Gator Capital Management commentary for the third quarter ended September 2020, discussing their investment theses in ConnectOne Bancorp and Flushing Financial.

Q3 2020 hedge fund letters, conferences and more

We are providing you with Gator Financial Partners, LLC’s (the “Fund” or “GFP”) Q3 2020 investor letter. This letter reviews the Fund’s 3rd quarter investment performance and discusses the Fund’s current net exposure and positioning by sub-sector. Additionally, we will provide a review of the Fund’s portfolio, opportunities we see in regional banks and our investment theses in ConnectOne Bancorp and Flushing Financial.

Review Of Q3 2020 Performance

For the 3rd quarter of 2020, the Fund outperformed both the Financials sector benchmark and the overall market. PennyMac Financial Services, OneMain Financial, Ally Financial, and SLM Holdings were top contributors to performance. The largest detractors were Western Alliance Bancorp, Ambac Financial, Pinnacle Financial, and OFG Bancorp.

Update On Investment Themes In Fund’s Portfolio

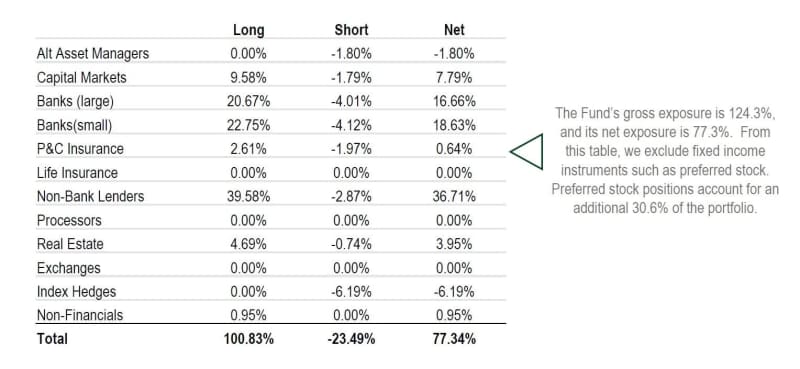

Here’s a closer look at the Fund’s portfolio by sub-industry.

Long Positions

Mortgage Banking & Mortgage Insurance – Mortgage banking companies continued to have strong performance in Q3. PennyMac Financial Services (“PFSI”) was up 39.5%. In Q3, mortgage spreads continued to stay wide like they were in Q2. We hold this position as we expect PFSI to post strong results again in Q3.

Financial Guaranty - We continue to hold our positions in Fannie Mae preferreds and Ambac although both positions lagged in Q3. Neither company had noteworthy news. We expect both names to garner more attention as they approach their respective catalysts in Q4 & Q1.

Preferred Stock – The distressed preferred stocks we purchased in Q1 continue to perform well. In Q3, we added positions in Exantas Capital preferreds and Chimera Investment preferreds. The Exantas Capital preferreds had a 45% return after the board restarted paying dividends, including the accrued dividends.

Capital Markets– We exited our positions in MS, GS & COWN and redeployed the proceeds into regional banks. Since the recovery of these three stocks in Q2 and Q3, we believe the regional banks now offer more upside. We continue to own Credit Suisse and Barclays in the Fund.

Regional Banks – We continue to add to our positions in regional banks. Even though the Financials sector index was up 3.58% during Q3, the Regional Bank index was down 6.08%. We explore the compelling opportunity we see in regional banks later in this letter.

Consumer Finance – Our positions in consumer finance companies performed well in Q3. We continue to hold these positions as we think their credit losses will be less than market expectations. The consumer remains surprisingly strong. The consumer finance companies will benefit from higher government stimulus spending.

Short Positions

High-Multiple Regional Banks – Our high-multiple bank shorts added value again during Q3. These are well-run banks but trade at the very highest valuations of their bank peers. We believe these names will underperform if regional bank stocks rally.

Extreme Valuation Presents Opportunity In Regional Banks

We believe there is a “once in a decade” opportunity in regional bank stocks.

As you know, regional bank stocks have significantly lagged the broader market in 2020. Through September 30th, the S&P Regional Banks Select Industry Index declined 36.75% vs. the S&P 500 Index rising 5.57%. This poor 2020 performance comes after regional banks lagged the broader market over the previous three years. From 2017 to 2019, regional banks returned only 11% vs. the S&P 500 Index’s 52% return.

