Dan Loeb’s letter to Third Point investors for the second quarter ended July 2021, discussing cryptocurrencies, his new position in Restoration Hardware Holdings (NYSE:RH), and Walt Disney Co (NYSE:DIS).

Q2 2021 hedge fund letters, conferences and more

Dear Investor:

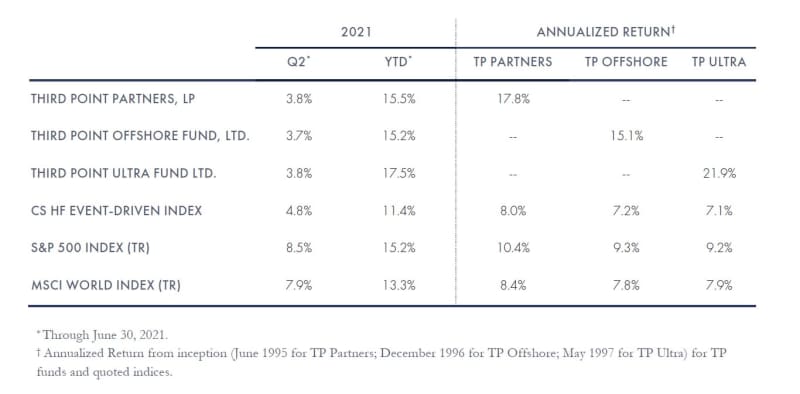

During the Second Quarter, Third Point returned +3.7% in the Offshore Fund and +3.8% in the Ultra Fund, bringing returns for the first half of 2021 to +15.2% and +17.5%, respectively. Assets under management at June 30, 2021 were approximately $17.1 billion.1

The top five winners for the quarter were SentinelOne Inc (NYSE:S), Intuitive Surgical, Inc. (NASDAQ:ISRG), Danaher Corporation (NYSE:DHR), Iqvia Holdings Inc (NYSE:IQV), and SoFi Technologies Inc (NASDAQ:SOFI). The top five losers for the quarter were Prudential Financial Inc (NYSE:PRU), PG&E Corporation (NYSE:PCG), Intel Corporation (NASDAQ:INTC), Macro A, and Paysafe Ltd (NYSE:PSFE).

Q2 2021 hedge fund letters, conferences and more

In Q2, market volatility increased materially with wild swings in sentiment and factors, which we expect to continue throughout Q3. The backdrop for risk assets remains constructive – financial conditions are loose, fund flows are healthy, savings rates are high, and policy is broadly supportive. At its June meeting, the Fed tried to assuage market concerns that it will let policy remain too loose for too long, but we expect anxiety about inflation and interest rates will persist. Risks arising from increasing infections driven by the COVID-19 Delta variant threaten to dampen (but not yet derail) tailwinds from re-openings, particularly in the service sector.

Our largest winner in Q2 was SentinelOne, which completed its initial public offering on June 30th. Today, it has a market cap of roughly ~$14 billion, over 4x its last private round valuation in November 2020. We first invested in SentinelOne in 2015, leading its Series B round at a post-money valuation of $98 million, and Robert Schwartz joined the board. After participating at each subsequent round, as well as in the IPO and after-market, we now own over 10% of the company and Rob remains a board member. SentinelOne’s next generation, AI-powered autonomous security product for the endpoint market continues to take share from legacy incumbents such as Symantec and McAfee. Its technology compares favorably to its most relevant next-gen endpoint protection competitor, Crowdstrike, in an environment where cybersecurity has become an essential enterprise need, highlighted by frequent, well-publicized attacks.

In our Q2 2018 Investor Letter, I laid out our rationale for shifting the emphasis of the portfolio toward higher quality compounders and growth stocks, although they trade at higher multiples than traditional value stocks, in a section titled “Growth Is Where the Value Is”. Recently, legendary value investor Howard Marks expressed a similar view, albeit much more comprehensively and articulately than I could have. In this framework, we had in mind companies like S&P Global, Visa, Danaher, and some large tech names we own such as Microsoft, Google, and Amazon. We retain high conviction in each of these companies, and believe they still offer excellent “value” despite near-term earnings that exceed the S&P average multiple of ~ 18x.

Q2 2021 hedge fund letters, conferences and more

While valuation always matters, our analysis is more focused today on business quality, differentiation, innovation, disruption and market structure. This contrasts with our previous focus as an event-driven fund on using “events” (spinoffs, recaps, mergers, etc.) as opportunities to find “cheap” stocks. We have not abandoned this approach and have found that the broader lens helps us recognize more opportunities. For example, today, we see many high-quality companies “hiding out” behind the opaque curtain of corporate reorganizations, or smeared by the taint of having come public in an unorthodox manner and bearing the four scarlet letters “S-P-A-C.”

