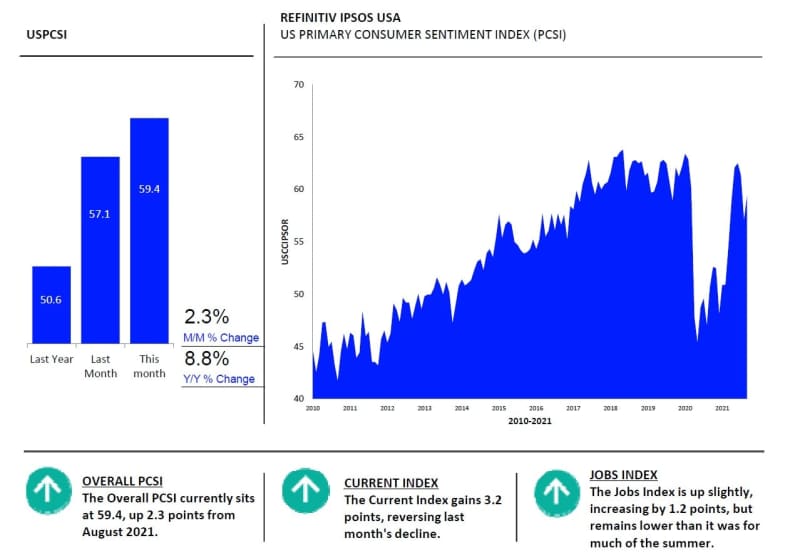

WASHINGTON, DC ‐ The Refinitiv/Ipsos Primary Consumer Sentiment Index for September 2021 is at 59.4. Fielded from August 20 ‐ September 3, 2021, this month’s index marks a significant increase from August.

Q2 2021 hedge fund letters, conferences and more

The Consumer Sentiment Index increases 2.3 points from last month but remains below both its reading from two months ago and its pre‐pandemic reading in March 2020 (60.1). All sub‐indices increase this month, and all are at levels similar to their pre‐pandemic March 2020 readings.

Reversing last month's decline, the Current Index gains 3.2 points and now reads at 53.1. This month's reading puts the Current Index on par with its July 2021 reading (53.0) and its March 2020 reading (53.4).

The Investment Index, at 54.8, also increases by 3.2 points from August. This increase is tied with the Current Index for the largest across the sub‐indices. This month's reading is also similar to its pre‐pandemic reading in March 2020 (54.6).

The Expectations Index (63.9) gains 1.8 points from last month. Even with this increase, the reading remains significantly lower than it was in late spring and early summer and is on par with where it stood a year ago (64.1).

At 69.5, the Jobs Index increases by 1.2 points, the smallest increase among the subindices this month. Despite this small increase, the Jobs Index remains lower than it was for much of the summer.

"Following a turbulent month for consumer sentiment, this month's Refinitiv/Ipsos Primary Consumer Sentiment Index increases, and so do all the sub‐indices. Despite these gains, the index and all four sub‐indices remain below their late spring and early summer readings," Chris Jackson of Ipsos states. "Although consumer sentiment is generally on par with where it stood before the pandemic, optimism about the economic recovery has dampened as another wave of the pandemic hits the country.”

Jharonne Martis, Director of Consumer Research at Refinitiv, said, “The Delta variant continues to triggers shifts in consumer sentiment, and this is reflected in the retail sales and earnings results. Ninety‐seven percent of companies in the Refinitiv Retail/Restaurant Index have reported Q2 2021 earnings. As people cope with the Delta variant, it is clear that their spending is focused on improving the stay‐at‐home experience."

