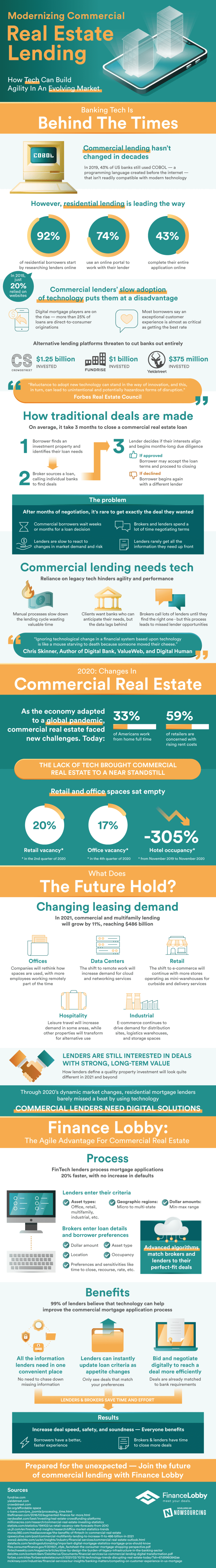

Tech’s ability to build agility in an evolving market is well known, but not universally applied. In commercial real estate lending, for example, the current process reflects a bygone era of finding and closing financial deals. It takes, on average, 3 months to close a commercial real estate loan. Brokers are still expected to call individual banks in pursuit of deals. As late as 2019, 43% of US banks still used COBOL, a programming language older than the internet.

Q2 2021 hedge fund letters, conferences and more

Extended timetables for dealmaking aren’t merely annoying. When deals take months to form, it’s rare for either side to get exactly the deal they wanted. Furthermore, the creeping pace means lenders are also slow to react to changes in market demand or risk. As shown by last year’s pandemic and resulting recession, conditions on the market can change rapidly. Reliance on legacy technology hinders commercial lending’s agility and performance.

Commercial And Multifamily Real Estate Lending Expected To Grow

Now in 2021, commercial and multifamily lending is expected to grow by 11% to $486 billion. As the industry grows, it will also change to suit a new era of expectations. In offices, companies will rethink how spaces are used now that more employees work at least partially remote. Data centers will proliferate as demand for cloud and networking services increases. The revival of leisure travel will increase demand in some areas even as other properties transform for alternative use. As the usage of commercial real estate transforms, why should the lending process remain stagnant?

The stakes are real; if banks don’t adapt to the times, they could become iced out of commercial lending entirely. Already, alternative platforms like Crowdstreet and Fundrise have over $1 billion invested. According to the Forbes Real Estate Council, “reluctance to adopt new technology can stand in the way of innovation, and this, in turn, can lead to unintentional and potentially hazardous forms of disruption.”

Finance Lobby offers an agile advantage for commercial real estate. Their process is simple: lenders and brokers enter their criteria for loans simultaneously. Once numerous entries for both are in the system, an advanced algorithm can match brokers and lenders to deals of best fit. All information lenders need rests in one convenient place, lenders can update loan criteria instantly as appetite changes, and bidding and negotiating are streamlines as a result of pre-clearance. Both lenders and brokers are spared precious time and effort. Everyone benefits from increased deal speed and safety.

Infographic source: Finance Lobby

The post Modernizing Commercial Real Estate Lending appeared first on ValueWalk.