Black Bear Value Partners LP annual letter to investors for the year ended December 31, 2020.

Q4 2020 hedge fund letters, conferences and more

“Nothing valuable can be lost by taking time.” – Abraham Lincoln

To My Partners and Friends:

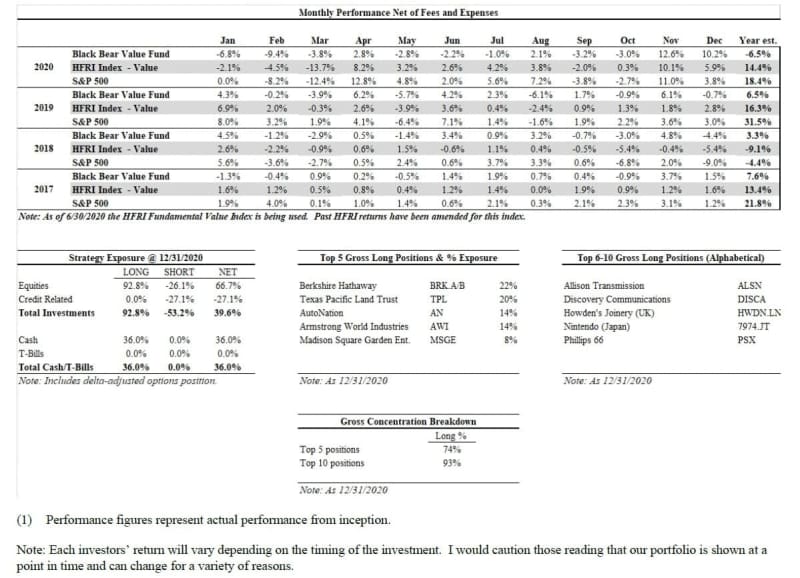

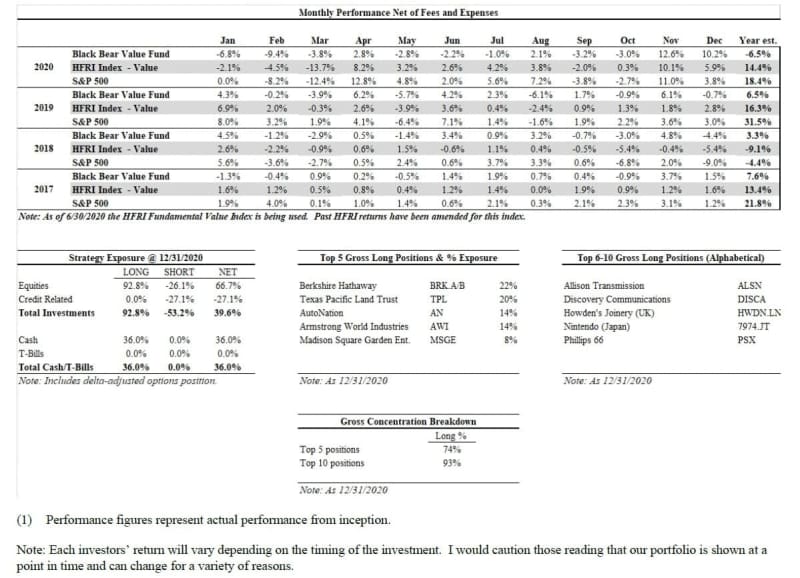

- Black Bear Value Fund, LP (the “Fund”) returned -6.5%, net, in 2020.

- The S&P 500 returned +18.4% in 2020 while the HFRI index returned +14.4%

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

Thank you to all who have continued to put themselves in harm’s way to assist humankind. I also extend sympathies to anyone who has felt the loss of COVID in their lives. Black Bear Value Fund has tried to help in our own way by contributing 100% of 1H 2020 management fees to various hospitals and relief efforts in Florida. Let us all hope 2021 is a year that includes good health and peace.

