What’s New In Activism

The California Public Employees’ Retirement System (CalPERS) said it will vote in favor of Engine No.1’s four director candidates at Exxon Mobil Corporation (NYSE:XOM)’s annual meeting next month.

The pension fund will vote for dissident nominees Gregory Goff, Anders Runevad, Kaisa Hietala, and Alexander Karsner, as well as eight incumbents, including Jeff Ubben, according to public voting records.

Ubben, a renowned activist investor, joined Exxon’s board last month in a move widely seen as an effort by the oil giant to fend off Engine No. 1’s board bid and mollify other shareholders concerned about the company’s investment strategy, particularly its focus on oil projects.

Engine No. 1 has argued Exxon faces an “existential business risk” because it “has no credible plan to protect value in an energy transition.” The oil giant countered by saying its strategy balances green ventures with cash flow generating projects that ensure stability and its $15 billion per year dividend.

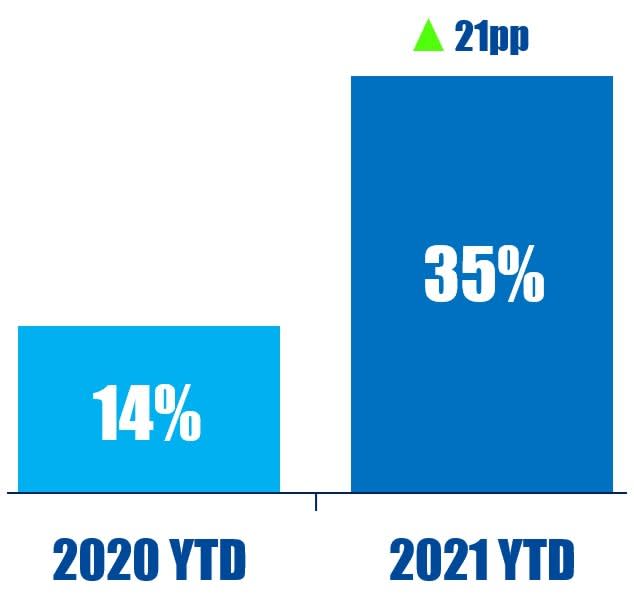

Activism chart of the week

So far this year (as of April 28, 2021), 35% of Europe-based companies publicly subjected to activist demands were Germany-based. That is compared to 14% in the same period last year.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting

President Biden announced the U.S. aims to cut its greenhouse gas (GHG) emissions by 50% below 2005 levels by 2030, in a statement made during the U.S. Leaders Summit on Climate.

This new target essentially doubles the U.S.’ previous emissions reductions goal. Biden did not disclose how the U.S. plans to meet this ambitious target but the president is embarking on a major legislative push in coming weeks to pass stimulus and infrastructure bills that are expected to boost green industries.

“My administration is advancing the most ambitious climate agenda in our Nation’s history,” said Biden.

Japanese Prime Minister Yoshihide Suga also pledged that Japan will aim to reduce GHG emissions by 46% by 2030, based on 2013 levels, while the president of the Republic of Korea, Moon Jae-In, announced that his country will end all public financing of coal-fired power plants. Two days earlier, U.K. Prime Minister Boris Johnson said the U.K.’s goal is to cut emissions by 78% by 2035, compared to 1990 levels.

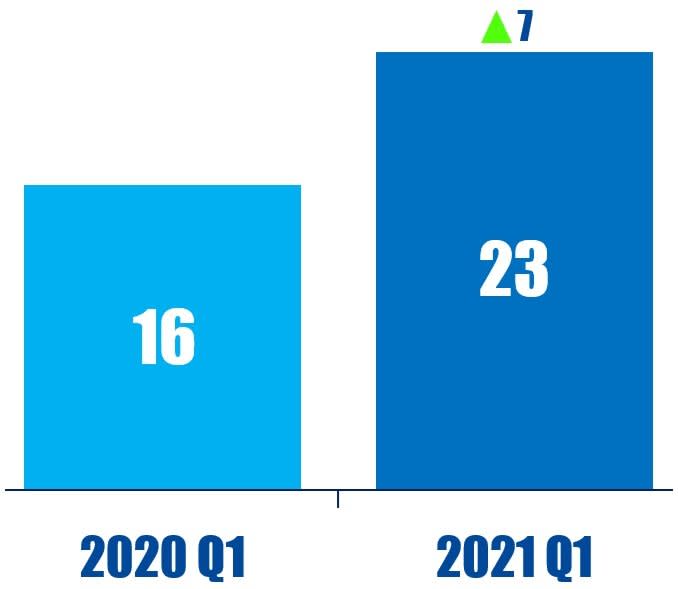

Proxy chart of the week

The number of “say on pay” proposals at U.S.-based companies receiving more than 20% opposition increased from 16 in 2020 Q1 to 23 in 2021 Q1.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts

Mariner Research placed an 88% downside target on PyroGenesis Canada Inc (NASDAQ:PYR) (TSE:PYR), claiming the environmental solutions company inflated revenues via related-party deals and that it failed to scale any of its operations despite promising to do so over the years.

In its report, Mariner said that as much as 80% of PyroGenesis’ 2020 revenues are “suspect,” potentially tied to companies controlled by management. The short seller argued the recent hype around PyroGenesis’ stock is tied to a series of overconfident press releases regarding future revenue streams. The company’s shares traded below CA$0.50 at the beginning of 2020, a far cry from the CA$12.12 touched two months ago.

Since 2014, PyroGenesis has promised to deliver hundreds of millions of dollars in revenues from various businesses like 3D printing and waste to energy systems, Mariner said. Despite this, the company has only generated CA$7 million in average annual revenue while burning a cumulative CA$23 million in free cash flow, the short seller added.

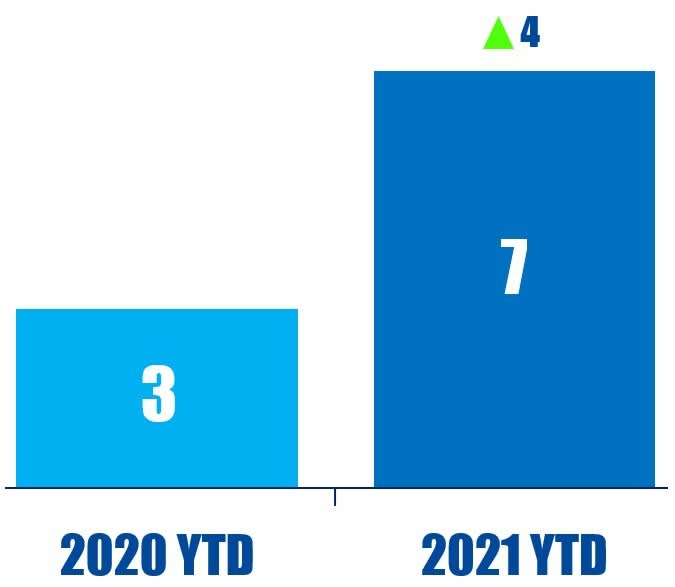

Shorts chart of the week

So far this year (as of April 29, 2021), seven activist short campaigns have alleged competitive pressures against the company. That is up from three in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote of the Week

This week’s quote comes from Bluebell’s Marco Taricco in an interview for Shareholder Activism in Europe 2021.

“Danone proves that France can be a very friendly market. The board listened to our requests and acted promptly, the government with which we had a constant dialogue, never interfered, and support by fellow shareholders – also the French ones – was overwhelming.” – Marco Taricco

The post Mariner Research’s 88% Downside Target On PyroGenesis Canada appeared first on ValueWalk.