WASHINGTON – In honor of the Presidents Day trading holiday (still officially the Washington’s Birthday holiday, BTW), US stock and bond markets took Monday off. However, futures trading opened Monday morning with limited hours, which offered nice outcomes for traders with long positions in commodities and futures contracts. Due to a record Polar Vortex cold snap engulfing much of the Deep South, West Texas Intermediate crude (WTI) topped $60.12 per barrel Monday morning, an astonishing near-term recovery over last year’s lows. And natural gas prices continued to soar, topping $3.00 per million BTUs on today’s frigid Presidents Day holiday.

You can certainly tell that a new anti-American worker administration now runs the Washington policy show.

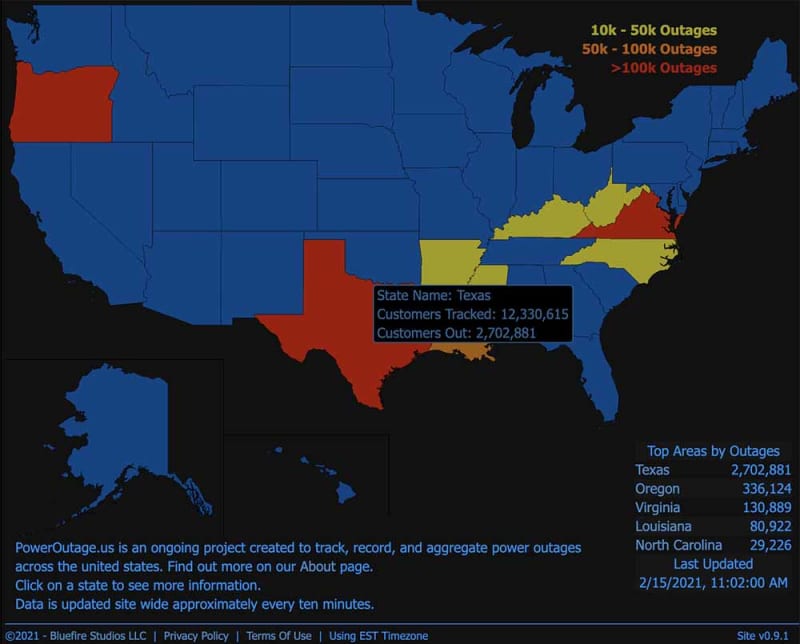

Worse, the frigid Polar Vortex cold snap actually disabled numerous natural gas transmission lines, cutting off supplies to already overloaded utilities, particularly in Texas and parts of Louisiana. As a result, the entire state of Texas and parts of Louisiana continue to endure rolling power outages at exactly the wrong time for customers trying to stay warm. It’s too bad that enviro-fanatics have largely eliminated the coal-fired plants that could have come online as emergency backup, just as they always used to do.

Polar Vortex cold snap puts Texas in an unaccustomed Deep Freeze condition

ZeroHedge offered an updated report on the Texas situation as of 11 a.m. ET, via Texas-based utility Oncor, a successor company to the bankrupt former Texas Utilities (former symbol: TXU).

“Oncor asked people to prepare for the worse as the power grid experienced a systemwide failure due to historic winter conditions across the state.

“Due to the severity of the electric generation shortfall, our expected *utage length of 15 to 45 minutes has been significantly extended. Outages due to this electric emergency could last for hours & we ask you to*be prepared.**

“In addition, we are responding to *eparate outages caused by the record-breaking winter storm that continues to impact our entire service territory. We are doing everything possible to respond to each of these power emergency events.*

“We remain in close coordination with ERCOT & we appreciate everyone’s patience as we do all we can to protect the integrity of the Texas grid.

“Grid managers declared an emergency after unprecedented demand spiked strained utilities beyond capacity. Blackouts could last until Tuesday.”

Further details on the Polar Vortex cold snap fuel price impact here.

Power outage map via Zero Hedge

A spreading Polar Vortex power crisis kicks up fuel prices and clobbers natural gas pipelines

