhabi, it's not a great position to have. Everybody has a great position there with oil and natural gas is so nothing special.

Okay, they are doing okay, their cash flow profitable, they are now balancing their situation with COVID. But their target is high and likely never to be reached because every company has a return on average capital employed target of above 12%. But if everybody has that target, it's unlikely that they will reach it because of too much competition. So I don't think they'll reach it. If we look at their long term, return on capital employed, yes, it has been than 15%. But then it crashes in a bad year and bad years is what you don't want to see, as a dividend investor. As an investor as such, let's say difficult, high capital intensive businesses.

The time to buy is here, whenever thing looks like, it's going to end, never going to see that company, then it's the best time to buy, as it was the case in 2016. But as soon as the company reaches its potential, especially in a cycle, you have to sell it, perhaps it's going to jump again over the next year, see if the situation in oil improves. But then you have to sell it if the situation doesn't improve, this trend can continue for a while. So that's the risk and reward of investing.

Production

Plus, they go and do acquisitions, they just acquired another, their second stake in Borealis and they did that as the prices of polyethylene and polypropylene or whatever Borealis is doing have significantly crashed. So they paid 4.68 billion for a 49% stake, or reality that made 0.9 billion euro net profit in 2019, based on great growth over the past decade. So they paid what is this I think about 12 times earnings on top earnings in a decade that if prices remained subdued, will be another okay investment, but one with low return on capital. Because, yes, this is just Europe, there is another chart globally. And look at the competition. Everybody has money here, everybody can borrow at very low interest rates invest in new production.

So it is a forever competition. And that's the ugly part such business is not a business that let's say Buffett would say let's buy it, you don't have a mode, it requires a lot of capital, and therefore it's not beautiful. Then also, if they make a mistake with acquisitions, then they sell that total disposals 3.1 billion euros, try to change something else 6 billion of acquisitions. And it's those all of those acquisitions are highly competitive. So the return on capital on investment is usually lower than expected. They did some good things, okay. They have increased production, they have lowered the cost of production, they have another seven years of reserves to produce. So okay, stable seven years is also something like shelf has nothing special not 50 years, like other companies has have like Gazprom. But let's say it's an again, an average from a reserve perspective.

Fundamentals

From a business perspective, if we look at the fundamentals, you would say, okay, operating cash flows 5.4 billion in 2019, compared to the market capitalization of 8 billion. It's crazy. That's what one point something price to operating cash flow ratio, but when I look at what they do with the cash flow, so we have cash flow from operations, and then we have the net investments, how much have they spent for investments over the last 15 years, and you can see that the free cash flows above zero are only they're in really, really good times. So, it is a business This requires a lot of investments just to keep up and therefore there is not much with for the shareholders and therefore also the 5 billion they say in operating cash flows do not trickle down to shareholders, which explains the business and how things work.

Dividend

If I look at owners earnings from OMV cumulative over time, those have started to pile up over the last decades. But it's still an average of 2.5 euro, which is close to what the dividend is. If you add taxes on that, I would say that you can't expect more than the dividend from or invent. And here is the proposal for now, again, one point 75 euros. But this will hopefully continue for the next 5-10 years. But at some point, the story with arm will be an uglier one, because of the negative winds in the oil sector.

And I would say if I invest in something like this, and I hope I'll get the dividend, but then the stock in 2027 crashes, another 50%, then five dividends are needed seven dividends to just cover for the drop of 50%, which is possible with such companies because it all depends on oil prices out there. And that's a high risk for a relatively small reward. There is not some something out there that's not priced in, that's positive, everything is priced in here. And therefore I would say leave this stock to pension funds, I'm sure we can find better. So you can read more into my article. If you enjoyed this analysis, please subscribe to the channel. As always check more articles on my website.

Better stocks

For Austria, this is a good business. So for example, if I compare this with OMV, it's a better business better long term outlook, better management, more focus to shareholders safe business, probably a little bit more expensive. But the question is, do you want to have ugly in your portfolio? Or do you want to have good in your portfolio? Linx Textil with the hotel, also very interesting. This is a little bit more risky. And I'm looking at these companies. I still have a few of them to go but I'm sure that I'll find three or four of them that I'll follow on my stock market research platform, and perhaps over the next 5-10 years. Find one or two great investment opportunities. This is what I do. You can check more on my blog, you have my research platform, my book, so feel awfully free to look around. Thanks for watching, and I'll see you tomorrow in the newest video about the economy. We'll discuss what the Fed is doing and saying.

The post OMV Stock Analysis – A 5.6% Dividend Stock NOT TO BUY appeared first on ValueWalk.