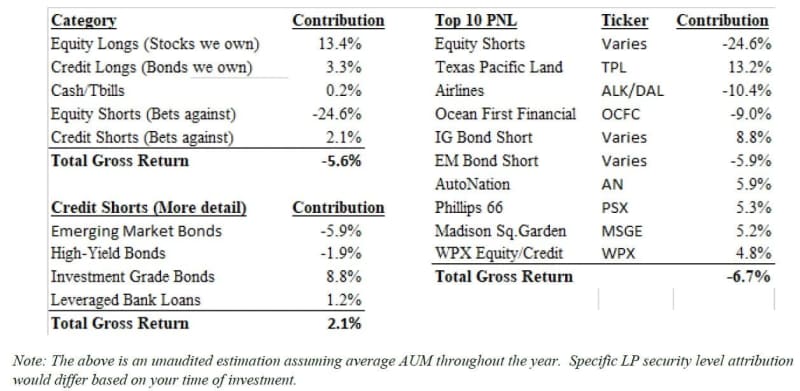

In 2020 we made money in the businesses we own, the bonds we owned and the bonds we are short. Unfortunately, the businesses we shorted (bet against) went up in price and overwhelmed our profits. We will discuss the shorts later in the letter.

Looking forward our prospects look promising. We own high quality businesses at cheap prices and have very asymmetric shorts. What will the catalyst be to get us to fair value? It’s hard to say. Nobody would have predicted a pandemic as the singular event of 2020, yet many waste time trying to predict what will move markets in 2021. If we are right on the quality of our businesses the semi-random ups and downs will matter less and less and our partnership will profit.

We experienced a strong rally in Q4 with our partnership up ~20%. There is a long way to go for our portfolio to approach fair value.

Please see the attribution below for more details on our performance in 2020.

Black Bear Value Fund Performance Summary

Top 5 Businesses We Own

Brief descriptions of the top 5 long positions follow in order of position size as of 12/31/2020.

Berkshire Hathaway (22% of assets)

For more discussion on Berkshire I would refer you to past letters as we have discussed it at length.

In the 3rd quarter of 2020 Berkshire bought back $9.3BB of stock, which is the most ever in a single period (the 2nd quarter was the most ever at that point). Year-to-date BRK has bought back ~$15BB of stock and potentially more in the 4th quarter.

Berkshire is very cheap for owning such high-quality businesses. I estimate that we own the stock at ~1.2x book value. This is not a heroic multiple by any stretch. A rough sum of the parts includes the value of the cash + stocks + operating businesses. We have gone thru a more detailed sum of the parts in past letters and little has changed. Roughly speaking, Berkshire is somewhere between 15-40% cheap on any reasonable metric.

Texas Pacific Land Trust (20% of assets)

TPL entered our top 5 in the 3rd quarter and has continued to increase in size as the stock price has moved up. Since year end, the corporate conversion to modern corporate governance is complete. While the price has moved up dramatically, I am still attracted to the high-quality nature of the business which I describe below. TPL stands to dramatically outperform in an inflationary environment.

TPL is a publicly traded land trust that is one of the largest landowners in Texas and one of the oldest listings on the NYSE, having been formed in 1888 and listed in 1927. Most have not heard about TPL as they are not in passive indices due to their corporate structure (they are a trust with unique corporate governance – though this has changed due to the above-mentioned corporate restructuring).

TPL is a royalty company with 100% of their acreage located in the Texas Permian Basin. In a nutshell they make money when drilling activity occurs but DO NOT have the capital needs as they simply provide access to land. Think of them as a franchisor of fast-food energy and the drillers and/or midstream as the actual restaurants.

If you drill oil on their royalty-land you pay a portion to TPL. Need a road to drive to the site? You pay a fee/easement. Need water? Need a pipeline? Need electricity transmission lines? I think you get the picture. If you want access to the assets underneath the ground or to travel on top (oil/natural gas/water) you must pay TPL.

The incremental amount of work on TPL’s part is minimal as the extraction and movement of the oil/natural gas is undertaken by others. They are merely a toll collector with Returns on Capital of 80+%.

Longer term some of the cheapest to deliver hydrocarbons are in the Permian basin. Some are concerned that the long-term push towards renewable energy will harm them. I see it a bit differently. First, change takes time and while there are increasing amounts of electric vehicle (EV) or solar power discussions, it is going to take a while for it to become a large part of our everyday lives. Secondly, and probably more importantly, renewable products require commodities and/or compounds that need to be extracted and/or heated (Silicon, silver, copper, lithium etc.). Their production requires hydrocarbons. To get to a lower hydrocarbon long-term future, we will need hydrocarbons. The cheapest place to get these are in the land owned by TPL.

