NVIDIA DGX A100 system sets new records for scalability and performance on key financial industry benchmark.

Q3 2020 hedge fund letters, conferences and more

As whiplashing stock markets have put volatility in the spotlight for 2020, NVIDIA’s DGX A100 AI platform is on a streak of records for a key risk model benchmark used by some the largest firms on Wall Street and the global financial industry at large.

With billions of dollars at stake, investment firms use risk models to help anticipate and manage the impact of market volatility. But that’s become more complicated amid the market’s wild rides, spurred by COVID-19 lockdowns, trillions of dollars in bailouts, social media and global trade tensions.

Investment banks and hedge funds depend on algorithms to help analyze a dizzying array of options pricing, so staying up with the latest financial technology can make a difference.

Performance leaps on risk models promise deeper insights and faster risk calculations across more options and derivatives for the financial services industry.

20x More Simulations

NVIDIA’s DGX A100 AI platform delivers 20x more simulations than a single standard CPU server — a dual socket x86-based system — on the STAC-A2.β2.GREEKS.MAX_PATHS benchmark.

The record results from NVIDIA have been validated by the Securities Technology Analysis Center. Members of STAC include 400 of the world’s leading banks, hedge funds and financial services technology companies, which contribute to the benchmark’s makeup.

Streak on Greeks

The STAC-A2 market risk benchmark simulates fluctuations in interest rates, options prices over time and other factors that make up risk scores known in the finance industry as “the Greeks.”

STAC-A2 simulates these option-price sensitivities of the Greeks for multiple assets by applying a finance technique called Longstaff-Schwartz Monte Carlo.

Using a Monte Carlo simulation (randomly sampling a probability distribution) and the Longstaff-Schwartz method (a backward iteration algorithm, which steps back in time from a maturity date) it solves for option-price steps over time.

The technique enables financial services firms to calculate price paths over time steps for options and other investment vehicles.

DGX Devours STAC-A2

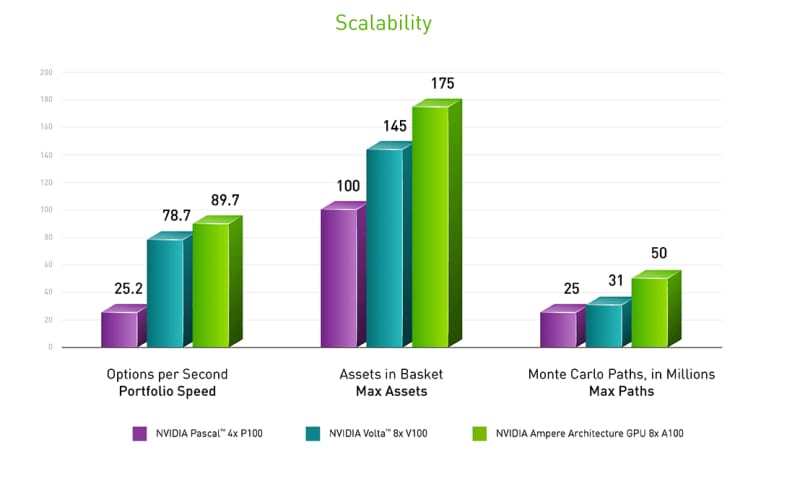

NVIDIA DGX systems are gobbling through STAC-A2 simulations in record time. Powered by NVIDIA A100 GPUs, the systems can run a staggering 50 million simulation paths on the STAC-A2 benchmark in roughly 10 minutes, up from the 31 million paths of NVIDIA’s prior-generation system.

A simulation is one completed set of calculations of a multidimensional stochastic integral equation, essentially a calculation of option values and risk metrics for every point, or step, in time, applying Longstaff-Schwartz Monte Carlo.

The NVIDIA DGX A100, sporting eight of our NVIDIA Ampere architecture-based GPUs, can solve almost 90 of these equations per second. That’s more than 3x faster than a standard CPU server.

On scalability, the system also set a new record. It bests the previous maximum number of assets, hitting 175, illustrating how big a basket of options or indexes can be managed at once within the 10-minute limit.

To manage risk, large investment banks run these types of calculations for hundreds of thousands of options, multiple times a day.

Fastest Warm Time

NVIDIA also set a record on speed of results for “warm” runs, those that represent larger simulations such as crunching multiple risk positions simultaneously.

The DGX A100 delivers results for the baseline Greeks benchmark in 0.016 seconds — 2.15x faster than the standard CPU server.

Compared with NVIDIA V100 architecture, the system improves on scalability — 61 percent higher maximum simulations and a speedup of 54 percent faster in the large Greeks benchmark.

Learn more about NVIDIA DGX systems.

Footnotes:

1. STAC SUT:INTC190402

2. STAC-A2.β2.GREEKS.MAX_PATHS; SUT ID NVDA181105

3. STAC-A2.β2.HPORTFOLIO.SPEED; SUT ID INTC190903

4. STAC-A2.β2.GREEKS.MAX_ASSETS

5. STAC-A2.β2.GREEKS.TIME.WARM; SUT ID INTC181012

6. STAC-A2.β2.GREEKS.MAX_PATHS; SUT ID NVDA181105

7. STAC-A2.β2.GREEKS.10-100k-1260.TIME; SUT ID NVDA181105

The post Risky Business: NVIDIA AI Platform Demonstrates Ability to Help Financial Industry Better Manage Market Volatility appeared first on ValueWalk.