Mild coronavirus vaccine data concerns and other headwinds weighed on the markets on Thursday as the indices closed mixed.

Q3 2020 hedge fund letters, conferences and more

News Recap

- The Dow Jones closed up 86 points, or .29% after rising over 200 points at the session high. After closing at record highs for two straight sessions and hitting another intraday high, the S&P 500 pulled back .06%. The Nasdaq rose 0.23%, and small-caps once again led the way with the Russell 2000 gaining .60%.

- Reports that Pfizer was scaling back its vaccine rollout plan for 2020 due to supply chain issues weighed on markets . After finding raw materials in early production that did not meet its standards, Pfizer now expects to ship out only half the vaccines it planned to ship in 2020. However, Pfizer and BioNtech are still on track to roll out 1.3 billion vaccines in 2021. Pfizer’s stock fell 2% on the news.

- Jobless claims from last week came in at 712,000 and beat estimates of 780,000 . This is the first time in 3 weeks that jobless claims fell, and was the lowest figure since the pandemic started.

- US job cuts also slowed in November. 64,797 job cuts were reported in November, a drop from the 80,666 cuts in October , and the second-lowest monthly total for 2020. However, it is 45.4% higher than the 44,569 cuts in the same month last year.

- The ISM Non-Manufacturing PMI, or indicator for the U.S. services industry, fell to 55.9 in November from 56.6 in the previous month , and was largely in line with estimates. However, this reading is the slowest increase in the services sector in six months.

- House Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell spoke for the first time since the election and discussed the stimulus package . McConnell on Wednesday rejected a $908 billion bipartisan proposal but said that he sees “hopeful signs” toward reaching an agreement by the end of the year.

- Further stroking the flames of tensions with China, the House of Representatives unanimously passed a bill that will mandate Chinese companies to adhere to U.S. auditing standards if they want to be listed on American exchanges. President Trump is expected to sign the bill into law.

- COVID-19 continues to rage at alarming numbers. Over 100,000 patients are currently hospitalized. The initial wave in the spring never came close to this. 2,800 COVID-19 deaths were also reported \- the highest single-day death toll on record.

Markets Traded Sideways Due To Mild Vaccine Concerns

In the short-term, there will be optimistic days where investors rotate into cyclicals and value stocks, and pessimistic days where there will be a broad sell-off or rotation into “stay-at-home” names. However, in the last two sessions, markets largely traded sideways.

In the mid-term and long-term, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would feel like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening such as small-caps should thrive.

Markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While more positive vaccine news continues to trickle in day by day, there is still discouraging COVID-19 news, economic news, and geopolitical news to consider. Amidst the current fears of a double dip recession with further COVID-19-related shutdowns and no stimulus, it is very possible that short-term downside persists. However, it’s encouraging that Pelosi and McConnell are talking again. If a stimulus passes before the end of the year, it will certainly boost sentiment.

Due to this tug of war between good news and bad, any subsequent move downwards will likely be modest in comparison to the gains since the bottom in March and since the start of November. It is truly hard to say with conviction that another crash or bear market will come. If anything, the constant wrestling match between sentiments will keep markets relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

S&P 500 Pulls Back

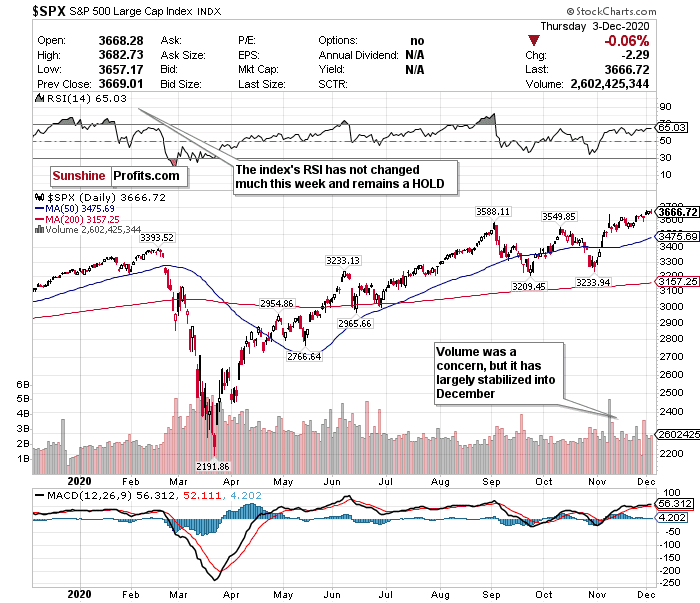

After two straight record closes, the S&P 500 somewhat pulled back on Thursday. There are a few indicators that show that the S&P could face some near-term volatility, however, these indicators have largely stabilized this week. The S&P’s stabilization in volume for one is a big deal. After volume sharply declined from November 9th, there were doubts on the sustainability of the rally, but it has largely been stable over the last few weeks.

Low volume, especially a sharp drop in volume, means that there are fewer shares trading. Lower volume also means less liquidity across the index, and an increase in stock price volatility. Therefore, a stable volume trend means that volatility may decrease. Again though, this is a market that trades largely on news and sentiment, so anything could change.

The RSI of 65.03 also keeps the S&P in a HOLD category. Although the RSI has not moved much this week, be very wary if it exceeds the overbought level of 70 - because it’s approaching – however, sideways trading should mute this.

With this data, further pullback from these levels would not be a shock… but another surge based on good news would not be a shock either. Because of all of the uncertainty, a HOLD for the S&P is an appropriate call. For an ETF that attempts to directly correlate with the performance of the S&P, the SPDR S&P ETF (SPY) is a good option.

The premium analysis this morning will showcase a “Drivers and Divers” section that will break down some sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! Always happy to hear from you.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Matthew Levy, CFA

Stock Trading Strategist

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Matthew Levy, CFA, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Levy is not a Registered Securities Advisor. By reading Matthew Levy, CFA’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading, and speculation in any financial markets may involve high risk of loss. Matthew Levy, CFA, Sunshine Profits' employees, and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

The post Markets Close Mixed Due to Mild Vaccine Concerns appeared first on ValueWalk.