Third Point is itself a “growth” company, particularly in our mindset around learning and evolution. We have taken this thinking about the intersection of growth and value a step further and moved decisively into building our capability to invest in “hyper-growth” companies, focusing on early-stage ventures. Investments in our two biggest winners this year, Upstart and SentinelOne, were made at times when they had only a basic product and were at the earliest stages of revenues. From a financial point of view, I see these early stage investments, although they begin as a small part of our portfolio, as an indispensable way for us to create significant positions which we would never be able to replicate by waiting for such companies to come public.

While I am pleased with both SentinelOne and Upstart’s returns, I am even more excited that we have created a replicable process to make investments, add value to young companies, and continue to participate constructively and profitably across their lifecycle. Our venture effort complements our traditional equity processes. From a portfolio point of view, even with an approximate 10% cap at cost on our private exposure, this strategy has provided us with substantially differentiated and uncorrelated rates of return, much like our investments in structured credit, capital markets, and other strategies that contribute to the idiosyncratic nature of our gains.

Q2 2021 hedge fund letters, conferences and more

Cryptocurrency

While crypto is popularly viewed as an alternative (and speculative) asset class, we are most intrigued by its potential to become a disruptive technology, impacting broad swaths of the economy. It has all the appealing characteristics of disruptive innovation: greater inclusion and access, a decentralized model providing unique transparency, (potentially) faster speeds with lower costs, and a sense of independence for users and developers.

The rise of cryptocurrency is part of a broader transition to “Web 3.0” where devices are connected securely but the user is in control of their data, content, activity, and independence. In the long-term, this will shift users’ digital presence away from centralized search, social media, and data services to decentralized apps that will target marketplace, gaming, lending and borrowing, gambling, meta/multiverse, social media, and collectible engagement.

Over the past two quarters, we have made several investments in private companies that are creating critical infrastructure to enable broader crypto trading and usage. These include CipherTrace, which enables KYC/AML; Bitwise, a passive asset manager that provides access to crypto as an asset class for the RIA, retail, and institutional communities; and FTX, a world class digital asset exchange led by Sam Bankman-Fried. We have also participated in PIPEs for eToro and Circle.

We will continue to pursue more of these investments in the portfolio and see opportunities for several areas of our business. We have sized our exposure to the space to be commensurate with the significant risk of capital. Like many emerging asset classes, we anticipate extreme volatility in price and sentiment, but these concerns are dwarfed by the incredible disruptive potential offered by this technology. Recently, investors have grown concerned about the impact of increasing regulation, but we believe it has upside in the long run as a more clear set of guardrails should pave the way for a greater range of capital to flow into the industry.

Q2 2021 hedge fund letters, conferences and more

New Position: Restoration Hardware (RH)

We started acquiring RH in Q4 of 2020 when the market started to fear what a “Blue Wave” and peaking “work from home” could mean for high-end furniture demand. Our focus was less on those issues and more on a high-quality underlying business at a fundamental inflection point. Our confidence was buoyed by CEO Gary Friedman, a once-in-a-generation leader who is both an innovator and effective capital allocator.

Furniture companies are not known for their high returns on invested capital, and a common bear thesis on RH was that furniture companies had never sustainably earned >10% EBIT margins (which RH had recently exceeded). However, in the same way that Ferrari should not be compared to other auto manufacturers, we believe RH should not be considered a traditional furniture company. Gary Friedman has employed a methodical strategy that involved improving product quality and design, supply chain efficiency, retail presentation, and essentially eliminating discounting. The result is the ability to command higher product gross margins, better leverage on fixed costs, and a unique advantage in retail, where landlords basically pay RH to anchor retail properties, as RH’s stores draw high-income traffic and create a “halo effect”. Financially, this has translated into EBIT margins in the mid 20% range and an eye popping >60% ROIC.

