S&P Global Ratings’ most recent report has found that the food system is responsible for about one-third of global GHG emissions, including up to 10% from lost or wasted food. Food supply disruptions due to the pandemic and extreme weather have further brought this issue into the spotlight. However, if it optimises its food production and supply chain by adopting more efficient systems, the food industry could reduce food waste which would, in turn, help pave the way to a more sustainable future.

Q3 2021 hedge fund letters, conferences and more

Key Takeaways

- Each year, a staggering one-third of food produced globally--worth almost $1 trillion--is lost or wasted, with unconsumed food contributing up to 10% of global greenhouse gases (GHG) in addition to emissions from farming, processing, and other activities.

- More efficient food systems will help eliminate food loss and waste while reducing the impact on the environment, especially since about 14% of the world's food is lost before reaching supermarket shelves.

- With the U.N.'s 2030 target for halving per capita food waste fast approaching, we believe the food industry can create a path to more sustainable food production and supply through closer collaboration and process integration.

- Companies able and willing to adjust their business models and adopt sustainable agronomic practices can strengthen their resilience to operating setbacks and reduce food-related emissions, while delivering higher margins through value-added product offerings.

Studies suggest that the food system is responsible for about one-third of global GHG emissions, including up to 10% from lost or wasted food. This stands out when compared with about 12% from manufacturing and construction and 14% for the transportation sector, according to data from the World Resources Institute (WRI). Food supply disruptions, especially over the past two years due to the pandemic and extreme weather, have brought this issue further into the spotlight.

Last year, for example, one of the warmest on record according to the World Meteorological Organization, thunderstorms, wildfires, plagues, and drought destroyed millions of hectares of crops and displaced thousands of people. In addition, COVID-19-related restrictions severely hampered the transport of agricultural commodities over air, land, and sea. This increased the amount of food lost or wasted at the production and retail stages, already vulnerable to storage capacity, freight availability, and political instability among other factors.

S&P Global Ratings believes agribusinesses can strengthen the food production and supply chain through closer collaboration at every stage, both downstream and upstream. There are meaningful gains to be had, for example by companies expanding into advanced food ingredient technologies to improve product shelf life, or by integrating transport with processing and sales. Some companies are already rethinking their long-term strategies, putting greater emphasis on managing environmental and social risks. We believe they stand to gain a competitive advantage using this approach. The big question is whether they can do enough to have a visible impact on food-related emissions by 2030.

The High Cost Of Food Loss

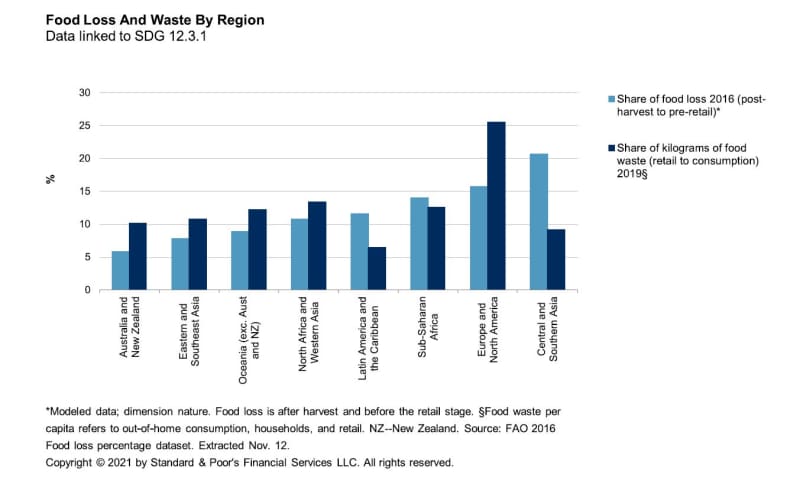

Although limited data is available, the Food and Agriculture Organization (FAO) estimates (2016) show that, excluding retail and households, about 14% of the world's food is lost between the harvest and retail stages. Before and during consumption, the highest food loss and waste per capita occurs in Asia, according to a World Economic Forum report, followed by North America and Europe. The report states that "if food waste were a country, it would rank behind only the U.S. and China for greenhouse gas emissions." The UN Environment Program (UNEP)'s Food Waste Index indicates that, in 2019, 61% of food waste came from households, 26% from food service, and 13% from retail.

A large share of food waste stems from consumers, food providers, and retailers in developed markets. In North America, the U.S. Department of Agriculture estimates that, in 2010, 31% of the domestic food supply was lost, to the tune of about $161 billion. Seven years later, a report by the National Conference of State Legislatures showed that about 40% of food produced in the U.S. is wasted throughout the supply chain, from farms to households, while 41 million Americans faced food insecurity in 2016.

In the U.K., despite considerable progress in this area, estimates show that households and businesses still waste around 9.5 million tonnes (mt) of food per year (70% intended for human consumption) valued at over £19 billion. The edible portion of this food (6.4 mt) would have been enough to feed the entire U.K. population three meals a day for 11 weeks.

Food is wasted in many ways. Here are just three of them:

- Edible fresh produce not meeting certain criteria, for example in terms of shape, size, and color, is dumped during sorting operations.

- Foods that are close to, at, or beyond the "best before" date are often discarded by retailers and consumers.

- Large quantities of edible food not eaten by households and restaurants are often thrown away.

More Businesses Need To Focus On Sustainability

While the world is focusing on the energy transition, the U.N.'s 17 sustainable development goals (SDGs) are keeping the attention on issues such as hunger, poverty, climate action, and sustainable cities and communities. Resolving these clearly also support the reduction of GHG emissions. In particular, SDG 12 is to ensure sustainable consumption and production patterns, including a target (SDG 12.3) to halve--by 2030--per capita food waste at the retail and consumer levels, while reducing food losses during production and supply. Over 190 countries formally agreed to the SDGs, set in 2015, as part of the U.N.'s 2030 Agenda for Sustainable Development.

