McIntyre Partnerships commentary for the second quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Partners,

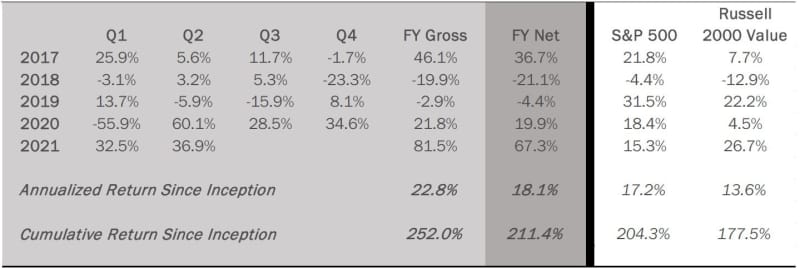

McIntyre Partnerships Quarterly Returns

Performance and Positioning Review - Q2 2021

Through Q2 2021, McIntyre Partnerships returned approx. 82% gross and 67% net. This compares to S&P 500 and Russell 2000 Value returns including dividends of 15% and 27%, respectively. Our investment in GTX/GTXAP is a “big bet” investment, which, given our concentration, makes market comparisons less useful at present.

The largest event in the quarter was the catalyst the fund has been waiting for since September 2020: GTX’s recapitalization and emergence from bankruptcy. Since the filing, GTX’s underlying business has improved substantially, and the terms of the recapitalization were finalized in a favorable manner. However, the stock had been tethered to the $5.25 price at which GTX was being recapitalized. After emergence and relisting in early May, the technical overhang was removed and both the stock (GTX) and the newly issued convertible preferred shares (GTXAP) have begun to reweight, rallying ~70% in Q2. While the rally has been strong, I continue to believe GTX trades at a substantial discount to both comparable companies and intrinsic value. As promised in previous letters, I expand upon GTX below. Beyond Garrett, the only other substantial move was CC’s ~25% rally on continued TiO2 momentum.

I have exited our MCS and “Cruise Options” positions and begun to build two new positions that I will disclose later once we have established the positions.

In the YTD winners’ column, GTX/GTXAP and CC both contributed over 1000bps of performance, with our GTX gain the larger of the two. MCS, TPHS, and CAAP contributed 500-1000bps, while LPX, NTP, Permanent Bank, and our “Cruise Options” portfolio contributed 100-500bps each. In the losers’ column, our GSE bet (FNMA, FMCC) lost ~100bps.

Portfolio Review - Exposures and Concentration

At quarter end, our exposures are 111% long, 7% short, and 104% net. Our five largest positions are GTX/GTXAP, CC, CAAP, Permanent Bank, and TPHS, and account for roughly 100% of assets.

Portfolio Review - Existing Positions

Garrett Motion Common Shares (GTX) and Convertible Preferreds (GTXAP)

Garrett Motion Inc (NASDAQ:GTX)/Garrett Motion Pref Shs (OTCMKTS:GTXAP) is a “big bet” for the fund, which I define as a position where we put over 30% of the fund’s assets into a single bet – or, in this case, two related securities in the same underlying business, with GTXAP representing the majority of our position. In later paragraphs, I lay out the fund’s thesis on GTX as well as link to some recent presentations I have posted. However, first I want to explain my decision to make GTX a big bet.

When I originally wrote to explain my rationale for “big bet” investments in September 2019, I laid out a list of criteria and definitions that is attached to the end of this letter. The following bullet points are the criteria and my explanation of how GTX meets them.

- No Real Potential for Permanent Capital Loss – See next paragraph

- Deep Moat/Predictable Cash Flows – GTX has a duopoly position in the turbocharger market with significant geographic, customer, and model diversification. While global auto numbers can swing on macro events, global car sales are broadly a replacement and/or slow growth market and cars are a basic necessity with, at present, no realistic substitute. I believe GTX has a very wide moat and is one of the most predictable companies I have analyzed.

- Sufficient Liquidity in Any Environment – When GTX filed, it had sufficient liquidity at the time of filing despite incredible macro stress. Now that it has restructured and further strengthened its balance sheet, it has even more liquidity.

- Clear Differentiated View (For Liquid Securities) – GTX was not a liquid security during the bankruptcy process, although I expect liquidity to substantially improve going forward. My GTX estimates are significantly above GTX’s forecasts during the bankruptcy.

- Reasonable Growth (Or Very Slow Decline) – At present, GTX is rapidly growing. For instance, in Q1, GTX grew ~1500bps above auto sales, and I believe global auto sales are in a multi-year 5-15% CAGR recovery cycle. While BEV is a clear and likely long-term risk, I believe GTX will grow for the next 10+ years before entering a manageable decline sometime post-2030.

