A stock market crash should be the latest of your worries, an investing tragedy is developing which could be detrimental to you finances for the coming decades!

Q3 2020 hedge fund letters, conferences and more

Low interest rates, immense stimulus, incredible deficits and all focusing on issues that are not long-term issues, means the world of investing might be heading into a decade or two of terrible returns. Something normal in stock market history as you have 15 good years followed by 20 bad years on average.

Actually, a stock market crash would be a blessing for 90% of us because it would allow us to buy stocks on the cheaper, the current stock market with a dividend yield below 2% and expected returns around 5%, is not a great compounding tool to reach your financial or retirement goals.

There are other opportunities to invest, but those require a lot of knowledge, looking where others don’t and not fearing volatility even if I think volatility is better than what is likely to be ahead for the S&P 500 or other index funds.

I don’t think the S&P 500 will crash, I just think real returns will not be what people expect, especially after the bull market of the last decade.

Don’t FEAR A Stock Market CRASH, fear an INVESTING TRAGEDY!

Transcript

Stock Market

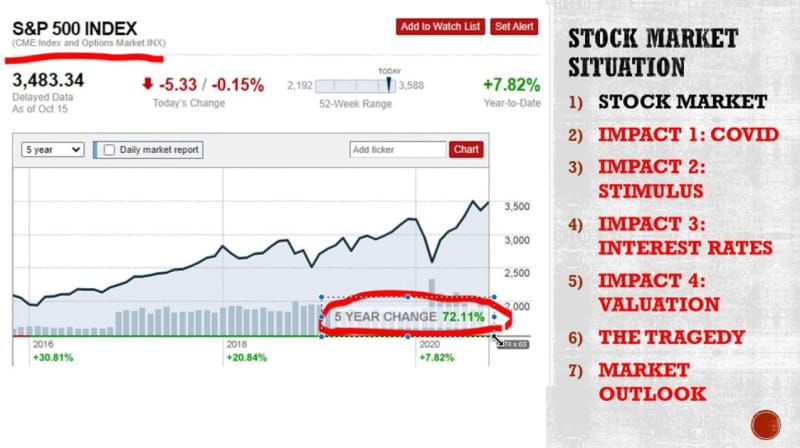

Good day fellow investors. What will happen to the stock market? Are stocks going to crash? What will happen? In this video, I’ll discuss the current stock market situation. I’m sorry, but I must laugh. On Friday I saw this news, how the S&P 500 has been declining for three days, what’s going on with the stock market, and this is really ridiculous. Butthe fact that this three day declined, on a five day positive change, makes the news that this is what gets clicked on, really explains this stock market. Something we have to take advantage as long term investors because in the long term, this is the real change 72% this is something amazing. This is something stellar, this is something that happens really, really rarely. But when you look at the impact that this has on other investors, that’s something really crazy. And that’s the environment we are living in.

If I just write stocks to buy on YouTube, I look over the last three weeks, one month, I look at the crazy number of views, oh, I might have to do what are the four stocks to buy now, crazy number of views that all these different channels get, 100,000 views, which means that there are millions of views every week on what is the best stock to buy, all different channels. So this is really, really insane. But this also shows that a lot of people may have a lot of money, and that the stock market looks like a very, very easy game where all you can do is make money. This is a very dangerous situation, we’ll explain why it has happened, COVID stimulus, interest rates that lead to valuation, how that impacts financial assets, why everything is going up. And then we’ll also discuss what might be the outlook long term. Where is the next thing pushing stocks higher what might happen, how it usually happened in history, and how to adjust your strategies, especially if you are a long term investor. And you’re if you’re looking for long term common sense investing, this is the channel to subscribe to.

Covid Impact No Crash

Let’s start, of course, the first impact on the economy that has consequences on other things is COVID-19. Of course, when the thing passes, I have a feeling it will pass. Hopefully, I hope it will pass over the next six months, still a hard winter ahead of us. But then like it has been historically pandemics last a year, two years. So we should hope for the better of us to be COVID free from the next six months. I’m again in lockdown, we are not allowed to go get out of the region. So here we are, again. However, if we look at the stock market, actually, it has done better after COVID, then with COVID. Actually COVID has been a positive for stocks, which is insane. It’s crazy. But that’s how it is.

Stimulus

And this is because of course stimulus. Everybody’s talking about new stimulus. The only issue is will it be before the elections or after the elections. So there will be stimulus, don’t worry. And then also in Europe immediately now with the new COVID expansion, there is an arsenal of economic stimulus on standby. So here is the help. Here is the money. we’ll print it work magnificently. It worked magnificently over the last COVID crisis. So lets push assets higher and higher. We can do whatever we want. We have an arsenal of economic stimulus. This is really insane. But this is the world we are living in. So what everybody expects now and what politicians say they will do, and everything is a big put. So when stocks fall the Fed, Bank of Japan, China bank, everybody will intervene and save the financial statements, save the assets, save everything, because that’s what they do, and they have an arsenal to do that to push financial assets higher because we live in a financially engineered economy. So let’s do whatever we can to save that economy in the form it is. Okay, those are the rules for now. Let’s live by those rules. The only question is, of course, for how long can this be sustained. So we have huge stimulus packages all over the world, money’s being printed with no thoughts of consequences, huge fiscal deficits, huge debt piles even higher than the debt crisis of 2009. Because the solution is here, the vaccine is here, you just print money, and it washes all the financial viruses away. So they are working on a vaccine for covid. But the vaccine has been developed already by central banks and politicians. That’s the world we are living in. The question is for how long.

