Both decentralized and centralized exchanges –DEX and CEX respectively– are finding new and innovative ways to facilitate transactions. As the crypto space grows steadily, some platforms –especially CEX– may want to keep an eye on DEX platforms and some of their latest payment services to make transactions easier.

Q3 2021 hedge fund letters, conferences and more

While some DEX’s may be setting the pace in the DEX world, centralized cryptocurrency exchange Coinbase started allowing users to buy ethereum, bitcoin, and other cryptocurrencies using Apple Pay since August this year.

However, Apple Pay is breaking its way into DEX platforms thanks to increasing reputation, which is something centralized exchanges are following from close range. DEX platforms incorporating similar payment methods are an enticing view for users and the industry alike.

Could Apple Pay Option Be A Killer Feature?

Crypto exchanges are currently in a race to incorporate a wider variety of payment options, making transactions easier and giving investors more in terms of choice. Apple Pay is not a rare service, since most exchanges are already eager to add Google Pay options or real-time payment networks (RTN) to boost their services.

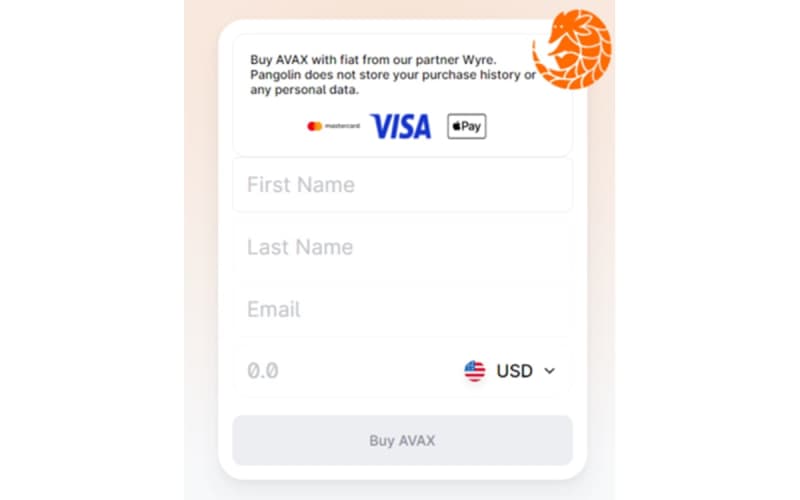

However, decentralized exchanges like Pangolin offering Apple Pay are a rarity in the crypto exchange space. AvaLabs created Pangolin on the Avalanche Network as a flagship DeFi app and decentralized exchange.

The introduction of these new payment methods is believed to increase crypto adoption rates, as more users will bank on the convenience they offer to have a stake in the crypto world.

The impact on DEX is bound to be bigger, as integration is a key element in the crypto space since it eradicates the complexities linked with transferring funds through some less conventional means. Instead of getting DEX to make a debit card or having users create a hard wallet, withdrawal options like Apple Pay are a method users already know.

Apple and other big tech giants might be looking to foray into crypto in the future, and such a move could be a boost and lead to collaborations to mainstream DeFi.

The most important part of this new payment option and what it means for DEX is that users can cash out quickly and flexibly. Apple Pay is not only helping simplify cash-outs but also making them faster. In all, the more decentralized exchanges that add to the ones currently offering Apple Pay, the more transactions DEX will be able to process.

DEX Potential

Decentralized exchanges are a developed version of the classic centralized exchanges. The difference is that the inner workings of the platform run directly on the blockchain through on-chain smart contracts, pieces of code that eliminate intermediaries –in addition to improving both the security and the trust of everyone who moves in this sector.

Smart contracts facilitate trade between individuals while avoiding having control over the assets of different users. With centralized exchanges, all operations are managed by the same entity, in addition to being the same platform that stores the assets of each of its users.

Regarding alternative payment methods, opportunities for DEXs are rife, as according toBusiness Insider, at present, there are more than 35 DEXs in existence globally including Uniswap, Kyber, and Bancor.

“The two obvious advantages of DEXs are security and sovereignty. The fact that they are decentralized means there is no one entity that can be hacked, whereas a centralized exchange is more vulnerable to exploits, which in turn could affect its users. In addition, users retain access to their wallets and hence retain control of their own crypto holdings.”

DEX is only the beginning, but offering alternative payment methods like Apple Pay and Google Pay are a way to the future. With big tech companies connecting crypto users via DEX platforms, this is an essential step to further adoption.

Updated on