- Substantial Upside – I believe GTX shares can trade >$15, significantly above the price at which I made GTX a big bet and the current price of $7.50.

- Reasonable Timeframe to Work – GTX has already begun to work, and I think as the story gets out, the stock can further reweight toward peers.

- Catalysts – Emergence from bankruptcy, relisting, sell side coverage and earnings growth are strong catalysts.

- Technical or Panic Selling – GTX’s filing created both significant technical and panic selling. Further, the recapitalization is entirely technical in nature.

By far, the most important criteria is the first. The fund’s big bets simply cannot have a realistic chance of loss. What constitutes a “realistic chance” boils down to my judgment and is inherently subjective, but I hope the other criteria help to frame my thinking. Frankly, it is easier to explain what I would rule out more than what I would rule in. For instance, venture capital, operating companies that do not generate cash flow, high-cost commodity producers, and discretionary spending driven businesses immediately come to mind, though this list is by no means exhaustive of what I seek to avoid.

To explain my thinking on GTX’s risk, I provide two analyses. First, I take GTX’s Q2 2020 results and run them through the current capital structure to provide a conservative “worst-case” analysis. Second, specifically referencing GTXAP, I compare GTXAP’s yield and equity characteristics with the securities GTXAP replaced in GTX’s pre-filing capital structure to illustrate the deep discount to market prices at which GTXAP was issued.

In Q2 2020, GTX earned $63MM on a ~50% decline in sales. To be clear, GTX’s sales decline was driven entirely by global macro factors and represents an entirely unrealistic actual trough scenario. The pandemic-driven decline last spring pushed auto sales to an unsustainably low level and the market’s sharp recovery and widely reported auto shortages – used car prices are in some cases surging to an unheard-of premium to original MSRP – speak to how ridiculous an even short-term 50% decline was. Annualizing Q2 2020 levels and calling it “trough” is an unrealistic level of conservatism, but the absurdity supports my reasoning in GTX’s safety. Having said that, annualizing the Q2 results yields $252MM of EBITDA which compares to ~$20MM of maintenance capex and ~$50MM of term loan interest, which at a 23% tax rate yields ~$140MM in earnings or ~$0.45 per share assuming full conversion. While there are numerous caveats in this analysis, such as the Pref B payments which I expect to be repaid by YE2021, that GTX is profitable at crazy trough scenarios let alone profitable enough to justify its current trading price speaks to our investment’s low risk profile.

Further, the pricing of GTXAP was done at far from market prices, providing a large margin of safety. Prior to filing, GTX’s capital structure was a senior term loan with ~$1.2B outstanding, ~$400MM bonds, $1.3B of HON liabilities, and ~75MM shares outstanding. During the restructuring, the loan and bonds were repaid, and the HON liabilities were eliminated. To finance this, the company issued a new term loan with ~$800MM outstanding net of cash and conducted the GTXAP rights offering to raise $1.25B. HON was also issued a ~$600M Preferred B, however it is junior to our GTXAP investment. In effect, the GTXAP offering replaced ~$400MM of the previous term loan, the $400MM bond, and $400MM of the HON liabilities. Prior to GTX surprising the market with its intention to file in August 2020, both the term loan and bonds were trading between 90-100% of par for a 3-5% yield to worst with no equity upside. Notably, the 3-5% yields were before the significant improvement in global auto sales and GTX’s underlying results over the last nine months. Further, the more junior Pref B was issued simultaneously with GTXAP and carries a ~7% yield. The GTXAP offering was priced at an 11% yield and is convertible into GTX at a price of $5.25, which compares to my estimates of ~$1.50 in 2022 EPS assuming full conversion. It is almost unheard of to refinance existing paper ~700bps wide of market prices, let alone also to receive an option to convert into equity at sub-4x my earnings estimate. This wide discount to market and the seniority of the GTXAP paper further support my belief that GTXAP at issuance had no realistic chance of loss. While GTXAP is illiquid and the market can change quickly, its early trading prices support my view that GTXAP was issued at a steep discount, and GTXAP has never traded at less than a 50% premium to par.

Beyond my downside analysis, I believe GTX has compelling upside. I have recently published several presentations and a podcast, linked below, that detail my work. The simple pitch is I believe GTX will generate FCF/sh. of $1.50 in 2022 and $1.80 in 2023, which at current prices implies a multiple of 5x and 4x, respectively. This compares to comparable auto supplier peers, such as BWA and CON GY, at 10-12x 2022 and 8-10x 2023. I believe GTX is a superior company than its auto supplier peers, albeit with post-2030 terminal value risk, and I believe the >20% FCF yield in the hands of the talented and aligned shareholders who have taken over the company sets the stock up to reweight towards auto supply peers. Investors can find more on GTX here:

- Website – gtxisacheapstock.com

- Blog Post - https://mcvalue.blog/2021/05/17/garrett-motion-gtx/

- Podcast – Yet Another Value Podcast on Spotify/Apple/etc., or on Youtube with video:

Please feel free to reach out to me with further questions.