Interest Rates

Because we have already seen the failure of interest rates. So whenever in history, there was an economic hiccup, the government would lower interest rates, this was what stimulate the economy borrowing and everything, and the economy would recover, then again, next election always the same, same, same, this was inflationary. So look at this period, what is this 30 years of growing interest rates. And that’s something that nobody now thinks now, the predominant idea is low interest rates, zero interest rates for a very, very long term, even if inflation goes from 2 to 4% as we discussed from the Fed, zero interest rates forever. And that is yes, like the scenario until they lose control of what they are doing. So we have already seen monetary policy, one uneffective, you can’t lower rates anymore. And even if they try to increase rates, when they tried it 2017-18, it immediately had the negative impact on the economy and rates were already lowered three COVID. So going down free COVID. Because this is what people expect. This is the market. This is what everyone expects zero interest rates. So this stimulust, lust for stimulus cannot go over on forever, will be over at one point in time. And this is the main story between long term investors and everything else.

Stock Valuations

Low interest rates, of course, push everything higher, September 1981, 15.84 was the interest rate on the 10 year Treasury. Now it is 0.73. With this environment, everything goes up and the S&P 500 consequently went up. And as interest rates went lower, stocks went even higher. So that’s normal, because you use a lower discount rate, the valuations go higher. But high valuations mean low returns, the current price earnings ratio is 35. But I would prefer to take let’s say 24, which leads to a 4%-5% with growth, inflation, 5% expected return. So we have treasuries with less than 1% return, stocks compared to treasuries would be still cheap. But all in all, look at the median, the median was 15. Let’s say the mean was 15, which means 6-7-8-9% long term returns with the growth now those returns are 4%-5%. So half of what was the average historical and then there were historical periods, with even higher returns 10-15-20%. And this is actually the investing tragedy.

Worse Than Crash Ahead

Most people and if you look at YouTube everyone, we are making so much money, we are rich, we are really smart, we are nailing the right stocks, but this is an investing tragedy for you. Why is this an investing tragedy for you? Because if you are younger than 50, you are still a net buyer of stocks investments for your retirement. If stocks are 72% higher than they were five years ago, to create something for your retirement is 72% more expensive and that’s something people don’t get. So as stocks go higher, it’s an investing tragedy for you for everyone that saving investing that doesn’t already have millions. So if you are younger than 65 still an investing tragedy. So only if you want to sell everything now and I don’t know then it’s great that stocks went up. But if not, it’s not that great and it leads to low long term returns. If we take a look at the dividend yield of the S&P 500 ETF history Oracle lows, which means that the yields on that investment will be at historical lows. And you have to put five times more money into a retirement fund than somebody in the past. Another investing tragedy if they’re printing so much money, what will be the effect on currencies? Well, we know the result over the long term now everything is blocked, locked down. So we don’t see what will be the effect still, but gold is going up has gone from 1000 to 2000, just to three years. Also speculation but there is also some fundamental change there because of so much printing. Also deficit that like there is no tomorrow everybody is borrowing, borrowing, borrowing free money, arsenal of stimulus like that this has no impact. However, I think that sooner or later, this will have an impact. So when COVID finally seizes, when it’s gone, I bet we will have much bigger problems than COVID. So we’ll have huge debt piles, real bankruptcies, because when reality hits and there is no more free money from arsenals of stimulus, then we will see what is real, what is fake. When the tide changes, we will see who has been swimming naked. Now we can see not even COVID, not even the crisis, showed us there because there is so much money coming in from the stimulus, let’s save everybody, a real environment would change things.

Stock Market Outlook

And this also will lead to high uncertainty, high volatility over time, we already know there will be low returns because low interest rates, political issues, etc. As everybody will want to get their own piece of a pie. Low returns ahead, we are already now at zero in bank, 1% bonds, 4-5% from stocks on average. So the party will be over sooner or later. And we have to look for different strategies. Because this, okay, as long as it works, it is great. But it hasn’t been the case in history, we are now at something like this, there have been plenty of times in history, one decade, two decades when it looked like stocks can only go up or reach a plateau forever. However, when you look at the up, those are usually shorter, then the downs or 0, 17 years, 25 years, 22 years and when this comes, those YouTube videos will be watched much less, it will be really ugly. And if you look at 1982, late 1970s, nobody wanted to even talk about stocks. Nobody liked stocks, also 1930s, 1940s, 1950s, stocks were really not deemed to be concerned then when it started to go up exuberance. And then again, forget about stocks, forget about investments, no good, good, no good, good, etc, etc. This is investing, and we have to be prepared for no good period, which is what and when investors really do good.

Also longer period here 30 years of nothing. How are you going to invest with 30 years of nothing? Well, that would be a blessing for real investors What to do? Again, always same answer, just apply common sense financial, value investing, risk reward, fundamental investing. That works. Of course, it works less than buying Tesla 3 years ago, but it works forever. And that’s the message of this channel. Let’s do things that work no matter what happens in the economy, with politics, with stimulus, let’s do things that work forever. Perhaps our returns will be, no they won’t, it our returns will be good. It will lead to our financial goals. And that’s it. Tomorrow we’ll discuss one idea then over the next week I’m premiering other ideas there are cheap markets there. There are cheap stocks. For example, we have Hong Kong, Chinese market due to stimulus up 25%, Hong Kong is down 15%, there are cheap stocks not only in Hong Kong, all around the world, but you have to look elsewhere and have the right investing mindset. For that subscribe. Thank you for watching ideas on where to look for long term great value investments. always welcome in the comment section. Let’s get to a good discussion there. I’ll see you the next video.

The post Don’t FEAR A Stock Market CRASH, fear an INVESTING TRAGEDY! appeared first on ValueWalk.