This long-term underperformance of regional bank stocks created the current opportunity that we see.

Industry Valuations at S&L Crisis Levels

Regional bank valuations are very compelling. Currently, 100 of the 186 banks, with deposits of at least $3 billion, trade below tangible book value. At the end of 2017, only 6 banks traded below tangible book value.

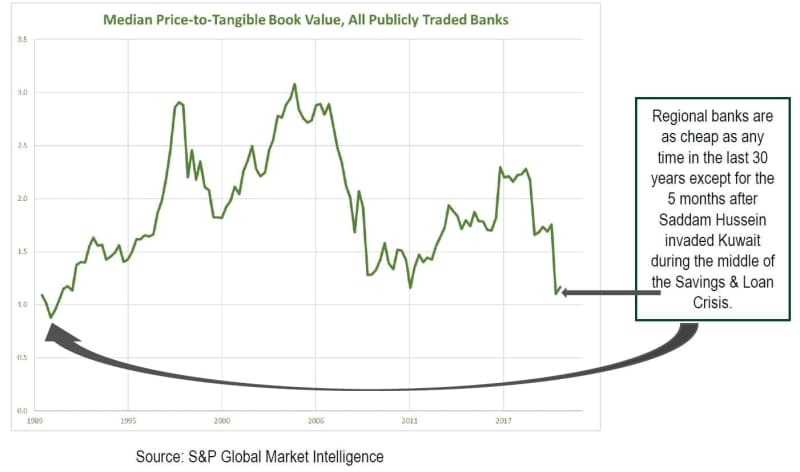

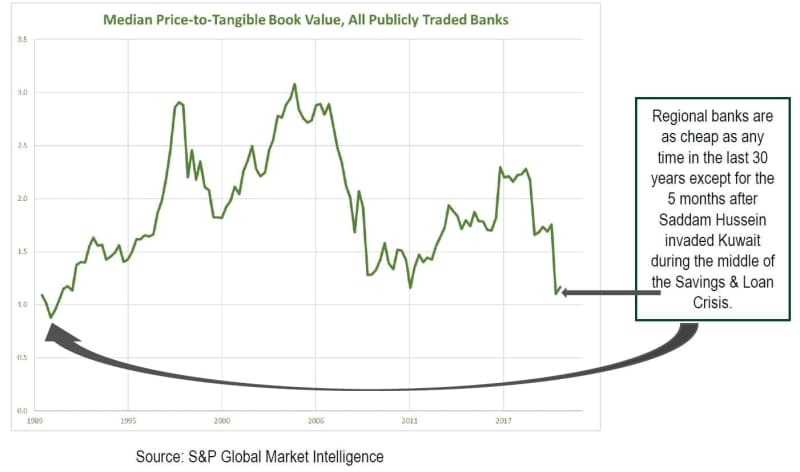

The median price-to-tangible book value of all publicly traded banks is 1.1x. This is lower than the valuations during the Great Financial Crisis (“GFC”). The only time in the last 30 years with lower bank valuations was during the stock market break in late 1990 when Saddam Hussain invaded Kuwait during the height of the Savings & Loan Crisis (“S&L Crisis”). From August 1990 to January 1991, regional banks traded at 0.9x tangible book.

We think the median regional bank valuation can easily reach 1.5x tangible book in the current interest rate environment. As recently as 2016 to 2018, the median regional bank traded at 2.2x tangible book. In 1998, and from 2004 to 2007, the median regional bank traded close to 3x tangible book. We don’t think regional banks will reach those valuations due to increased capital requirements and increased competitive intensity. But, as credit quality concerns abate, we think regional banks can rally.

Another way to evaluate how attractive regional bank valuations are is to look at the implied deposit premiums of banks versus where M&A transactions historically have been priced. This view of value makes sense because most investors look to deposits as the franchise value of a bank. To measure value, investors look at deposit premiums. Since 2016, the average deposit premium for acquired banks with more than $3 billion of deposits was 14%. Currently, only 3 of the 186 banks with deposits greater than $3 billion trade for a deposit premium of 14% or greater. At the end of 2017, 49 of 148 banks traded with deposit premiums above 14%. So, almost all banks trade below where they would trade in an M&A transaction.