Yet only 1% of food companies' business models support responsible consumption and production, according to a September 2020 Trucost survey of 3,500 companies representing 85% of global market capitalization. And not much time is left before 2030. The Trucost report also states that about 90% of the companies it examined provide products and services related to food logistics, including taking products from harvest through to consumption.

Among the largest global food corporations working with farmers, retailers, and other organizations in support of the SDGs are market leader Cargill, which has launched several initiatives under its Sustainable Supply Chains program (beef, cocoa, corn, and cotton, among others). Similarly, ADM (food and beverage ingredients) has SDG-aligned environmental targets it aims to achieve by 2035, including a 25% drop in GHG emissions. Nestle (more than 2,000 food and beverage brands) has committed to tackling emissions through 100% deforestation-free supply by 2022, 100% recyclable or reusable packaging by 2025, and food loss/waste reduction targets. Bunge (the world's largest oilseed processor) has an ambitious goal that includes a deforestation-free supply chain by 2025. Mondelez (brands include Cadbury, Philadelphia, and Oreo) reports that it's on track with its 2022-2025 sustainable-ingredients targets. Danone (including Activia, Alpro, and Silk) has pledged a 50% reduction of food waste from the 2016 level, plus 100% next-generation, recyclable, biodegradable packaging by 2025.

There Are Many Possible Solutions

Several global companies plan to effect changes to reduce the environmental impact of their own activities, but this is not enough to transform the entire food production and supply chain. Successful collaboration and consolidation won't be easy, but food companies have several options open to them.

Support for farmers and the local salesforce through better data, technology, and training. We believe direct links with farmers and closer relationships with salespeople where crops are grown are increasingly important to limit loss at production. In large crop-producing regions such as the eastern coast of Latin America, South East Asia, and the Black Sea, local currency inflation and volatility often mean that farmers make storage, sale, and process decisions every week, depending on trading data. Such fragmented decision-making means that transport companies operating with long-term contracts might see their freight capacity underutilized if farmers renege on supply contracts. This is a particular risk if the monetary penalty for farmers is small relative to the potential gain of diverting the sale.

Value-added products in food processing can help reduce waste further down the line and offer agribusinesses opportunities for profitable growth. Innovative technologies can help reduce waste at consumer level by improving the shelf life and appearance of staple foods. In addition, they can promote more efficient crop use by improving the taste and texture of more environmentally friendly plant-based food. Many companies are investing in this are also looking at new materials, to be used, among other things, in food handling and packaging.

Collaboration with retailers is key to cutting distribution inefficiencies and food waste at households. This will enable large agribusinesses and consumer product companies to reap the full benefits of their measures to tackle food waste. Grocers, for instance, can play a huge role in influencing consumers' food choices and attitude toward waste. In recognition of this, leading agribusinesses, consumer products groups, and food retailers have joined the WRI's "10x20x30" initiative since it launched in 2019. The program aims to drive progress on SDG 12.3, using a "whole chain" approach, with participating companies pledging to engage with at least 20 of their suppliers and--together--halve their food loss and waste by 2030.

Adoption of the "Target-Measure-Act" strategy can help track sources of waste/loss, find solutions, and record progress. The strategy was launched by U.K. sustainable resources advocate WRAP and the IDG (Institute of Grocery Distribution) in 2018 as part of the country's Food Waste Reduction Roadmap, which is geared toward the U.N.'s SDG 12.3 target. Three years into the program, nearly 200 companies, including top global names like Unilever, Nestle, Mondelez, and PepsiCo have committed to using the Target-Measure-Act method to speed up food loss/waste reduction in their operations, and make the results public. U.K.-based Tesco was the first retailer to use the approach, inviting 27 suppliers to take part in 2017. WRAP has also called on COP26 delegates to adopt to Target-Measure-Act to tackle climate change. The U.K.'s September 2021 Food Waste Reduction Roadmap progress report showed that businesses had lowered food waste by an estimated 17%--worth £365 million--over the previous year. The U.K. is the first nation to create a plan to achieve SDG 12.3's target of reducing food loss and waste by 50% by 2030.

Increased use of processed food byproducts and restaurant waste for renewable fuels. Animal fats and meal resulting from meat processing, well as cooking oils from food-service establishments, are increasingly being used to produce renewable fuel, thereby reducing the amount of waste as well as reliance on fossil fuel. Under initiatives such as the U.S. National Renewable Fuel Standard Program, gasoline refiners are required to increase their blend of such biofuels into the gasoline supply, with production mandates for renewable and biofuels expected to increase by more than 20% in 2022 compared with 2020 levels. Continued biofuel demand growth will also increase the economic value of such byproducts for recycling into fuels. In fact, a market for various grease grades (for example yellow grease, choice white grease, and poultry grease) already exists, with prices rising more than 100% year over year in the quarter ended Sept. 30, 2021, according to the Jacobson Index.

What Food Companies Are Already Doing

We see global agri-commodity companies consolidating their agricultural platforms (such as for grain, coffee, and cotton), while pursuing geographic expansion and shifting their product mix toward more sustainable alternatives. Scale and cost efficiencies should enable them to deliver affordable products. However, they are increasingly recognizing that to improve supply chain sustainability, they have to invest upstream as well as downstream to reduce reliance on less sustainable food inputs even though they may be more cost effective.

The related investments typically stop short of direct ownership of farmland and crop production, but look at all parts of the food system's infrastructure. This includes partnering with growers and supporting them with new sustainable technologies and processes. Such an approach could entail optimizing drying, storage, and quality controls, land transit, and the high volume of crops passing through port terminals.

Article by S&P Global Ratings

Updated on