Since the beginning of 2020, wildfires have burned more than 3.6 million acres in California, an area larger than the state of Connecticut. In particular, the August Complex fire in northern California is by far the largest forest fire in California’s history at 471,000 acres. A combination of drought, lightning, heat, and climate change can explain the deadly situation on the west coast including Washington, California, and Oregon State.

Q2 2020 hedge fund letters, conferences and more

To be specific, changes in climate have resulted in drier and warmer conditions, inducing vegetation to dry out and become flammable fuels when temperature rises, which increases wildfire risk. When a wildfire happens, carbon dioxide is released into the atmosphere, increasing climate change. Hence, the importance of financing climate action and sustainable forest management are intertwined. In particular, green bonds that invest in forestry assets are an emerging fixed income product that provides investors with options with receiving steady return and green premiums.

How Forest Bonds Work

A green bond is a fixed income instrument that earmarks proceeds to finance projects which deliver environmental and climate benefits. It provides up-front large-scale capital to fund projects and provides foreseeable environmental returns in the expected future. Predominantly, green bonds have been used to invest in renewable energy, green buildings, and transportation infrastructure. Nevertheless, emerging forest bonds use proceeds to acquire forestry assets and projects that deliver multiple benefits of forest ecosystems relating to carbon sequestration, food, water, and livelihoods.

Globally, first issued in 2016 by the International Finance Corporation of the World Bank Group, the world’s first forest bond raised $152 million and provides investors with options of receiving cash or carbon credits as a return. Investors who choose to receive carbon credits could either retire them to achieve corporate offset targets or sell back to the carbon markets. The bond channels private capitals to fund the Kasigau Corridor region in Kenya, a project that is estimated to protect 200,000 hectares of forest and offset 1.4 million tons of carbon emissions each year over the next 30 years.

In the U.S. The Conservation Fund, a nonprofit with a mission to protect land and water resources through land acquisition, issued a 10-year green bond totaling $150 million. The bond is given an A3 rating by Moody’s and provides investors with a 3.474% yield rate. To scale up forest conservation, the proceeds from the bond will be directed to The Conservation Fund’s Working Forest Fund, which is dedicated to protecting natural ecosystems, supporting rural economies, and mitigating climate change. The Fund aims to conserve working forest by acquiring and managing such forest properties until appropriate protections are put in place. By far, the proceeds have been invested in seven forest projects in the U.S. and sequestered 35 million metric tons of CO2 equivalent emissions.

Considerations for Forest Bonds

However, forest bonds have been rare, and only 3% of the total green bond market have been allocated to land use projects, which include investments in forest land, plantations, grassland, cropland, and wetlands.

