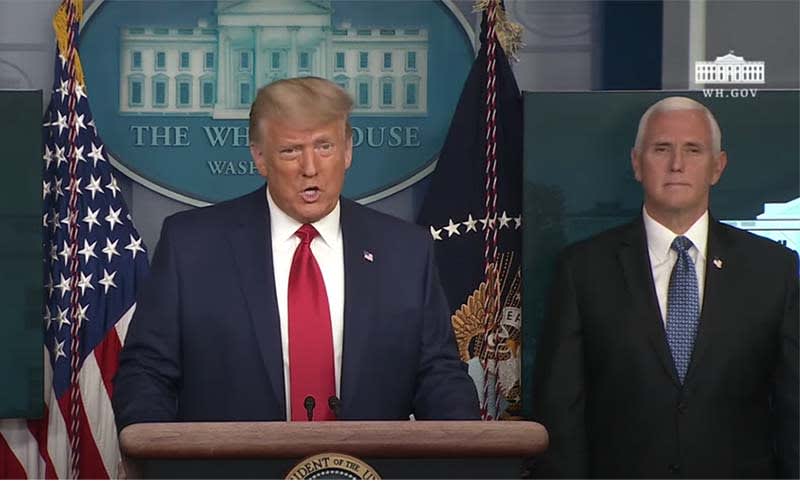

WASHINGTON – President Donald Trump held a brief, straightforward, but upbeat press conference Tuesday. The centerpiece of the occasion? A celebratory announcement that this week’s astounding stock market rally that today carried the widely followed Dow Jones Industrial Average (DJIA) up and over the 30,000 point mark. In the midst of a major, ongoing recovery, Dow 30,000 sets a new, all-time high in the market, at least for the 30 large-cap stocks making up the DJIA. (White House video clip below.)

Economic policies of President Donald Trump reverse the negative effect of Covid-19 on US stocks

While not particularly crowing about this remarkable event, the President, accompanied by VP Mike Pence, celebrated a market and investment victory for his administration. His chief appointees were largely responsible for putting a floor under stocks’ remarkable (almost) post-coronavirus disaster recovery, along with the robust economy they helped build in four short years.

An economy that, we should note, proved robust enough to withstand an unprecedented and nearly complete economic shutdown of this country for many months, and one that endures in many coastal states.

Trump, along with Pence, immediately departed from the White House press room without taking questions from a flummoxed audience of media detractors, depriving them of a sound bite they could edit into something negative prior to their networks’ evening news broadcasts.

More on Dow 30,000

A morning report from CNBC zeroed in on today’s astonishing numbers.

“The Dow Jones Industrial Average rallied on Tuesday, breaking above 30,000 for the first time amid positive vaccine news, hope for a strong economic recovery in 2021 and easing of political uncertainty as the Trump administration approved the start of the presidential transition.

“The 30-stock Dow advanced 476 points, or 1.6%. At its high of the day, it traded at 30,116.51. Chevron, JPMorgan Chase and Boeing led the way for the Dow, rising more than 3% each.

“Meanwhile, the S&P 500 climbed 1.5%, putting it on pace for a record closing high, and the Nasdaq Composite advanced 1%. The small-cap Russell 2000 also hit an all-time high.”

Also Read: V-shaped recovery continues, according to October jobs numbers

Tuesday’s markets are like the Energizer Bunny. They keep going, and going, and going…

Market averages continue to pick up steam into early Tuesday afternoon. Currently, as of nearly 2:00 p.m. ET, the Dow remains above 30,000 – 30028.07 – up 430+ points for a gain of 1.44%. The broader-based S&P 500 is doing even better. It stands at 3633.45 at the moment, up 55.89 points for a gain of 1.55%. Even the tech-heavy NASDAQ, which has suffered from profit-taking and stock rotation over the last two weeks, is enjoying the recovery. At least as long as it lasts. That average is up a whopping 152.62 points, putting the average at 12,034.47, a 1.29% gain. Quite a recovery here as well.

These numbers are likely to differ at least somewhat at 4 p.m.’s closing bell. But they’ll be fun while they last. Given this week’s upcoming Thanksgiving Day holiday, this abbreviated trading week tends to drop on the Wednesday before and the Friday after the holiday, given that a considerable number of traders and investors have other things – like family – to focus on for the rest of this week.

That means that if this rally wants to build, it may take a day or two off before re-launching itself next Monday, November 30.

Growth stocks, tech, give way to “value stocks” in major stock market rotation

As for stock rotation, the phenomenon appears to be in full bloom, as it has been for at least a week now. As strong as they remain, techs and growth stocks recently found themselves considerably ahead of fair value. That triggered traders and investors alike to bail out and take their considerable profits with them. And even today, action in most tech stocks lacks that old vim, vigor and vitality.

They’ve reluctantly passed the torch to long hated “value stocks,” it seems. Among these stocks, oil and fuel related shares consistently took this year’s nastiest beatings. Travel was way down due to coronavirus restrictions. Along with virtually nonexistent airline travel, this put a serious dent in the sales of oil and gas. Worse, America’s GOP-encouraged Fracking Party resulted in over-filled fuel storage tanks when the big buyers halted purchases. Even worse, this excess fuel sat in under-used fuel transportation vessels still floating around offshore.

Even fossil fuel stocks have “value” right now. But they may have issues after January 20, 2021

But with multiple Covid-19 vaccines on the verge of major approvals, oil and gas, travel, cruise ships, hotels and motels and all related industries enjoyed a ray of real hope this week. So all these “value stocks” – stocks priced in many cases below actual book value – began to perk up considerably. It looks like their businesses may hit the comeback trail at all.

All of which require fossil fuels in abundance, at least insofar as the (apparently) incoming Biden Administration lays off that New Green Deal nonsense for at least a quarter or three, giving the economy time to revive itself before Obama’s New Feudalism Part II hits the airwaves. President Donald Trump has been a gift to these companies. The terrain may deteriorate, however, after January 20, 2021.

Drug stocks begin recovery on the wings of imminent new coronavirus vaccines

The pounded drug stocks also rose from the grave today, by and large gaining significantly. That’s partly due to the positive coronavirus news. But these stocks are also getting juiced because it looks like President Trump won’t be able to implement his complex rules that would effectively channel massive drug price savings to US consumers, who’ve long paid some of the highest prices in the world for the drugs they require.

The pharmas hate President Trump. Any sign that he might actually be gone on January 20, 2021 has them breaking out the champagne. They know that a President Pro-Tem Biden won’t rain on their profit parade. That’s because they, like those obscenely wealthy Silicon Valley tech lords, contributed mightily to Biden’s campaign. Nonetheless, in a remarkable bit of irony, the President’s “Operation Warp Speed” gift to this industry — and to the world — was his well-funded “Operation Warp Speed.” That financial incentive program proved the chief driver to a new vaccine. It encouraged drug companies to go full speed ahead on discovering that new vaccine. Which they did with record breaking speed. And with some considerable incentives from the administration of President Donald Trump.

In any event, traders and investors remain happy today as the markets either hit or continue to pursue new records. Who knows how long this will last?

But current market action could magically transform into an entirely unexpected Santa Claus Rally. If so, any remaining short-sellers might want to get out of Dodge.

Metaphorically speaking, of course.

*– Headline image: xxx*