In an inflationary environment, businesses that have lower capital intensity both in capital assets and people stand to benefit. In other words, if oil goes up a lot, the incremental cost to TPL is close to 0 so it’s all incremental profit. This is a business that should benefit in a massive way if we have energy inflation. In the meantime, we likely own it at a 4-5% free cash flow yield with massive upside.

AutoNation (14% of assets)

Despite COVID, AutoNation and the auto dealer industry experienced a record year. While new and used car volumes are down, dealers have been able to increase profit margins due to a variable cost operating model and lower inventories.

Auto dealers have a large variable component to their expense base as they can reduce headcount, ad spending and other costs when business slows. We saw evidence of this in 2008 which repeated in 2020.

AutoNation has been testing used car supercenters called AutoNation USA over the last 2 years. Given its’ success they are investing an incremental $200MM to open another 20 over the coming 3 years. This is another potential area of growth for the company.

There is a lot of focus on online car shopping disintermediating traditional retailers like AutoNation in the used car market. Note that most traditional dealers have pivoted to online fulfillment. The legacy dealers have an inherent advantage both in terms of sourcing cheap cars from trade-in and scale/density of existing dealerships to transport cars. Additionally, the cash produced by the parts and service business allows AN to reinvest in other methods of customer fulfillment whether they be online, in person, or omnichannel.

The 1-2 lot dealers will likely be the ones to suffer as they lack scale and density. The short-term disruptions to the business from COVID will accelerate changes and benefit those who have (AN) and hurt those who do not (smaller dealers).

AutoNation can generate a range of $4.00-$7.00 in free cash flow per year. This implies a 5-8% yield to us presuming limited growth. My expectations for AutoNation’s prospects have gradually improved as I see them effectively addressing costs and reinvesting in areas of growth.

Armstrong World Industries (14% of assets)

AWI is a 129-year old designer and manufacturer of commercial and residential ceiling, wall, and suspension systems. 95% of their sales are for commercial use with the majority (70%) for repair and remodel (R&R). This translates to less sensitivity to new construction as R&R is a more stable revenue stream.

The US ceiling industry is consolidated with the top 3 companies controlling 98% of the market. AWI is the market leader with 65% market share. Because of a large previously installed base and exclusive distributor relationships, they’ve been able to increase pricing in the 5+% range annually.

AWI should be able to generate $4-$5 in annual free cash flow which implies a current yield of 5-6% that should be able to grow 5-7% per year over the long-run. This is an excellent business at a cheap price.

Madison Square Garden Entertainment (8% of assets)

MSGE is a real estate owner/operator with core properties at the epicenter of COVID (NYC and Las Vegas). Their largest assets include Madison Square Garden (the arena, associated air rights and the attached theatre), the Tao Group and the Radio City Rockettes show. In addition, they are in the process of building a large event space called The Sphere in Las Vegas that connects to the Venetian. Business is not going well now as they are effectively closed to outside customers. What protects them is an extremely healthy balance sheet with plenty of cash, limited debt, and a reduced corporate cost structure.

These assets have real value, a strong franchise and customer interest. People will attend sporting events, concerts, and shows again. Their strong financial position will allow them to get to the other side of the COVID canyon.

We purchased our shares at a price that implied a 50% discount to fair value (implying a 100% potential return). While the stock is up 30+% since then, it remains cheap. As a long-term investor I wouldn’t mind seeing it go down as I’d like to be buying more of it at a cheaper price.

Our Mission Continues

When I discuss the fund with potential LP’s I take care to not “sell” them on investing with us. Instead my goal is to communicate our mission and goals and if we mutually agree that our principles line up, we can work together. It is better to determine early on if there is a general agreement of what guides both our investment and business decision making. Our guiding principles are:

- Black Bear Value Fund has a long-term view of success rooted in patience and discipline.

- Everything we do is through the lens of creating equitable relationships with our LP’s to foster deep and long-lasting roots.

- We invest in undervalued businesses whose prices do not reflect their true intrinsic value.

- We focus on making the best 10-year business decisions, even if it comes at a short-term cost.

- Today’s news is riddled with a lack of trust. We seek to provide an antidote to this, always treating our partners with honesty and integrity.

