WASHINGTON – Today is one of those weird days on the market. With banks closed and with bonds not trading, stocks – which are trading – are up. Most of the time on a national holiday, everything, including stocks, is closed for trading. But not so today. As a result, market stats might be a bit skewed, as more skeptical players like the bond ghouls are on holiday. At any rate, that means that at least for today, it’s Happy Columbus Day for the bulls. With stocks up, what’s not to like?

Tomorrow, we might find this situation valid. But today, who knows? We’ll just enjoy our happy Columbus Day, and worry about Newtonian stock market physics tomorrow.

Also read: Wall Street thrill ride continues, as stocks soar on mini-stimulus possibility

A really Happy Columbus Day for Amazon.com. So far…

Speaking of a happy Columbus Day, techs are up big time today after spending most of September in a state of slow strangulation. In fact, as we write this today, Amazon (NASDAQ:AMZN) shares are in the midst of a moon-shot day, up a colossal $203.35 (+ $6.01%) as we write this article Monday mid-afternoon. That puts the shares at $3,488.4525 currently. For obvious reasons, being middle-class investors, we only own a tiny number of these very costly shares. But they’re helping the bottom line considerably today.

We do think these shares should be split, à la Apple (NASDAQ:AAPL). But the fashion in Amazon and Google circles today is to keep those share prices free of splits, like Warren Buffett with Berkshire Hathaway. It’s an upper class thing, we think. Or maybe at prices like these, the Buffetts and Bezoses of the world are telegraphing that they don’t want too many little guys accumulating their shares. Whatever the case, it’s a fun day for Amazon shareholders today.

Will Mr Market’s Tuesday attitude give us a Happy Columbus Day sequel?

Days like today are a bit unreal. Ao we can’t help thinking there’s a better than even chance Mr Market will reverse on us tomorrow. But what’s really going on. Preferred stock guru Tim McPartland may have a partial answer to that question in his lead column today.

“Last week the S&P500 was up by almost 4%. The markets are waiting and betting on a stimulus package from congress and as has been the case all year (or actually a few years) massive liquidity simply keeps moving markets higher. This likely won’t end well, but whether the reckoning comes next week, next year or in 5 years no one knows.

“The 1 year treasury closed around .78% on Friday after knocking on the door of .80% all week. This was an increase of about 8 basis points from the close the previous Friday. I suspect if we do get a stimulus package soon we will see an interest rate pop that will put us up in the 1% area (or maybe I am still in my dreams from last night)…

“Just like common stocks last week income issues took the opportunity to move to the highest levels since early March…

“Obvious[ly,] the move higher in interest rates had little affect on price movements–as expected. Seasoned holders of income issues know that ‘speed kills’–slow movement in rates will have little affect on pricing.”

Bulls and optimists remain guarded

On the other hand, chart guru David Keller, writing in the free article section of Stockcharts.com, is a bit more cautiously optimistic about any upcoming market moves.

“I would currently describe myself as a “cautious bull,” in that I recognize that the market is trending higher, I’m prepared to follow that trend as long as it continues, and I’m always looking for some signs of potential weakness and/or exhaustion.

“Over the last two weeks, I’ve seen many of the most negative market conditions, particularly in the area of breadth, transition from distribution phase to accumulation phase. This suggests that the recent upswing to push the S&P 500 back above 3400 is not just based on a relatively small number of mega cap names, but rather a broader increase based on widespread participation.”

That would be nice. It would certainly get us out of the trading rut we’ve been in since August. In general, the market still appears unable to break through to new highs, always stopping at the resistance point engraved on the charts at the previous market highs.

Earnings season and beyond…

It’s also the beginning of another earnings season. Again. So investors will be eagerly looking for at least one of two things to happen

1. Individual stocks experience a significantly lower loss-per-share than they did in the previous quarter; or 2. Individual stocks break out into unexpected profitabilit. This might demonstrate that Trump and the Fed really have re-ignited much of the US economy. That, in turn, might cause a return to the animal spirits we saw in January-February, pre-Covid-19.

But Nancy Pelosi’s CPUSA-affiliated party wouldn’t like that. It might interfere with their Marxist revolution.

Conclusion?

But what the heck. Let’s enjoy a bullish Happy Columbus Day today. At least it looks like we’ll close on a bullish note. And tomorrow is another day.

But perhaps it might be prudent to leave on a cautious note. Gold and silver aficionado Jesse, proprietor of Jesse’s Café Américain reminds us today of a gloomy but thoughtful quote from off-the-wall detective Rust Cohle (Matthew McConaughey). Rust was one of a pair of co-stars who transformed the gritty Season I of “True Detective” into a high art mini-series masterpiece.

“Time is a flat circle. Everything we have done or will do we will do over and over and over again — forever. This place is like somebody’s memory of a town, and the memory is fading. It’s like there was never anything here but jungle. “– Rust Cohle, True Detective**

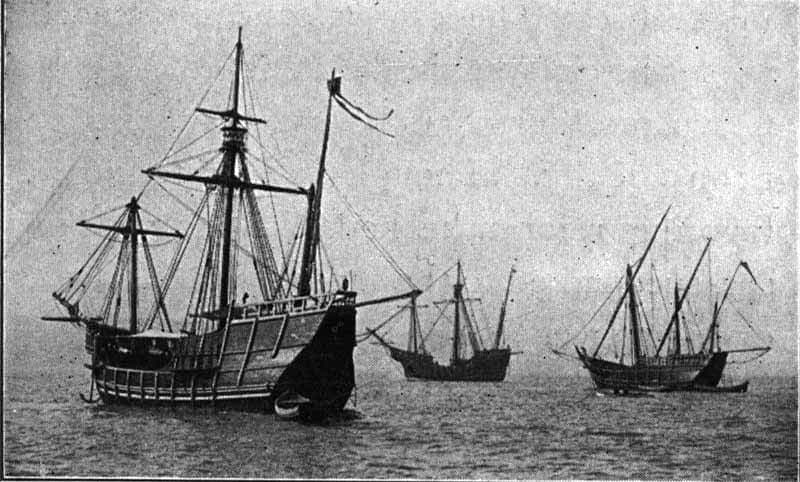

*— Headline image: Replicas of the Pinta, Niña and the carrack Santa Maria. Lying in the North River, New York. The the trio of replicas crossed from Spain to be present at the 1893 World’s Fair at Chicago. Image and part of this caption via Wikipedia entry on Christopher Columbus. Appears in E. Benjamin Andrews’ History of the United States, volume V. Charles Scribner’s Sons, New York. 1912. This work is in the public domain* in the US.