WASHINGTON – “‘Twas the Monday after Christmas, and at the exchange, just a few stocks were stirring. It all seemed so strange.” Actually, all the major US stock averages are up as of 1:45 p.m. ET, ranging from +0.62% for the Dow to +0.91 for the tech-heavy NASDAQ. The small-cap Russell 2000, which we don’t always reference, is up as well, +0.17% in the green zone. In other words, we see US stocks up Monday. But the low volume, post-Christmas trading action is not convincing.

CNBC’s website currently trumpets the following headline:

Dow jumps 200 points to record high as Wall Street kicks off last week of the year

But, once again, volume is low today, making Monday’s gains suspect. ‘Tis still the season. And most people have other things on their mind during 2020’s year end, mostly virtual holiday festivities. Of course, the family dinner table can still come to life each evening, as family members try to solve the world’s problems, hopefully without killing one another. Everyone continues to seek answers to questions like “When the hell to America’s (mostly) Blue State governators release their subjects from WuFlu House Arrest?”

Also Read: 2020 year-end trading schedule; Plus, boring Wednesday markets

Fake news, real news and unexpected news can distort market averages

Anyway, so much for clickbait headlines like CNBC’s. And, let’s all remember, 2020 itself started out wildly bullish with a post-impeachment President Trump a sure bet for a landslide win in Election 2020.

Unfortunately, we all know what happened next: The Covid-19 hyper-panic, resulting huge (but probably seriously over-estimated) coronavirus death counts, mass small business (but not big business) lockdowns, the wreckage of America’s middle class and a likely hijacked national election. (Calling Dr. Fauci…)

In the meantime, market averages crashed in March, were proclaimed dead forever. And then re-launched their massive, ongoing, post-Election 2016 Great Trump Rally. That Rally is back today, at least for now. But if America’s political tragedy plays out into a ruinous final act, a potential Great Biden Crash may not be far behind.

So, what are home-gamers supposed to do to end the trading year?

All of which gets us wondering: What’s the best strategy for at-home traders and investors to pursue in the likely unfathomable year 2021? With US stocks up Monday, should we keep buying? Should we take our profits and run?

My initial answer: Damned if I know. But as an active investor, I’d better figure out something fast. So should you. We now face less than 3 active trading days before we enter the New Year. 2021 trading action will formally commence on Monday, January 4, 2021. What to do, what to do? So little time. So much confusion.

Post-Christmas trading: Time to dump fossil fuel issues?

Well, the first thing to do is snug up those portfolios. We’ll need to consider whether or not to dump all oil- and gas-related stocks. If the comedy plays out and a Biden Administration moves into the White House on Inauguration Day, mass quantities of eco-freaks will take back the currently fossil-fuel and fracking friendly EPA and proceed to confiscate all internal combustion automobiles, because global warming climate change.

Post-Christmas trading thought #2: Time to buy into electric cars and the end of the fossil-fuel combustion engine era?

So we’ll next all have to go into hock to buy incredibly expensive, underpowered electric cars and spend much of each day hunting for electric fueling stations that don’t exist. We’ll all be saving a huge amount of energy, of course. Except for the fact that every house will need to get retrofitted with commercial grade windmills and the Grand Canyon will have to be covered over with an ocean of solar arrays. None of which will be enough to replace the fossil fuel-based electricity that’s met the cancel culture headlong. And lost.

It’s always a wonder to me how the eco-freaks proclaim that electric cars will free us from fossil fuels without explaining where the electricity for running those “clean cars” will come from after fossil fuels are gone. Minor matter, I guess. Maybe we can start building nukes again.

Nahh. We don’t need no more stinkin’ Chernobyls. When it comes to life in the 21st century, we truly live in a Bizarro World. Anything that makes sense is no longer part of The Narrative.

All of which is to say that investing in fossil fuels could be super dangerous if Biden’s Legion of Leftists take over control of those parts of The Swamp they don’t already control. I’m still in some fossil fuels stocks. And, surprisingly, I’ve done quite well in them this year. The big question now is, do I stay or do I go?

