WASHINGTON – Given that a junta of radical socialistas are already in charge of the world’s newest and biggest banana republic government in Washington, are similar feeble-minded individuals posing as financial geniuses now running the Wall Street’s never ending Wheel of Fortune as well? That scenario certainly looks plausible. Apparently, 2021, already notable as the year America’s first dementia-addled non-president was inaugurated, also threatens to become Wall Street’s Year of the Swashbuckling Jackasses. Coincidence?

This year’s constantly bungee-jumping market averages continued to back and fill Tuesday, following Monday’s Red Ink Festival. It seems a fitting, fizzling conclusion to last Friday’s pre-Easter holiday week rally. But this week’s end-of-quarter action makes me wonder about the sanity of it all. And worry more than a bit about the jackasses that are wrecking the country.

A fake 2021 history lesson staged by the Swashbuckling Jackasses in Washington

We began January 2021 with the Capitol Hill “riot” that wasn’t. Aside from the senseless murder of a single Donald Trump supporter by an alleged Capitol cop, that “seditious insurrection” hadn’t the critical mass to overthrow the Capitol building’s janitorial crew, let alone the US government. The hype, plus the FBI dishonesty directly following this sad but not very notable “uprising,” continues to this day.

The Pelosi-crats transformed the incident – which I suspect they were in on – to cage in Capitol hill with high fences and barbed wire, making the “people’s house” look more like a high-security Federal prison than the place where America’s political representatives are supposed to undertake more serious matters of good government.

It’s all been a show, of course, meant to demonize and cancel President Trump’s likely majority of support in America and indict a whole bunch of innocent people and put them in jail.

When is a “riot” actually a riot?

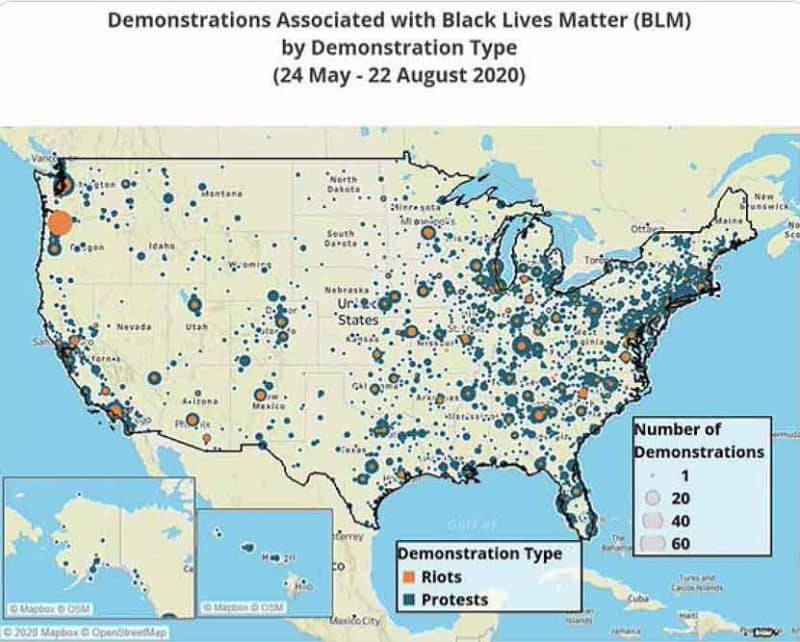

Elsewhere, beginning in 2020, the real Antifa / BLM riots and sedition continue to unfold in Portland, Seattle, Minneapolis and other cities across the US. Check out the following 2020 graphic, and you’ll see what I mean.

A riotous 2020 as charted by x. Funny, we never heard about most of these actual riots from CNN. Courtesy ZeroHedge, Mapbox, OpenStreetMap.

BTW, how much of this massive rioting and destruction was actually covered by the MSM, hmm? How many of the rioters are in jail? How many has the FBI seized in showy raids? By golly, there’s a difference, when you compare the “MAGA riot” with all the others.

We have a parallel flavor of chaos on Wall Street. Except that these Swashbuckling Jackasses are real

But back to Mr Market, who also supports jackasses galore. In a parallel but unrelated (and still ongoing) event, a short-squeeze “riot” unfolded on Wall Street, beginning around the turn of 2021. A bunch of crazy Reddit gamblers colluded en masse as “WallStreetBets” checked out available lists of big Wall Street short positions. With Alinskyite precision, the picked their targets and froze them. Next, they ganged up to nuke a once-storied Wall Street hedge fund that was way short shares of corporate disasters GameStop (NYSE:GME) and theater chain AMC (NYSE:AMC).

