S&P Global Ratings has published the first of a new series of “ESG report cards” in the U.S. public finance sector. The new report covers the New York, New Jersey, and Connecticut region and is titled “ESG U.S. Public Finance Report Card: Tri-State Region Governments And Not-For-Profit Enterprises.”

Q3 2020 hedge fund letters, conferences and more

"Our ESG report cards qualitatively explore the relative exposures (average, below, elevated) of UPSF issuers to ESG credit factors over the short, medium, and long term," said S&P Global Ratings credit analyst Nora Wittstruck. "Comparisons of ESG risks and opportunities are not an input to our credit ratings, rather they are descriptors reflecting what is already incorporated into our current forward-looking opinion of credit risks."

Key Takeaways

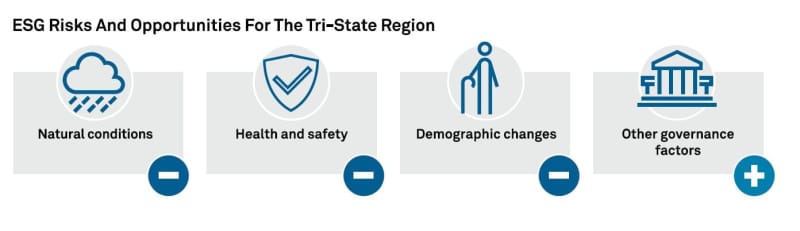

- E: A portion of the region is exposed to elevated environmental risks when compared to other regions in the U.S., depending on an entity's proximity to the Atlantic Ocean. Natural conditions, such as severe weather events like Superstorm Sandy, and longer-term issues resulting from sea level rise are more prevalent risks to credit quality for some entities without implementation of adaptation measures.

- S: The Tri-State area was once the epicenter of the COVID-19 pandemic in the U.S. and continues to reel from health and safety social risks related to reducing the virus transmission. However, outside of health and safety social risks, we view declining population and affordability concerns as elevated long-term social risks affecting the region.

- G: For government entities, we view the statutory framework as we define it in our criteria as a governance opportunity for entities in New York, New Jersey, and Connecticut as each provide oversight for distressed issuers, which we believe supports credit quality in the Tri-State.

In this report, we analyze the environmental, social, and governance (ESG) credit factors for select U.S. public finance (USPF) government and not-for-profit enterprise issuers in the Tri-State region of New York, New Jersey, and Connecticut. The list of entities highlighted in this report is not exhaustive but rather illustrative more broadly of the region's key ESG risks and opportunities and our view of where issuers across different sectors are positioned relative to those risks and opportunities. Beginning March 30, 2020, S&P Global Ratings incorporated a summary paragraph in all issuer-level credit reports describing their comparative ESG risks and opportunities. Select ESG summary paragraphs from Tri-State area issuers are reproduced in the Appendix to this report.