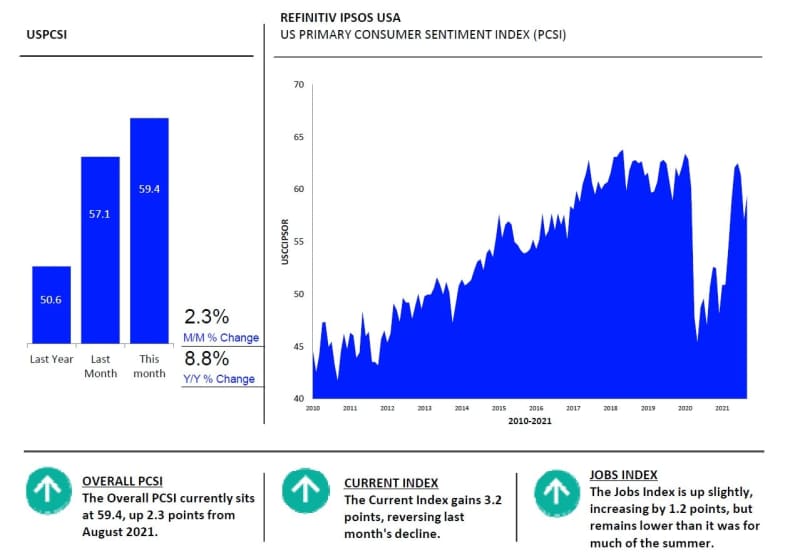

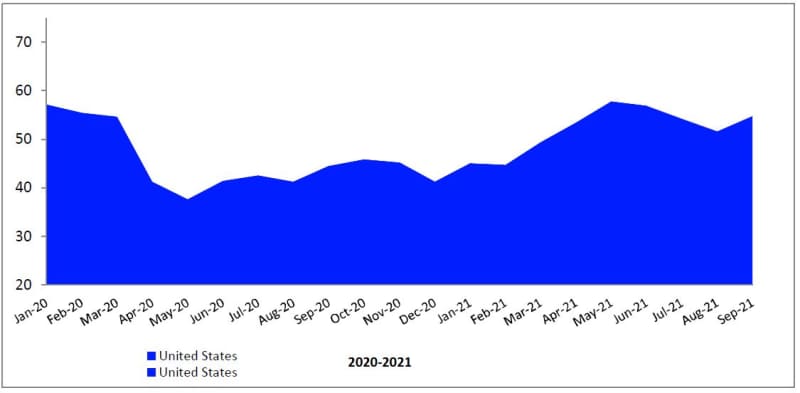

Current

The PCSI Current Index currently reads at 53.1. This sub‐index increases 3.2 points, reversing last month's 3.1‐point drop, and is now on par with its July 2021 reading (53.0). The index also sits at a similar level to where it was before the pandemic in March 2020 (53.4).

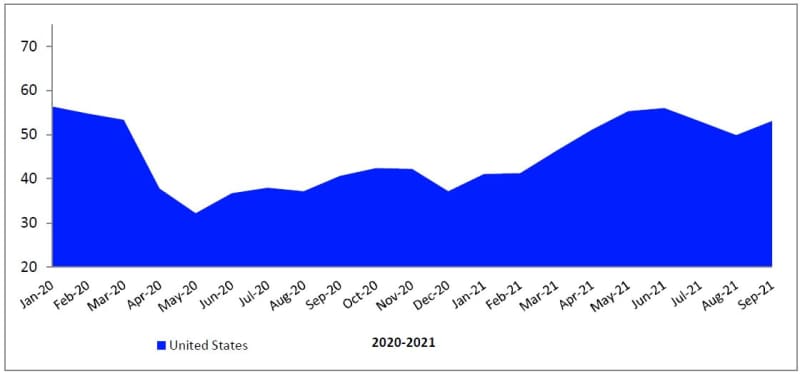

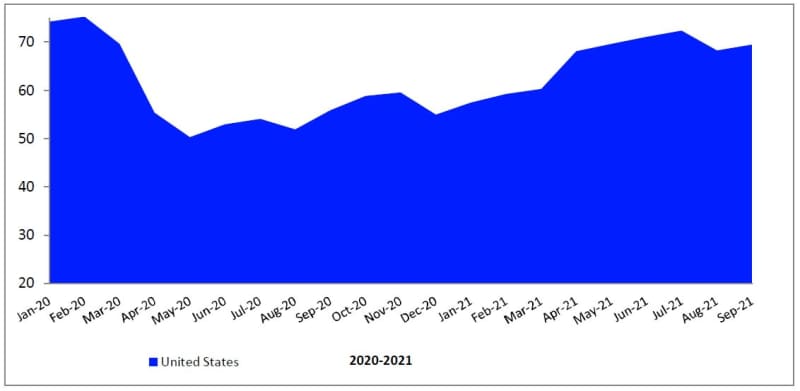

Expectations

The PCSI Expectations Index increases by 1.8 points, reading at 63.9. Despite the increase, this month's mark remains significantly lower than it was in late spring and early summer. It now sits about level with its pre‐pandemic reading in March 2020 (63.6) and with where it stood a year ago in September 2020 (64.1).

Investment

This month, the PCSI Investment Index reads at 54.8 after gaining 3.2 points from August. Along with the Current Index, the Investment Index is the sub‐index to see the largest increase from August. This improvement brings the reading for this sub‐index on par with its prepandemic March 2020 reading again (54.6).

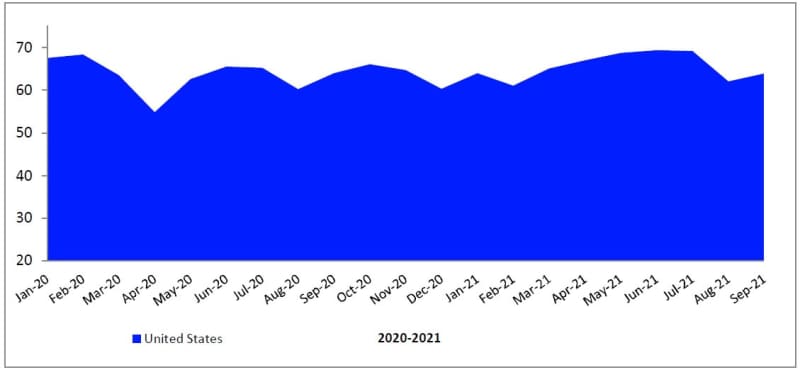

Jobs

The Jobs Index (69.5) increases from August, up 1.2 points, and is the subindex with the smallest growth this month. This sub‐index, like all the other sub‐indices, recovers to a level similar to where it stood just before the pandemic in March 2020 (69.7). Although this sub‐index increased, this month's reading remains lower than it was for much of the summer.

Updated on