Credit Risk in a Pandemic Economy

The fundamental cause of poor performance for bank stocks this year is investors fear of credit risk. When the economy started to shut down in March, the floor dropped out from under bank stock prices. But, credit losses haven’t appeared in the banks’ financial statements so far. We think the banks are going to have significantly lower credit losses in this credit cycle compared to the GFC or the S&L Crisis in the early 1990s.

The main reason for lower credit losses is better underwriting during this cycle. We believe the bank regulators stopped banks from making many marginal loans. We also think the annual banking stress tests have forced banks to restrict risk taking. This has positioned banks with much lower risk loan portfolios than past cycles.

Additional reasons for lower credit losses include:

- Lower customer leverage

- A strong economy before the sudden shutdown

- Quick reactions by businesses and consumers to conserve cash

- Speedy government action to provide stimulus and forbearance

There are two wrinkles that make the low level of credit losses indistinct. First, loan forbearance and deferrals obscure how many customers are able to make payments. The bank regulators directed banks to generously grant loan forbearance and deferrals. Many customers took the offers of help even though they had the ability to pay. At the end of Q2, the median bank had 15% of their loan portfolios in deferral. This high level of deferral made it difficult for many investors to get comfortable with the underlying credit risk. Investors were unsure if large numbers of these customers were going to default and cause losses. During Q3, many banks gave updates on customer payment trends as deferrals expired. These banks report that the number of customers getting a second deferral dropped on average from mid-teens to mid-single-digit levels.

The second wrinkle that made the low level of credit losses difficult for investors to see is the implementation of a new accounting methodology for loan losses, which is called Current Expected Credit Losses (“CECL”) Methodology. Under CECL, a bank has to provide for lifetime loan loss reserves when they make a loan. Then, each quarter, the bank has to adjust their CECL reserves for changes to their economic forecast. (Note - Most banks outsource their economic forecast to an independent firm such as Moody’s.) So, when the banks reported their Q1 earnings, it was their first earnings report using CECL. They had to use significantly worse economic forecasts in setting their loan loss provisions for Q1 than they did when they set their initial reserve on January 2nd. We think investors will be surprised as banks will have to keep building their loan loss reserves in Q3 and Q4 as a result of CECL forcing them to provide large reserves in Q1 & Q2.

Other Headwinds for Banks

Credit risk is not the only current headwind for regional banks. While there are several others, we think each is manageable. We also think the current stock prices of the banks overly discount these issues.

ZIRP – “Zero Interest Rate Policy” is a strong headwind for banks because there is pressure on loan earnings. Because many banks already have deposit costs close to zero, they cannot offset the lower loan yields with lower deposit costs. We see banks instituting loan floors to protect themselves from low rates. Some banks earn substantial loan yields because they have a niche.

Banks with weaker deposit franchises or banks with high loan-to-deposit ratios actually benefit from the current environment. They can replace high-cost funding with low-cost deposits.

We expect low-interest rates for an extended period. The Federal Reserve kept interest rates at zero from 2008 to 2015. Although we do not think the current economy is as bad as the GFC, we do think the Federal Reserve has changed its tolerance of inflation. We could easily see interest rates staying at zero for five years in this cycle. We acknowledge low-interest rates will limit bank returns and valuations for the next several years, but we believe the current valuations overly discount this headwind.

Bank Investors Torched – The community of institutional investors who focus on bank stocks has struggled this year. Many bank stock investors focus on small-cap banks with less liquidity. We observed forced selling by this group of investors from March to September as these funds had to raise cash to meet investor redemptions. In talking with other bank investors, there is consensus that bank stocks are cheap, but everyone is already fully invested. This community is looking for new capital to put to work.

Limited Loan Growth – After the revolving line of credit draws in March, loan growth has been tepid. We think this a demand problem rather than a supply problem. Although banks tightened credit standards in 2020, they still want to make new loans. With the economic uncertainty caused by the pandemic and the high levels of liquidity offered by the capital markets, bank customers are not seeking bank loans.

Election Risk – At first glance, it would seem the banking industry would have downside risk to a Biden Administration due to the potential for higher regulation. But, the S&P Regional Banks Select Industry Index is actually down 7% since Trump’s election in 2016 despite rallying 35% in the first four months immediately after the election. How much worse could the banks perform than they did under the Trump administration?

