Since tech acquirers discovered last summer that they could still do deals during a pandemic, they have spent at a historic rate – ever-larger acquisitions at ever-higher valuations by pretty much every type of buyer. The trillion-dollar shopping spree over the past 12 months has been a run for the ages, and shows no sign of slowing. A little bit of historical data indicates the unprecedented heights of the recent rebound.

Q2 2021 hedge fund letters, conferences and more

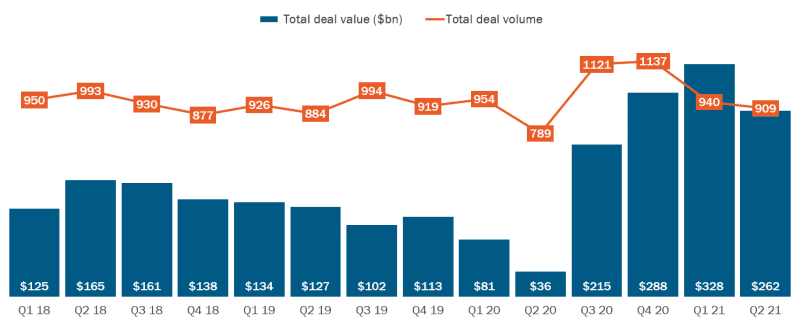

According to 451 Research's latest quarterly tech M&A report, of the roughly $6.8 trillion dollars' worth of tech deal flow chronicled over the past two decades in 451 Research's M&A KnowledgeBase, a massively outsized $1.1 trillion of that has come in just the past year. This means that although the past 12 months only account for about 5% of the total time covered in our data, a whopping 16% of overall tech M&A spending has come just since last summer.

Tech M&A Market Shows Record Activity

Key highlights from the report include:

As we noted in our just-published report on Q2 – which, once again, saw spending soar to about twice the level of a typical quarter – the record activity is showing up in virtually all aspects of the tech M&A market.

- SPACs: Throughout the previous decade, blank-check companies acquired an average of a dozen (mostly unknown) tech vendors each year. Already in 2021, the M&A KnowledgeBase has recorded 97 acquisitions. Even more stunning: the combined enterprise value of this year's 'de-SPAC' deals totals $272bn.

- Private equity: Although PE firms took a little longer to get going after the COVID-19 outbreak because of the residual damage in the credit market, they have made up for lost time. Two of the four highest-spending quarters by buyout shops in our database have come in Q4 2020 and the just-completed Q2 2021.

- VC exits: The once-rare 'unicorn' transaction has become commonplace. Over the first decade of our data, the average year saw just a single sale of a venture-backed startup for more than $1bn. So far this year, thanks largely to wild SPAC activity, some 74 startups have booked billion-dollar exits.

**

**

About 451 Research

451 Research is the enterprise technology research unit of S&P Global Market Intelligence and was acquired by the division in December 2019.

The post A Trillion-Dollar Year For The Tech M&A Market appeared first on ValueWalk.