When work from home produced a surge in furniture demand, skeptics wondered if RH could sustain its recent revenue growth. Yet, bears missed the fact that the intentional “elevation” of the brand had actually restrained sales for the preceding few years. This strategy shift was only just manifesting into a growth phase when COVID hit. Coming out of COVID, we expect the years of hard work to pay off, driving years of above-consensus furniture growth domestically. Beyond the US, RH plans to begin an aggressive international expansion starting with a flagship England store in the spring of 2022 and a total of 10 European locations in the next two to three years. Like all great luxury companies, RH has also realized that its design competency and brand cachet extend beyond its core product category, and they are expanding their TAM to include residential real estate development, lodging, restaurants, and more – and are pursuing this growth with a capital-light, high ROIC philosophy. We are confident in RH’s potential for rapid earnings growth and multiple expansion as Friedman continues to execute on his vision, regardless of the political landscape or housing cycle.

Q2 2021 hedge fund letters, conferences and more

Equity Position Update: The Walt Disney Company

We initiated a position in The Walt Disney Company (“Disney”) in Q2 2020 and it has been one of our largest profit-generators since. Our investment was predicated on the value creation opportunity in DTC streaming, and our belief that Disney’s superior content and IP gave it the opportunity to build a subscription-led business that would eclipse the scale of its TV and box office businesses. We also believed investors would ascribe a higher multiple to those recurring subscription revenues. We encouraged CEO Bob Chapek to secure Disney’s future by investing more aggressively and implementing bold actions (including a permanent dividend cut) to capitalize on the full potential of Disney+.

The optimistic view of Disney’s streaming prospects has proven correct so far: less than two years after the launch of Disney+, streaming now generates over $15 billion in annual revenue from a base of 159 million subscribers (104 million from Disney+ alone). The market has rewarded this aggressive digital transformation, as evidenced by the 70% appreciation in the stock price since May 2020.

Disney has taken several important steps to accelerate the streaming transition since we initiated our position. At its December 2020 investor event, Disney doubled its medium-term Disney+ content investment relative to prior guidance (2024E spend of $8-9 billion versus prior 2024 guidance of $4 billion2) while retaining prior profitability guidance due to the platform’s early success. As a result, the cadence of new content availability on Disney+ will jump to 100 titles per annum (versus previous guidance of 60). Crucially, Disney is delivering enhanced value to Disney+ customers by incorporating greater flexibility into their tentpole film release strategy. Disney has experimented with both ‘Premier Access’ (releasing blockbusters like Black Widow under a “day-and-date” model with a surcharge) and exclusive marquee premieres on Disney+ at no added cost, notably Pixar’s “Luca” and “Soul”. They have also simplified the streaming value proposition in Europe and APAC by combining Star general entertainment content with the Disney+ library under a unified service which has been a tailwind to engagement.

While the progress thus far has been commendable, even more can be done to realize Disney’s full potential in streaming. In our view, the combined strength of Disney’s various sports, general entertainment, and blockbuster franchises remains unparalleled in the global media industry. We continue to believe that the best way to capitalize on this strength to maximize future earnings potential globally (both reach and pricing power) is by providing an all-you-can eat DTC offering on a single platform under the Disney+ brand, where all theatrical content is available day-and-date with no additional fee to subscribers.

Disney management deserves credit for leaning into the DTC transition during a very challenging operating environment. The COVID-19 pandemic caused unprecedented operational disruption to Disney’s parks and live sports businesses (Disney’s California theme parks, for example, were closed for over a year). The magnitude of this challenge cannot be overstated: in the year preceding COVID, parks accounted for over 1/3 of Disney’s operating profit. While the Delta variant’s recent rise highlights that the pandemic is far from over, it appears the parks may be set to ultimately emerge from this crisis even stronger than before. Domestic theme park demand has recovered to previous highs, while management has optimized pricing and fixed costs relative to 2019 levels. Consumer Products, another key segment, is thriving despite a shrunken physical footprint due to the success of digital-first IP like the Mandalorian’s “Baby Yoda.”

Over the past year, we have left our conversations with Mr. Chapek and CFO Christine McCarthy impressed by their relentless pursuit of long-term value creation for Disney and its shareholders. They have done what is right for consumers, even when it may be at odds with the legacy Hollywood ecosystem. The opportunity ahead remains immense: 1 billion global broadband-enabled homes, 4 billion mobile smartphone subscribers and, most importantly, at least 1 billion global Disney fans. A successful transition to a subscription-led DTC business model has consistently proven accretive to both long-term earnings and valuation multiples for the businesses we follow, with notable examples including Microsoft and Adobe (both saw forward P/E multiples triple between 2010 and 2020 with long term earnings expansion at a teens CAGR). Establishing a durable leadership position in the competitive global streaming market will require tough choices, aggressive investment, unwavering focus and consistent innovation. We are confident that management is up to the challenge and look forward to remaining partners along the way.