Credit Short

Considering the Fed activity and dollars flooding the system we reduced our credit short in Q2 2020 and made a small profit for the year. We have since added back a material amount of the short given the absolute low rates of return offered by these securities. With yields in the 2-5% pre-loss range, very little in the way of defaults or inflation is being priced in. It’s possible current investors in these securities are accepting a real negative return.

If you are of the belief that the Fed will make all losses whole, our shorts will not work as well. While the Fed helped the liquidity of the ETF machines and the bond markets, I doubt they will provide explicit make-wholes for companies that default and experience loss.

As the economy returns to “normal” and companies can fail, the holders of these securities will encounter anemic returns if not losses. Additionally, if there is a modest amount of inflation (which the Fed is targeting) the long end of interest rates should increase. Given the longer duration of our Investment Grade short, we would profit substantially in that case. We are short the usual culprits: high yield corporate debt, investment grade corporate debt and emerging market debt.

This short seems extremely asymmetric and we have been adding it throughout Q4 and in Q1 2021.

Shorting Stocks - Strategery, Lockboxes, TAMs , Flywheels and a Little Yiddish

We lost a healthy amount of money shorting businesses discussed below. I could sound like sour grapes but nonetheless I believe that our LPs deserve to know what I am thinking on the subject.

In the 2000 presidential election the terms “strategery” and “lockbox” brought some humor to a tense election. For some, those words defined the candidates (at least those who are comedically inclined). When we look back years from today it feels like the terms that define today could include: “TAM” (jargon for market size) and “flywheel.” (jargon for…. reflexive velocity?) Truth be told when I hear these descriptions, I react with a nervous laugh and mild queasiness. There are certainly businesses that will both disrupt and grow. Call me old-fashioned but isn’t successful investment buying things for LESS than what’s expected?

Current pricing implies nearly every business will be successful because there are many billions of people on the planet and even a small percentage of those billions as customers will yield lots of dollars…this in turn creates the flywheel with astronomical returns. Oye.

We are short a basket of companies that are priced to or beyond perfection. I’ve heard pushback on many of them…Bulls in the space have told me that I do not understand:

- their growth potential, or

- their disruptive nature, or

- the feedback loop from their flywheel etc.

While I could be missing the mark, the odds are in our favor. Let me briefly explain why. The qualitative points above can be true …but if you’re paying a price that implies 50% growth and it turns out to be 25% growth than you have grossly overpaid for the business. Additionally, the last I checked a business needs to be profitable and is typically valued at some multiple of those profits. Many of these companies are being valued on sales or newly created industry-jargon metrics. Remember back in 2000 when companies were valued on eyeballs? Only in an auction-driven popularity contest like the stock market can something thing like this thrive for periods of time due to fear of missing out. In owning these companies at such aspirational valuations investors have suspended their own rational thinking and skepticism resulting in playing a dangerous game. In short, there is an extreme amount of optimism backed into the share prices.

The concept of a flywheel is interesting to people so long as it continues to move forward. Can’t wheels go in the opposite direction too? In the words of Mel Brooks, what happens when we exit ludicrous speed?

Giving Thanks

Thank you to our partners. We have continued to grow, and I am fortunate to have such a great group. We continue to focus on growing with the right LP base who take a longer-term and more patient view to investing. The last couple of years have been underwhelming and I appreciate your partnership and patience.

Thank you to my wife, Lauren and our girls, Sydney and Zoey. While COVID has its drawbacks, the extra family time has been special (though at times much louder).

A big thanks to our service providers who do an excellent job for us. This year resulted in many people working remotely and spread out. We experienced no interruption in the high-quality service we have grown accustomed to. Thank you to BTIG, EisnerAmper, and Kleinberg Kaplan.

General partnership business

I anticipate timely K-1’s and no need for any extensions from Black Bear.

Q4 showed what happens when there is a small return of reasonable valuation/investment decision making. The future looks bright and we will remain patient, rational, and disciplined.

Thank you for your trust and support. I wish you and your families a happy and healthy 2021.

Black Bear Value Partners, LP

Adam@BlackBearFund.Com

The post Black Bear Value Partners LP 2020 Letter: Long Texas Pacific Land Trust appeared first on ValueWalk.