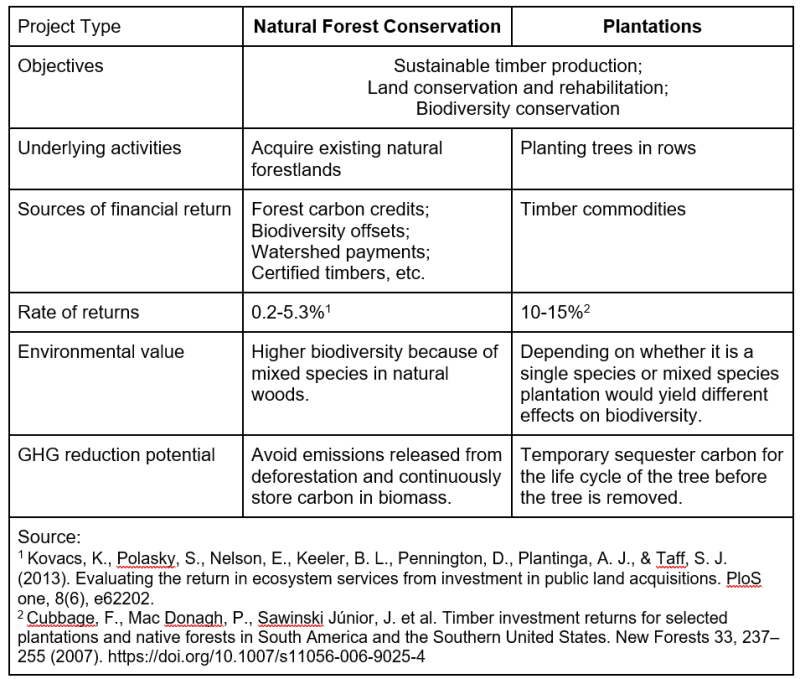

Investing in forest conservation is different from investing in plantations. A plantation is an artificially-established forest, farm, or estate, where crops are produced for sale. Tree plantations might potentially support forest conservation by substituting natural forest for timber production. Alternatively, it could result in increased deforestation when replacing natural forests that have lower market value due to a lack of logging activities. Nevertheless, investing in forest conservation and plantations provides different risk-return profiles and greenhouse gas emissions impacts, which are shown in the table below.

An obstacle relating to the development of forest bonds is the lack of investor interest. Unlike clean energy infrastructure investments such as solar farms, that tend to generate an immediate and direct revenue stream, forest bonds tend to have a more diverse set of sources of return. Forest bonds have two mechanisms of forest-based revenues, which are cash flows generated from underlying forest investment, are through direct markets and indirect markets. Direct markets generate revenues from trading the benefits of forest biodiversity and ecosystem services, such as through the forest carbon market, biodiversity offsets, and watershed payments. On the other hand, the value of forest biodiversity and ecosystem services can be linked to indirect markets through certified timbers, green commodities, or ecotourism user fees. However, because the revenue streams are diverse and less obvious, it could be a reason for a lack of investor interest in forest bonds.

Even though there is a direct revenue stream, forest bonds are subject to many uncertainties, such as credit and market risks, that affect its ability to pay back the bonds. Credit risk such as natural hazard risk and political risk could induce failure of the underlying forest asset to produce the goods or ecosystem services expected. Events like forest fires, disease, drought, and extreme weather result in acute impact on the quality and productivity of the forest assets.

Concern Among Potential Investors

Additionally, political risk is the primary concern among potential investors in assessing REDD+ projects in developing countries as a revenue stream for forest bonds. REDD+ stands for Reducing Emissions from Deforestation and forest Deforestation, an initiative that aims to slow the loss of forests. REDD+ projects aim to encourage forest conservation in developing countries through verifiable emissions reduction, preservation, and enhancement actions in the forest sector and are financed by the sale of forest carbon offsets. The risk of commercial failure due to action or inaction by the government where a forest investment is made, such as expropriation of assets, cancellation of forest concessions, or non-enforcement of forest law, could affect the value of forest bonds and its ability to generate stable and predictable cash flows. To mitigate credit and market risks, investors might seek insurance and guarantees that provide compensation in case of commercial failure.

Market risks may arise when the economic environment causes an investment to generate less revenue than expected. For example, the demand or price in the market for ecosystem goods, such as certified timber and carbon credits, could be lower than expected and increase market risk. Additionally, ecosystem market risk is inherently linked to the regulatory risk that governments will not implement the appropriate legislation to support direct or indirect market for forest-based services. These risks can be mitigated by portfolio diversification and investment tranching, to reduce the impact of commodity price volatility.

Other inherent risks in forest bonds such are the liquidity of assets and the time lapse between investment and revenue generation may worry investors. Investment in forestry have long tenures, with an average rotation periods of high-quality timber production of 40 to 100 years, requiring significant capital expenditures before revenues are collected. However, since many investors in the forestry space are impact investors or institutional investors - such as pension funds and endowments - manage their portfolios with a long-term view, the risks of illiquidity and lag of revenue allocation remain relatively low.

Though forest bonds are still in development compared to other green bonds, they are a key green financing option available today so investors can achieve their financial goals while delivering sustainable forest conservation benefits.

The post Investing In Forest Bonds To Save Our Planet appeared first on ValueWalk.