The bullish case for banks under Biden:

1. There is less pressure on the Federal Reserve to keep interest rates low

2. Stronger economic recovery as we get a federal government plan to snuff out the virus

3. Less economic volatility from on-again, off-again trade wars with China

4. Biden turns out to be surprisingly bank-agnostic. We see evidence of this from the decades of credit card company campaign contributions to Biden during his time as a senator from Delaware.

M&A is on Slower – The banking M&A environment has slowed since the pandemic started. There are several reasons

1. Potential acquirers are more internally focused

2. Acquirers are shy about buying another bank’s loan portfolio with the uncertain economy

3. Sellers have not adjusted price expectations for the decline in stock prices

4. Acquirers do not have the currency to make acquisitions.

We think there may be defensive M&A in the current environment where bank management teams know they need to sell. There may be some low-premium, merger of equal deals where two similar banks merge to cut costs and both participate in a bank stock recovery. We saw an example of a low premium deal with the announcement of the First Citizens/CIT deal last week. We think a full-scale regional bank M&A environment will not return until late 2021 or 2022.

Positives for Banks

Although there are headwinds for regional banks, there are also some positives in the current environment.

Awash in Deposits – Since March, the banking system has become awash in deposits. This has been driven on a micro-level by corporations and consumers keeping more cash than normal in their checking accounts because of the economic uncertainty. On a macro level, the Fed engaging in Quantitative Easing replaces bonds held by investors with cash, which finds its way into bank deposits. Regional banks have been able to use these deposits to replace other higher-cost borrowings and to improve their loan-to-deposit ratios. We expect the high level of deposits to remain in the banking system for an extended period.

Levered to Recovery Trade – We expect regional banks to outperform as stock market investors gain confidence that the economy is recovering as people return to the workplace and normal activities resume. We call this the “Recovery Trade.” Generally, stocks of companies most impacted by the economy shuttering down are grouped together in the Recovery Trade. These include retail shopping centers, hotels, restaurants, airlines, cruise lines, and casinos. Year-to-date, this group of stocks has massively underperformed the market. We see this group outperform on days where there is positive news about a possible vaccination. We believe that out of these groups regional banks have the least impaired businesses. The regional banks have remained profitable while most of the businesses in the other industry groups reported substantial losses and increased their debt and/or sold equity at dilutive prices to offset their cash losses.

Expense Cutting Opportunity – Banks have been cutting expenses for several years. With strong deposit growth during sheltering-in-place, banks are seeing further opportunities to cut expenses. We think this will initially focus on more branch consolidation. But, we think bank cost-cutting will quickly move to the back office in terms of both headcount and real estate. In recent weeks, we have seen a handful of banks announce they were cutting 15-20% of their branches.

Return of Stock Repurchases – Bank stock valuations are very cheap. Banks continue to make money and build capital, and loan demand is weak. This would be an opportune time to use their excess capital to repurchase stock. We are beginning to see several banks with assets below $10 billion announce resumptions of their buybacks. We think this is good news for investors and expect this trend to expand through the end of the year. We anticipate bank regulators will allow larger banks to restart their repurchase programs in early 2021.

Secular Issues

Banks have long been average market performers. There are some obvious long-term secular issues with banks. They are exposed to asymmetric risk to the downside in the form of credit risk. The industry is competitive, and the competitive intensity is increasing. FinTech is a persistent threat. We don’t think these issues are dealbreakers for the current opportunity, but they reinforce that the current opportunity is more a trade versus a permanent investment opportunity.

Increasing Competitive Intensity – The banking industry is increasing in competitive intensity. There are several reasons for increasing competition including:

- The removal of interstate branching restrictions

- Consumer lending products have consolidated nationally

- Traditional non-bank firms such as brokerage houses providing banking services

- Technology providers allow smaller banks to benefit from scale

This increase in competitive intensity will keep a cap on margins long-term for banks.

Encroachment by FinTech – Financial Technology firms are encroaching on various aspects of the banking business. Examples are prepaid products, mortgage banking, and consumer loan origination. We believe these products are not disrupting the banking business as a whole, but they are chipping away at the profitable edges of banking.