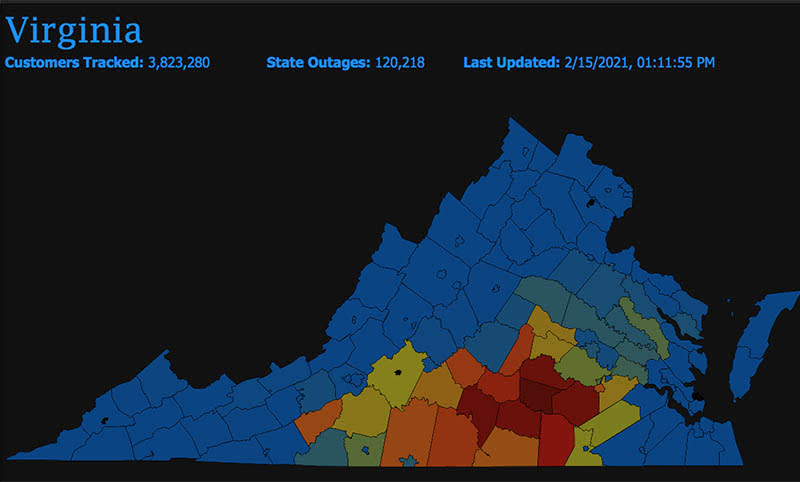

Although Texas is currently the hardest-hit state, power outages extended throughout much of the South. Closer to our own locale, Virginia endured considerable outages as well. Fortunately, for those of us living in the environs of The Swamp, these outages currently appear confined to the south-central portion of the state.

Snow and ice have bedeviled the region and much of the Atlantic seaboard as well for the past few days. After a brief pause, Mom Nature threatens more of the same here later in the week.

Arctic weather often proves hard to endure here in the Occupied South. But the resulting pressure on energy prices could hit consumer pocketbooks hard, at least over the next few weeks. That won’t bother the current Administration, of course.

Virginia Power Outages, via ZeroHedge.

Key Presidents Day crisis points

CNBC bulletized the key points and problem areas of this fast-breaking story, emphasizing both market and consumer issues.

“Freezing weather racked portions of the U.S. and fostered demand for fuel while simultaneously threatening to hamstring oil production in Texas.

“The jump in oil prices WTI crude futures up 24% so far in 2021. It touched $60.77 a barrel earlier in the session, its highest level since January 2020.

‘”Frigid weather means that many oil wells may be shut in. Water is produced along with oil, that water can freeze up equipment,’ oil analyst Andy Lipow wrote over the weekend.”

How about that legendary silver short squeeze that has yet to happen?

Elsewhere in non-stock markets and foreign exchanges (most of which, save for Canada’s markets [Family Day national holiday] are open today, traders and investors remain nervous about the silver short-squeeze that never happened.

At least it seems like it never happened as predicted by those intrepid Redditors. True, they transformed the nearly-dead shares of GameStop (NYSE: GME) and movie theater chain AMC (NYSE: AMC) into moon shots last month. But perhaps they just enjoyed beginner’s luck.

Yet something’s going on, just beneath the surface. Some of you might have noticed this if you’ve tried to buy silver coins or bullion recently. Result: For the most part, no silver inventory remains available to own or trade. That situation could last for months. It could negatively influence the liquidity of silver ETFs, notably SLV. Oh, wait… As a UK-based BullionStar report notes, the shortage of physical silver has indeed begun to affect silver ETFs like the widely traded iShares Silver Trust ETF, SLV (NYSE: SLV).

The shortage of silver bullion may affect ETFs like SLV — the Wrong Way

“…it’s particularly interesting that on Wednesday 3 February, right after claiming to add 3416 tonnes of silver to SLV by frantically tapping the LBMA vaults in London, the iShares Silver Trust prospectus was changed, and the following wording added:

“‘*he demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.*

‘To the extent that demand for silver exceeds the available supply at that time, Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket.

‘Baskets may be created only by Authorized Participants, and are only issued in exchange for an amount of silver determined by the Trustee that meets the specifications described below under “Description of the Shares and the Trust Agreement— Deposit of Silver; Issuance of Baskets” on each day that NYSE Arca is open for regular trading. Market speculation in silver could result in increased requests for the issuance of Baskets.'”

A Presidents Day warning for silver ETF holders

*“‘It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares.*

‘In such circumstances, the Trust may suspend or restrict the issuance of Baskets. Such occurrence may lead to further volatility in Share price and deviations, which may be significant, in the market price of the Shares relative to the NAV.’”

Oops. Like this writer, you, too, may hold some SLV shares in your portfolio. Perhaps we still await the Great Silver Squeeze that has yet to materialize. Save, of course, for serious shortages in the actual metal. Maybe this whole game won’t work out as well as planned, so we’d all best stay alert. You never know when or how the silver game may surface next.

The Presidents Day trading wrap

2020-2021 may mark the beginning of a long, unpleasant era of thuggish, globalist-controlled politics and monetary uncertainty. American investors can’t do much about this today. But we’d best remain on alert when US stock and bond markets open again for business Tuesday. It’s tough to predict what insanity will hit the Wonderful World of Investing next.

Stay tuned, and enjoy the rest of your holiday.

*– Headline image: Icy temperatures in Texas due to the ongoing Polar Vortex cold snap. Screen grab of YouTube video still via Austin TV Channel KXAN.*