Chemours Co

The fund has been invested in Chemours Co (NYSE:CC), in some size or another, since inception, and as long as CC remains at a substantial discount, I plan to maintain a position. However, we are now entering a different phase of our investment. In August 2019, I made CC a big bet when shares plunged below $12. Investors were panicked over PFAS lawsuits and doubted CC’s ability to regain its lost market share. Since then, with some “Covid-sized” volatility, CC has settled its largest PFAS lawsuits and recaptured most of its lost volumes, driving consensus estimates higher. I maintained our big bet sizing throughout 2020 and early 2021, and shares have rallied to ~$35 at present. Given the higher share price and significant reset in consensus estimates, CC has changed from a distressed/contrarian investment to a GARP investment with near-term catalysts. In the near term, CC remains cheap at ~7x my 2022 FCF/sh. estimate of $5 and has a host of potential catalysts, including rising TiO2 prices and volumes, a sale price of its cyanide business above expectations, and the resumption of its significant share buyback. My estimates for 2022 and 2023 EBITDA are 10-30% above the Street. There is also the potential for further positive news on PFAS liabilities, such as a settlement of AFFF litigation and the EPA’s PFOA MCL coming in above certain bears’ expectations. Longer term, I believe CC can grow EBITDA at a high-single digit rate while returning cash through dividends and buybacks. I project $8 in 2025 EPS. I believe this favorable near-term setup and substantial long-term discount warrants a sizable position. However, position sizing is dynamic and CC shares have risen substantially. I have reduced our position, but we retain a large investment.

As always, please feel free to contact me with any questions.

Sincerely,

Chris McIntyre

Appendix - Big Bet Criteria

For a “big bet,” I am looking for:

- Deep Moat/Predictable Cash Flows – While the phrase “deep moat” is often thrown around, what I mean by a “deep moat” is a business with strong competitive positioning that makes long-term cash flow predictable. I want investments where I am highly confident it would be difficult for my long-term estimates to be significantly incorrect. The vast majority of businesses do not meet this criteria, or at least I do not believe I am capable of analyzing them with such certainty. Single product medtech/pharma, growth investments without near-term cash flows, swing commodity producers, etc. come to mind.

- Sufficient Liquidity in Any Environment – Lots of things can go wrong in the world, from macro crises to plant fires to poor business decisions, which can cause a world of trouble for a business that needs to access the financial markets. I am only willing to invest substantial capital in businesses where liquidity is a non-issue.

- Clear Differentiated View (For Liquid Securities) – In a liquid security, there are likely to be a few issues which the market perceives as large risks. I must have a strong view on these and must be convinced that the outcome of these issues is knowable and substantially different from what the market expects. This would not necessarily apply to highly illiquid securities, where lack of investor knowledge sometimes explains the opportunity.

- Reasonable Growth (Or Very Slow Decline) – When buying a deeply discounted security (i.e. under 5x run-rate owners’ earnings), we do not need rapid growth. However, we are very cautious regarding businesses in secular decline and would avoid them in most cases.

- Substantial Upside – I am only interested in big bets where we stand to make a great deal of money, or a modest amount of money very quickly. Something like a greater than 50% IRR sounds right.

- Reasonable Timeframe to Work – As always, timing is an educated guess and I will frequently be wrong. However, I want our big bets to have a reasonable timeframe – think a few quarters not a few years.

- Catalysts – Related to timeframe, I should have reasonable near- and medium-term catalysts for our investment.

- Technical or Panic Selling – This is admittedly an arbitrary concept, but ideally, I would like to be buying from technical or panicked sellers who are price indifferent.

- No Real Potential for Permanent Capital Loss – This is by far the single most important criteria. My analysis should include not just general risks, like macro, but also tail risks. However, I must be focused on plausible tail risks. For instance, a plant fire is a plausible tail risk; three simultaneous plant fires at three separate plants on three different continents is not. This will always be a subjective judgment, but I must be convinced it is true.

Boiled down, I am looking for predictable businesses with reasonable leverage, down a lot on short-term or exaggerated issues, where we stand to make a lot of money in a reasonable timeframe.

Once I am convinced of the above and my only real fear is mark-to-market losses, my only goal as an investor is to 1) continue to obsess over whether the above is correct and 2) to make as large a bet as possible. Fat pitches are rare events and if after rigorous analysis I believe I have found one, I intend to swing big.

The post McIntyre Partnerships 2Q21 Commentary: Garrett Motion Is A Big Bet Investment appeared first on ValueWalk.