Narrow Business Lines – Regional banks are not as diversified as they were 30 years ago. Since that time, consumer lending products such as credit cards, student loans, and mortgages have consolidated to the large national players such as JP Morgan Chase, Bank of America, and Wells Fargo. Regional banks are left with commercial real estate lending and middle market C&I lending. This lack of diversification makes banks more cyclical. This cyclical aspect is somewhat offset by strong banking regulators limiting the credit risk that banks can take.

Regional banks with the most opportunity

Growth Banks – Several regional banks with historically higher organic growth rates trade for little valuation premium to the broader universe of regional banks. Banks like CNOB, PNFP, AX & WTFC trade in-line with regional banks, but they have grown faster than the industry. At some point, we believe the market will again place a growth premium on these banks. Plus, these banks tend to compound tangible book value at a faster rate than peers.

Very Inexpensive Banks – There are dozens of banks that are trading between 50% and 80% of tangible book value. Largely, these banks have been profitable throughout 2020. Besides credit fears, we believe these banks are cheap because too much investor capital has left the sector.

Puerto Rico Banks – As we wrote in our July investor letter, the Puerto Rico banks trade cheap compared to the mainland U.S. bank. This is despite significant consolidation on the island and a potentially strong Puerto Rico economy. We like all three banks in Puerto Rico: BPOP, FBP & OFG.

Example bank pick: ConnectOne Bancorp (“CNOB”)

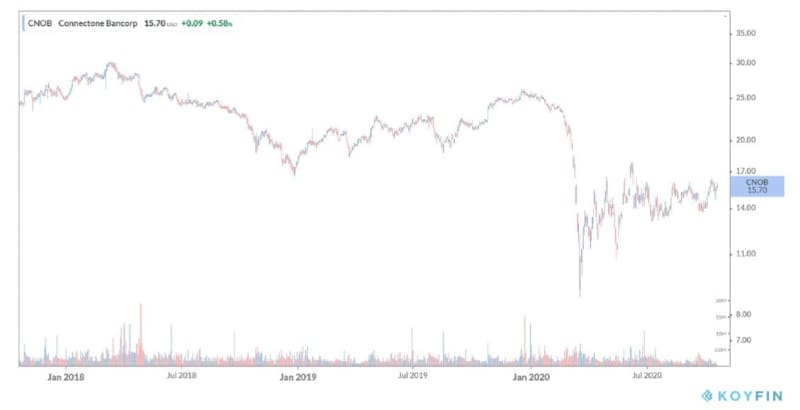

ConnectOne Bancorp (“CNOB”) is a $7 billion bank with 28 branches mostly in northern New Jersey. ConnectOne Bancorp has a strong management team led by CEO Frank Sorrentino. The bank has a history of strong organic growth. In recent years, it has become a skilled consolidator of other banks. With the pandemic, investors sold the stock due to general concerns regarding credit risk. We think the valuation is too low given the bank’s history of solid credit and strong growth.

1. Strong loan & deposit growth – Since 2010, ConnectOne Bancorp has grown loans per share by 14% annually and deposits per share by 11% annually. We look at the loan and deposit growth per share to account for both organic growth and shares issued through acquisitions.

2. Solid credit – ConnectOne Bancorp has a history of good credit quality. Other than taxi medallions, CNOB has had minimal losses throughout its history. We think the bank has a solid credit culture.

3. Favorable deferral trends – Like many other regional banks, ConnectOne Bancorp issued an 8-K during September showing that a large majority of customers who took loan deferrals in March and April are returning to normal payments. On June 30th, 17.2% of CNOB’s loans had deferrals. As of September 16th, loan deferrals dropped to 5%. We spoke with the bank on September 23rd, their construction loan portfolio has performed very well with a high level of residential demand in the Jersey suburbs.

4. Bank of New Jersey cost saves – ConnectOne Bancorp closed the Bank of New Jersey (“BNJ”) acquisition in January of this year. This was a great deal because ConnectOne Bancorp layered BNJ’s loans and deposits onto its balance sheet, but eliminated almost all of BNJ’s expenses. In fact, 8 of 9 BNJ branches have closed. This merger closed on January 2nd, so the financial benefits of this merger are obscured by loan loss provisions from the pandemic. If we look at the Pre-Provision Net Revenue/Net Assets, it increased to 1.96% in Q2 from 1.84% in Q4.