Looking at current, potentially vulnerable investments in our portfolios

Current investments: EOG Resources (NYSE: EOG), currently a big winner; Exxon-Mobil (NYSE: XOM), a recent spec buy that’s smelling up the portfolio house; and Valero (NYSE: VLO), a major refiner I gradually bought when it crashed a few months ago for no other reason than terrified investors who guessed wrong. For this trio, watchful waiting is in order. I haven’t decided what to unload during my own post-Christmas trading moves, although we have some nice profits in both EOG and VLO. For now at least.

Other winners I might be looking to unload? Maybe a small position in mega-online-retailer Amazon.com (NASDAQ: AMZN). I’ve been down for quite some time in the small position of shares I own. I purchased them mid-autumn after unloading a somewhat larger small position in late summer for a handsome profit. The new position mostly remained in the red, alas. Except that today, these costly shares blasted off for the next solar system.

At the current, astonishing price of $3,289.41 per share, AMZN is up a whopping $350.00 per share on the day. Or thereabouts. (This one isn’t for the faint-hearted.) No apparent news behind this huge jump in share price. But there must be something hiding in there somewhere.

Post-Christmas trading #3: Looking for Dogs of the Dow and Year-end Bounceback Candidates

Right now, I’m looking around to see if I can suss out my usual suspects for our 2021 Dogs of the Dow candidates and our 2021 year-end bounceback candidates.

The former are the highest-yielding Dow stocks as of COB on the last trading day of the current year. Many years, these beaten down but high yielding shares will make a nice comeback in the next trading year, making them potentially good initial investments, at least for awhile. But, like all strategies, this one doesn’t always work.

Likewise, behind Door #2 will be “year-end bounceback candidates.” These are stocks of various sizes, shapes and specialties that, rightly or wrongly, became the victims of tax-loss selling late in the current year. If you find the right ones, they can “bounce back” upwards of 10-20% within the first 6 weeks of the new calendar year. Problem with this category is that with market averages currently sitting at spectacular record highs, maybe these stocks are still overpriced. And so they may not bounce at all.

The wrap…

Anyhow, enough of today’s core dump. Between presidential politics and likely overpriced US stocks, not to mention the increasingly fake coronavirus scare that’s destroying small America businesses everywhere, 2021 is one of the biggest years for potential unknowns we’ve seen since at least 2008-2009.

I’ll be back tomorrow if I can find anything new or useful. In the meantime, let’s all resolve not to make any impulse buys. At least until January 4, 2021.

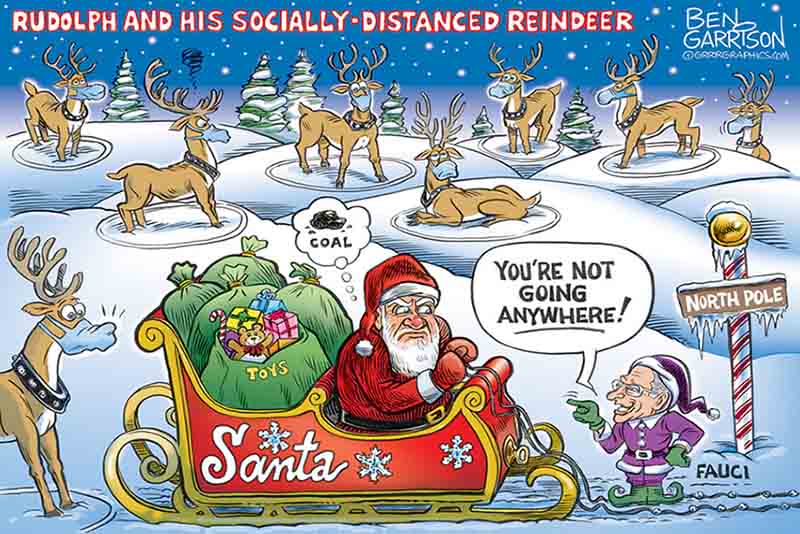

*— Headline image: Year-end market terrors. Cartoon by Garrison.

Reproduced with permission and by arrangement with Grrrgraphics.com. See link in article.*