ESG Risks And Opportunities In Credit Ratings

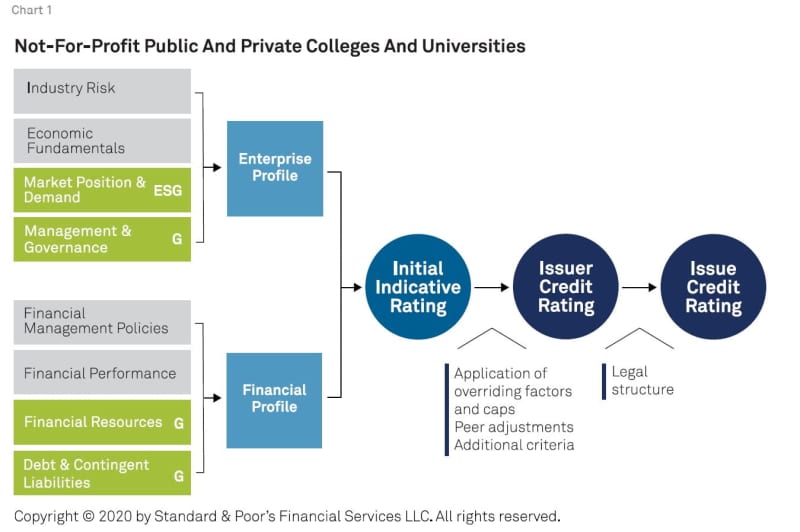

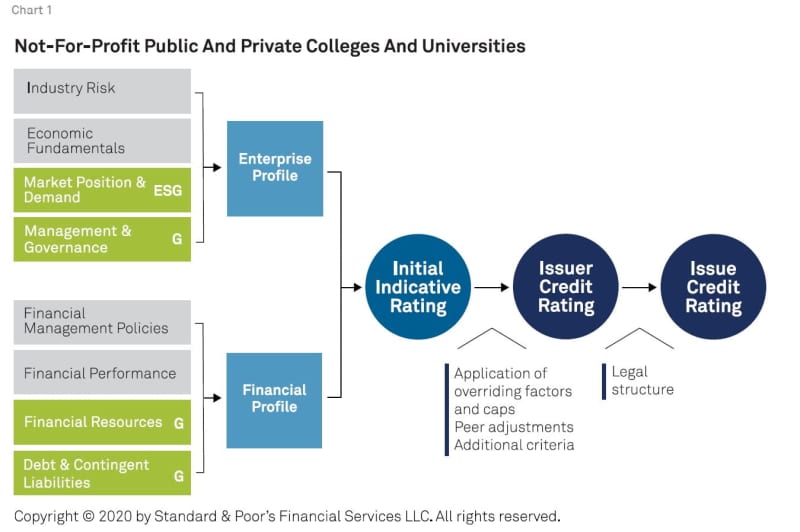

ESG risks and opportunities can affect an entity's capacity to meet its financial commitments, including debt service. S&P Global Ratings incorporates ESG considerations into its ratings methodologies and analytics, which enables analysts to integrate the qualitative and quantitative impacts throughout our credit analysis. Chart 1 shows an example of how we incorporate the most prevalent ESG risks and opportunities into our criteria frameworks. Strong ESG credentials do not necessarily indicate strong creditworthiness (see "Through the ESG Lens 2.0: A Deeper Dive into U.S. Public Finance Credit Factors," published April 28, 2020, on RatingsDirect, and "The Role Of Environmental, Social, And Governance Credit Factors In Our Ratings Analysis," Sept. 12, 2019).

Our ESG report cards qualitatively explore the relative exposures (average, below, elevated) of UPSF issuers to ESG credit factors over the short, medium, and long term. Comparisons of ESG risks and opportunities are not an input to our credit ratings rather they are descriptors reflecting what is already incorporated into our current forward-looking opinion of credit risks. This report card lists ESG insights for select governments and not-for-profit entities, including how and why ESG factors may have had a more positive or negative influence on an entity's credit quality compared to sector peers or the broader sector. These comparative views of ESG factors are qualitative and established by analysts during analytic discussions and described in issuer-level credit reports, with the goal of providing more insight and transparency.

Broadly, environmental risks for the Tri-State region focuses on natural conditions, primarily related to severe weather events and the long-term effects of climate change including sea level rise. Additionally, where appropriate, such as for our power and utilities sectors, we also will focus on GHG emissions, including carbon dioxide, pollution, and waste, water and land usage. Long-term social risks include demographic trends as the region is exposed to population stagnation and outmigration, partially as a result of affordability concerns. Finally, our views on governance include the government framework and reflect an opportunity in this region. New York, New Jersey, and Connecticut each provide some level of oversight and support to distressed entities through statutory frameworks, which we generally incorporate into our Institutional Framework scores for state and local governments.