5. NIM stable in current environment – ConnectOne Bancorp was able to maintain its net interest margin (“NIM”) over the last two quarters. Management expects the margin to remain stable as deposits reprice lower. CNOB’s loans are mostly fixed-rate assets or are floating-rate loans with floors that will reprice more slowly. CNOB benefits from all the liquidity in the financial system as the banking industry has a significant amount of excess deposits.

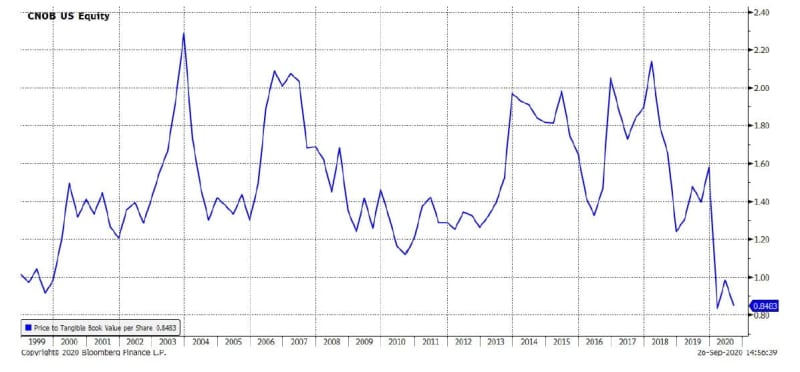

6. Valuation – ConnectOne Bancorp trades at 85% price-to-tangible book ratio and 7.2x 2021 earnings estimate. Peer banks in New York metro trade at 1.1x tangible book and 9.2x 2021 earnings estimates.

7. Not widely followed by sell-side – Only Keefe, Bruyette & Woods (“KBW”), Stephens, and Raymond James write research on ConnectOne Bancorp. We like stocks like CNOB where there is little to no research

coverage.

8. No well-known short thesis – As far we can tell, there is no controversial short thesis on ConnectOne Bancorp which would justify its low valuation. CNOB only has 1.1% of its shares sold short. CNOB shares sold short has ranged between 0.5% to 3.0%.

Issues

1. Loan-to-deposit ratio >100% - ConnectOne Bancorp’s loan-to-deposit ratio is 103%. We prefer banks with loan-to-deposit ratios of 95% or lower. We think a lower loan-to-deposit ratio proves the stability of the franchise. ConnectOne Bancorp had a lower loan-to-deposit ratio prior to its merger with Center Bancorp.

2. Commercial Real Estate concentration – ConnectOne Bancorp has a concentration of Commercial Real Estate (“CRE”) loans. Regulators have a long history of wanting to limit CRE concentrations. However, regulators have softened this guidance in the last several years to take into account strong collateral and a history of low credit losses. We think this applies directly to CNOB as their credit losses have been well-below banking industry averages.

We think ConnectOne Bancorp is too cheap for a growing, profitable bank with a history of low credit risk. From an 0.85x price-totangible book ratio, we believe CNOB can trade up to a 1.6x price-to-tangible book level. This is the average level that CNOB traded from 2013 to 2019. In fact, CNOB traded up to 2.2x tangible book in 2017-2018.

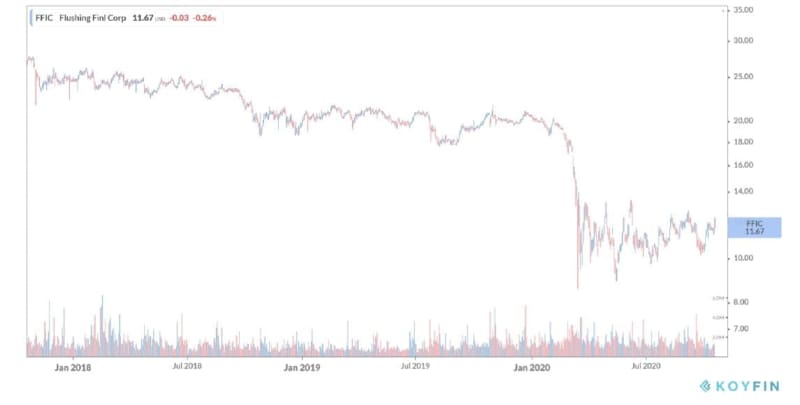

Example bank pick: Flushing Financial Corp (“FFIC”)

Flushing Financial (“FFIC”) is a bank with 20 branches on Long Island. Originally, FFIC was mutual thrift that converted to stock ownership in 1995. The bank has had a long history of strong credit quality, but investors have sold the stock due to COVID-19. We think the valuation is way too low given the bank’s long history of strong credit and incremental changes management is making to the business to improve returns

1. Strong credit – FFIC has a history of strong credit quality. During the GFC, its peak charge-offs were only 0.65%, which was a fraction of the industry’s charge-offs. We see FFIC’s real estate loans average less than 50% loan-to-value ratio.