Q2 2021 hedge fund letters, conferences and more

Corporate Credit Update

Third Point’s corporate credit book continued its strong year-to-date performance, returning +6.3% for the second quarter and +16.6% for the first half of 2021, comparing favorably to the JPM high yield index (+4.2% YTD) and the JPM investment grade index (-1.1% YTD). The retrace in interest rates helped the more rate-sensitive parts of the high yield and investment grade markets move higher. Rates have generally continued to move down through July. The move appears counterintuitive given robust growth; however, as we lap the largest shut down months of 2020, we believe growth and inflation figures may be at or near peaks. While it was a drag on second quarter performance, we are continuing to hedge the rate exposure in our credit book for durations beyond seven years.

The portfolio generated gains from subsectors ranging from distressed debt to investment grade credit. Energy credits have been significant winners for us in 2021. We have had exposure to upstream E&P based on a constructive view of both the supply and demand picture. We have limited exposure to service names and continue to avoid the offshore rig space which will require a long cycle of higher prices to sustain a recovery.

We are continuing to trade actively, harvesting positions that have met our prices targets, but still finding some laggards that offer appealing risk-adjusted returns. We are relatively indexed to the reopening trade and are carefully watching to ensure this trajectory is intact despite rising COVID-19 case counts among unvaccinated populations. Overall, our portfolio quality remains very high, with almost half the book ‘BB’ rated (the highest below investment grade rating) or higher. For the near term, we are conservatively positioned with respect to rate and spread risk but look forward to the increasing opportunity set later this year.

Q2 2021 hedge fund letters, conferences and more

Structured Credit Update

During the second quarter, structured credit contributed +1.0% to funds, driven by returns in reperforming RMBS, aircraft ABS and consumer loan/marketplace ABS. While high yield credit spreads are at historically tight levels, investor demand for senior securitizations came roaring back after first quarter-end. From March through June, we made several strategic purchases of residential mortgage and private credit student loan portfolios that we began securitizing in April. Despite the volatility in rates, we were able to access historically tight structural term leverage with both unrated and rated securitizations.

We are constructive on student loans and have increased exposure to this asset class for several reasons: a) we can leverage our experience in residential mortgage securitizations and apply it to these credits; b) private credit borrowers would likely benefit from any government forgiveness programs, as most private credit student loan borrowers also have federal loans and their overall debt will decrease, and c) there is a large data set of performance for this asset class, enabling us to accurately diligence loans and securities.

When we meaningfully added to our structured credit exposure last spring, we made a bet on the resilience of the US consumer. Consumer performance and savings remain strong, as evidenced by robust cash flow to our securities, but we remain vigilant about how those payment patterns may change as we move further into a post-pandemic environment. Despite the overall strength of the US economy, we have continued to capitalize on disruptions including volatility in global travel as COVID-19 evolves, which gave us the chance to add aircraft ABS exposure in April; the rise in used auto prices due to the post-pandemic microchip shortage and car scarcity issues emerging in auto loan ABS opportunities; and finally, increasing opportunities as COVID-driven extensions of tenancies and withholding of rents in real estate markets comes to an end.

As we look to the coming quarter, we remain constructive on our loan-sourcing to generate returns through our bank relationships and via collaboration with the ventures team and expect more investment opportunities as sectors experience change in a post-pandemic environment.

Q2 2021 hedge fund letters, conferences and more

Business Update

During the Second Quarter, we welcomed Curtis McKee to Third Point Ventures, where he will focus on investments across the IT landscape. Previously, Curtis was AVP and the Head of Corporate and Investor Development at Arista Networks, where he led Mergers and Acquisitions, including the Big Switch Networks and Awake Security transactions, as well as Ventures and Investor Relations. Prior to Arista, Curtis was an Investor and Corporate Development leader for Intel Capital, concentrating on Cloud, IOT, Enterprise SW, HPC, 5G, Edge/Networking and AI sectors. He also led Operations as Chief of Staff and Technical Assistant for the Datacenter Group’s Enterprise Software Division. He joined Intel following the company’s acquisition of Fulcrum Microsystems, where he was Head of Business Development. He began his career in engineering roles at Broadcom and Marvell. Curtis holds an MBA from the Wharton School at the University of Pennsylvania and a BS in Electrical Engineering from Purdue University.

Sincerely,

Daniel S. Loeb

CEO & CIO

The post Dan Loeb Q2 2021 Letter: Restoration Hardware And Disney appeared first on ValueWalk.