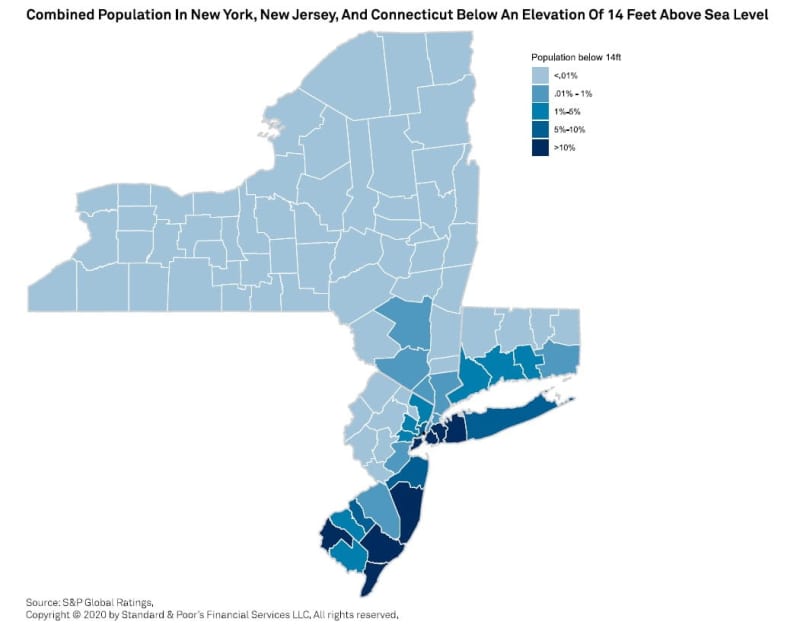

Environmental Risks - Elevated

USPF governments and not-for-profit enterprises in New York, New Jersey, and Connecticut have coastal exposure along the Eastern Seaboard that includes some of the largest communities in the U.S. including a population of over 20 million in the metropolitan statistical areas of New York City and northern New Jersey as well as the cities of Stamford, New Haven, and Bridgeport in Connecticut. Although we view some portions of this region as having environmental risks above those of the sector, the risk could vary depending upon an entity's proximity to the coastline.

Typically the northern Atlantic is less exposed to severe weather events when compared to the southeast region where warmer water temperatures in the Caribbean Sea and Gulf of Mexico provide more thermal energy to sustain a storm's strength. However, in 2012, Superstorm Sandy caused significant damage in New York and New Jersey and the storm surge hit lower Manhattan, displacing residents and workers for several months. More recently, Hurricane Isaias led to major power outages in New Jersey and Connecticut causing disruptions for several weeks despite its designation as a category 1 storm, demonstrating the need for utilities to consider hardening assets to ensure greater reliability during severe storms.

Although there is a relatively small portion of the population exposed to a subsequent storm surge equal to the magnitude of Superstorm Sandy's 13-foot surge (see chart 2), property value within these areas is substantial as it includes portions of lower Manhattan and northern New Jersey where the average home price is about $500,000 according to Zillow.

However, in response to Superstorm Sandy, various entities stepped up resilience and adaptation plans to help mitigate the elevated risk. We believe through regional planning, infrastructure initiatives and other adaptation efforts, the region can help buffer residents, preserve economic bases, and protect municipal facilities from the effects of climate change. Nonetheless, some issuers in the region are more exposed to environmental risks than others, as noted in our credit reports.

Social Risks - Elevated

We view the region's exposure to social risks as elevated when compared to other regions in the U.S. In the short-term, there is the impact from health and safety risks resulting from the pandemic; in the longer-term, there are the demographic trends including those stemming from population stagnation or decline and affordability concerns.

The Tri-State was once the epicenter of the pandemic in the U.S. with New York, New Jersey, and Connecticut together accounting for nearly 10% of cases in the U.S. Unlike other regions where restrictions were lifted more quickly, we believe the region's aggressive approach to curtailing the COVID-19 virus transmission rate, although important from a public health perspective, has negatively affected credit quality and could lead to a prolonged economic disruption. The virus transmission rate has largely slowed in the Tri-State, but the consensus among health experts is that it will remain a threat until a vaccine or effective treatment is widely available, which may not occur until the second half of 2021. Until then, elevated health and safety social risks may continue to pressure credit quality in the region.

The health and safety social risks stemming from the pandemic have cut across USPF asset classes in the Tri-State through reduced economic activity from stay-at-home orders, restrictions on domestic and international travelers, work-from-home requirements, financial liabilities associated with closing college campuses in the spring, and cancelation of elective surgeries at hospitals to preserve capacity to serve a surge in patient demand from the virus.

Our recent credit research has flagged the long-term social risks to the region from demographic changes (see "Increasing Generational Dependency Poses Long-Term Social Risks To U.S. States' Fiscal And Economic Stability," Feb. 24, 2020). In fact, the Tri-State area is disproportionately exposed to global aging, population shifts, affordability concerns, and an aging workforce.

In chart 2, we illustrate "old-age dependency ratio" or the number of persons age 65 and over divided by the labor force (age 15 to 64) as defined by the Organization for Economic Cooperation and Development. The map shows the projected trend in old-age dependency ratios over the next two decades based on IHS Markit Data. States are categorized based on how much their generational dependency is expected to increase: high--faster than 75% of all other states; moderate—the middle 50% of all states; and low--slower than 75% of all other states.

Read the full analysis here by S&P Global Market Intelligence

The post ESG Risks And Opportunities In Credit Ratings appeared first on ValueWalk.