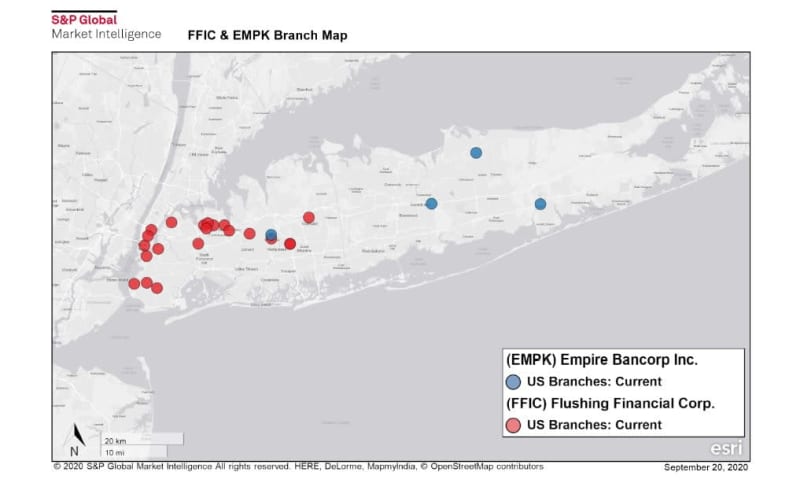

2. Pending merger will improve returns – FFIC is in the process of closing an acquisition to buy Empire Bancorp (“EMPK”). EMPK has four branches and will expand the FFIC footprint towards the eastern end of Long Island. FFIC is buying EMPK for 96% of book value. With the cost savings, the acquisition will be 20% accretive to FFIC 2021 earnings. FFIC’s estimated return on equity (“ROE”) will increase from 8% to 10%.

3. Expanding NIM in current environment – FFIC’s net interest margin (“NIM”) expanded in the last two quarters. Management expects the margin to continue to expand as deposits reprice lower. As a former thrift, FFIC has higher-cost deposits. Their customers have been consumers buying CDs rather than businesses with operating checking accounts. With the ample liquidity in this environment, FFIC is growing their deposits while lowering their deposit rates paid. FFIC’s loans are mostly fixed-rate assets that will reprice more slowly.

4. High, well-covered dividend – FFIC pays a 21 cent per share quarterly dividend, which translates to a 7.2% yield. With FFIC earning 35 per quarter this year while adding to its loan loss reserve, we believe the dividend is well-covered. As the loan loss provision declines and the Empire Bancorp deal closes, we think FFIC’s earnings will trend towards 50 cents per share a quarter in 2021.

5. Valuation – FFIC trades at 0.59x price-to-tangible book ratio and 5.7x 2021 earnings estimate. Peer banks in New York trade at 1.2x tangible book and 10.2x 2021 earnings estimates.

6. Not widely followed by sell-side – Only KBW and Piper Sandler provide sell-side research coverage on FFIC. KBW’s analyst has been lukewarm on the Empire acquisition. The Piper analyst has been restricted because the firm is an advisor on the Empire deal and has not published research on FFIC in many months. We like stocks like FFIC where there is little to no research coverage.

7. No well-known short thesis –FFIC only has 2.7 days volume of its shares sold short. This number has ranged between 1.7 days and 28 days with an average above 10 days. We talked with a few investors who have avoided FFIC because some of the commercial real estate loans have exposure to street-level retail stores in Brooklyn and Queens. We acknowledge this risk and believe FFIC’s low loan-to-value ratio on its loan portfolio protects against this risk.

Issues

1. Merger Integration – FFIC’s deal to buy Empire Bancorp is its first acquisition since 2006, so there may be higher than average integration risk. The good news is Empire only has 4 branches, so this is not an overly complex deal to integrate.