How?

By creating an enormous short-squeeze in shares of GME and AMC. Fierce and relentless buying in these shares routed the big short position of that unfortunate hedge fund. And, we suspect, others as well. It was the stock market version of a “riot.” And it worked. Chaos reigned. It was all actually sort of fun seeing a bunch of swashbuckling smart-ass shorts get their derrières handed back to them on a platter for a change.

The silver gambit fades and the Reddit Riot fizzles

But the swashbuckling Redditors’ next 2021 gamble fizzled, for whatever reason. After about a 15-minute buying panic in their next gambit – silver and its equivalents – both the metal and silver’s popular ETF – SLV (NYSE:SLV) began a long, slow decline that continues today. Looks like the shorts wised up and got their revenge. More or less. It’s hard to tell.

On the other hand, we learned this weekend that things continue to deteriorate for the swashbuckling, margin-addicted hedge funds and other investor classes hooked on Fast and Furious market action that continues to dominate 2021 thus far.

It seems that at least some of the intense selling pressure on last week’s markets and the underlying averages was due to yet another big, leveraged mistake made by an entity known as Archegos. That outfit is characterized in the financial media as a large, primarily family investment firm.

But there might not be much of Archegos left today.

More on the big Archegos margin call

A few bullet points via CNBC give us the executive summary version of this story:

- U.S. media stocks ViacomCBS and Discovery, plus a few Chinese internet ADRs experienced severe selling pressure on Friday.

- The culprit for the massive selling was a forced liquidation of positions held by the multibillion-dollar family office Archegos Capital Management.

- Archegos had built massive positions in these stocks through swaps, a type of derivative that investors trade over the counter or among themselves without having to disclose the holdings publicly.

- A slew of big banks involved are warning of “significant losses” from the unwind of Archegos’ trades.

The Twin Tylers tell it all to you

The Tylers of ZeroHedge weighed in with more fun facts in a Monday article. Picking up the Archegos margin call catastrophe, they tell us the rest of the story. At least as it continues to unfold.

*“Update (845am)*: well that didn’t take long to reverse: after ramping to session highs around the time the first US traders walked into their desks, the margin call stocks have since reversed and we trading near session lows as the US open nears and perhaps on expectations of a new round of BWICs \[Bids Wanted in Competition\] from Goldman

“One day after a historic plunge in several media and Chinese tech stocks which was started by the following BWIC from Goldman[,] which we now know was the result of Archegos capital’s terminal margin call, which may or may not be continuing today.

“So while we wait to see if we get any new BWICs from Goldman, Morgan Stanley or other Prime Brokers hit, there has been a reversal in the impacted stocks, with ViacomCBS, [NASDAQ:VIAC], Discovery [NASDAQ:DISCA or DISCK] and a group of Chinese ADRs [American Depository Receipts, often the way foreign stocks are traded on US exchanges] now trading mostly higher premarket, reversing earlier declines.”

In other words, we finally got an uptick in these slaughtered shares. So impressive was this downdraft that I picked up a few shares of DISCK during today’s limp recovery attempt just for fun. Looks like the Swashbuckling Jackasses of Archegos have gone down with the ship. Arrrgh!

Charts…

The wrap: Tuesday’s closing bell…

Fresh from CNBC, after some optimism earlier in the day, Mr Market decided to tank as the 4 p.m. closing bell clanged away.

“U.S. stocks fell on Tuesday as major technology shares came under pressure again after the 10-year Treasury yield touched its highest level since January 2020.

“The Dow Jones Industrial Average dipped 90 points, slipping from a record closing high. Apple and Microsoft were biggest losers in the 30-stock Dow, falling more than 1% each. The S&P 500 traded 0.2% lower, led by losses in utilities and technology. The Nasdaq Composite slipped 0.4%. The tech-heavy benchmark was down more than 1% at one point.”

That’s it for jackasses and games today, sports fans. We’ve noted this would be a weird week, and so far that call looks about right. Next exciting adventure starts Wednesday morning. Advice: Don’t place any foolish bets on how this market will close in December 2021.

Wednesday’s another day. We’ll see you then.