2. Loan-to-deposit ratio >100% - FFIC’s loan-to-deposit ratio will be 110% after the Empire Bancorp deal closes. We think a lower loan-to-deposit ratio proves the stability of the franchise.

3. Commercial Real Estate concentration – FFIC has one of the highest concentrations of Commercial Real Estate (“CRE”) loans. Regulators have a long history of wanting to limit CRE concentrations. However, regulators softened this guidance in the last several years to account for strong collateral and a history of low credit losses. We think this applies directly to FFIC. Their credit losses have been wellbelow banking industry averages because most of their CRE exposures are on rent-controlled apartment buildings in New York City. Rent-control apartment buildings in New York City have a history of low credit losses. This is result of few vacancies that do not last long.

4. Lower than peer fee income – FFIC history as a thrift means most of its revenue has come from spread revenue and less has come from fee income. Historically, commercial banks have had higher fee income than thrifts which has led to commercial banks having higher margins and higher returns than thrifts. Even though FFIC has shifted its balance sheet to have more commercial and industrial loans, FFIC has not grown its fee income proportionality.

We think FFIC is too cheap for a profitable bank with a history of low credit risk. From a 0.59x price-to-tangible book ratio, we believe FFIC can trade up to a 1.1x price-to-tangible book level. This is the level at which FFIC traded from 2013 to 2019. In fact, FFIC traded at 1.4x in 2017-18. If FFIC were to make substantially more progress in remixing its deposit base, we believe there is further upside to the valuation.

We are not arguing that ConnectOne Bancorp and FFIC are the greatest companies in the world. We are using them as examples of the opportunities we see in the bank stocks. We think both CNOB and FFIC could double in the next three years. If they did double, they would be trading in-line with their median historical valuation.

We believe there are several dozen similar opportunities in bank stocks, so we have purchased positions in many of them. We have expanded the number of long positions in the Fund’s portfolio to include more of these ideas. Even though the number of positions has increased, we don’t believe the concentration of the portfolio has been reduced because many of these positions are very similar and will trade as a group. The two benefits of increasing the number of positions are:

1. It keeps our Fund relatively liquid, and,

2. If one bank’s stock doesn’t work for idiosyncratic reasons, we don’t have much at risk.

Portfolio Analysis

Below are the Fund’s five largest common equity long and short positions. All data is as of September 30th.

Sub-Sector Weightings

Below is a table showing the Fund’s positioning within the Financials sector as of September 30th:

Conclusion

We are optimistic about the opportunities we see in the market. We know the Financials sector has badly lagged the broader stock market, but we believe the actual results of most Financial companies is significantly better than their stock prices suggest. Stock market investors are not giving Financial companies the benefit of the doubt about the potential credit risks in their portfolios. We think stocks of banks and other lenders will rise as they show their loan portfolios have fewer problem loans than the market expects.

We wanted to let you know about a couple of organizational changes. Erik Anderson, Gator’s CFO, has left to join Steve Pineault at AmbiView Capital. We believe this is a great opportunity for Erik as we expect AmbiView to be one of the more successful hedge fund launches of 2021. We are terribly sad to lose Erik. He joined Gator when we had less than $20 million in AUM and helped us grow the firm over the past 8 years. Erik had worked for Gator through an outsourced CFO arrangement with Oakpoint Advisors. Oakpoint has hired Tom Scully to replace Erik. Tom is a hedge fund veteran of Latimer Light Capital and Blue Ridge Capital. We look forward to Tom helping us at Gator. On happier news, Lexy Sayers, Gator’s long-time marketing analyst, gave birth in August to a beautiful baby girl. We are thrilled for Lexy and her husband, Yates, on the new addition to their family.

Thank you for entrusting us with a portion of your wealth. We are so thankful for our investors and their commitment to us. Despite the volatility in 2020, we have had positive net flows into the Fund during 2020. On a personal level, Derek Pilecki, the Fund’s Portfolio Manager, continues to have more than 80% of his liquid net worth invested in the Fund.

As always, we are available by phone whenever you want to discuss the Fund or investing in general.

Sincerely,

Gator Capital Management, LLC

The post Gator Capital Management 3Q20 Commentary appeared first on ValueWalk.