Black Bear Value Partners LP commentary for the fourth quarter ended December 31, 2021.

Q4 2021 hedge fund letters, conferences and more

“Nothing sedates rationality like large doses of effortless money.” - Warren Buffett

To My Partners and Friends:

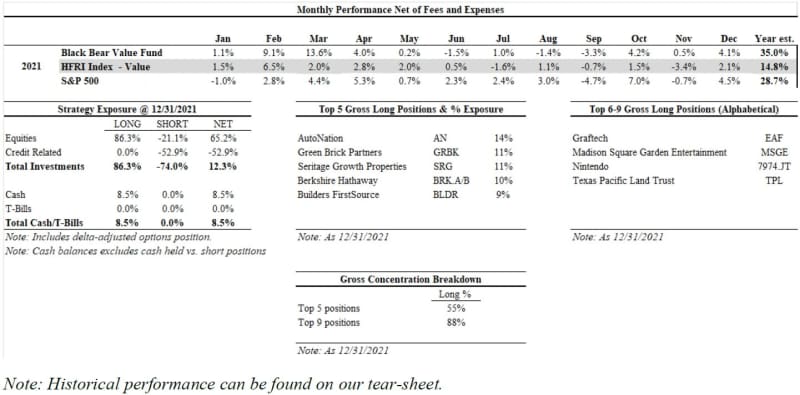

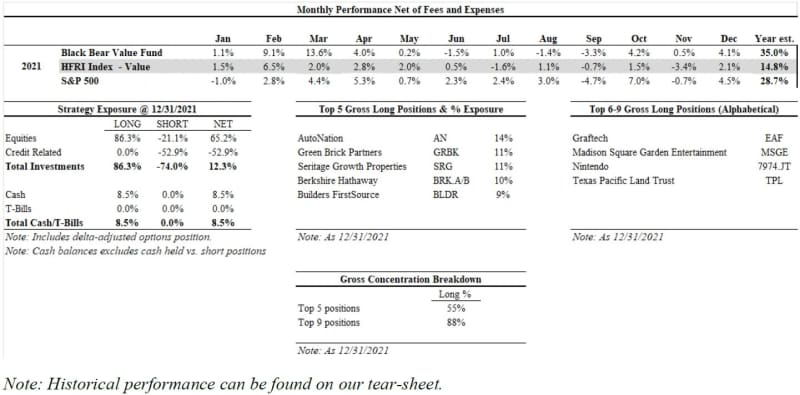

- Black Bear Value Fund, LP (the “Fund”) returned 35.0% in 2021.

- The S&P 500 returned +28.7% in 2021.

- The HFRI index returned +14.8% in 2021.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

Five years ago, when I began Black Bear Value Partners, there were multiple business paths to choose from. Typical questions would revolve around goals on asset size or how many people I was going to hire etc. Many looked at me quizzically when I said I didn’t have goals on asset size and was likely not hiring anyone for some time. The focus was going to be on LP quality. The goal was to build a partnership with extremely strong roots alongside extremely high-quality partners. It was ok if it took a while (which it has!) but eventually LP’s who understood our long-term mission would appreciate the business and invest with us if I communicated our goals effectively and performed.

It was and remains unconventional as size and scale seem to be the focus of many fund managers. It is understandable as many funds feel the need to have large staff and overhead. For better or worse, I crave simplicity in both the business design and the investment style. This approach has pros and cons. It allows us to invest alongside each other without the worry and distraction of constant marketing or concern about short-term market gyrations. It’s also fun! The cons are that we look different/smaller/less “impressive” than some firms that have teams of people. I tend to think groups of people making decisions leads to at-best average results and oftentimes the loudest/best sales-person’s ideas winning out. Growing methodically and allowing LP’s time to get to know me has created a business environment that is fun to manage.

Our partnership invests in a concentrated matter which means returns can be lumpy and not move up or down with the market. We invest based on the prospects of the business, not so much the current emotional opinions of other investors. To do this effectively you need a business that gives you a runway to allow the fundamentals of the businesses to be appreciated and properly valued. That means finding partners who are willing to invest for longer duration and designing a partnership that rewards those LP’s (lower fees) for agreeing to invest for a longer period. It is critical to design a business model that lines up with your investment style.

The journey has been immensely rewarding as over the last 5 years I have gotten to know our LP’s who have added value far more than their capital. They have become friends and advisors. Thank you for your trust and your patience.

Also, a big thank you to my wife Lauren and our children, Sydney, Zoey, and Max. I couldn’t do this job without their love and support. Being an entrepreneur requires a very supportive and patient spouse and I hit the ball out of the park with Lauren.

Remaining stoic and reasonable when the market has seemingly lost its marbles has not been without frustration. That said, I’m simply not going to risk our capital in ideas that require a large dose of imagination, a gamblers attitude toward speculation or free money from the Fed. There are some who made money that way and that is OK. I hope they recognize their good fortune and cashed in some chips on the way up. It is not and will not be the way we operate.

For the last decade plus, there has been a general feeling that interest rates will remain low, inflation will remain muted, and the party can continue ad-infinitum. Skepticism waned while “investors” believed every qualitative story and assigned nosebleed valuations. If a company made a good product, profits did not matter and the stock made a good investment independent of price. We know that is not true. Being short businesses like this was painful at times.

I don’t know if the party is ending, but the lights are certainly flickering, and people seem to be admiring the exit doors. The belief that money will remain free is dissipating as the costs of higher inflation (higher interest rates) are top of mind. Some skepticism is returning to the market. Those with a fundamental background who can understand the relationship between business quality and price will do well.

I am hopeful that these next 10 years+ can reward the skeptical and thoughtful investor. With our longer-term capital base, we can take advantage of market dislocations and plant the seeds for the next 5-10 years of returns.

Brief Discussion On 2021 & Fund Positioning

It is unusual to outperform the broader market when we have sizeable, short positions. While 2021 was extraordinary, we should not come to expect this kind of performance when markets go up so dramatically.

Our collection of businesses are both better qualitatively and cheaper quantitatively than most. They are led by able management who understand the importance of quality operations and top-notch capital allocation.

We entered 2022 with a meaningful short exposure to over-valued, lower-quality businesses. Many of these businesses were priced to perfection and rely on assumptions that do not have any room for error. They also require low costs of capital (i.e., low interest rates).

We continue to maintain a large short credit position. Rates seem likely to go up and those who think they cannot lose money holding bonds will discover a cruel reality. Inflation will silently eat the returns of fixed income instruments and provide negative real returns. Additionally, as wage and commodity inflation persist, margins will be squeezed, and the underlying credit metrics will look worse.

We remain highly concentrated in the businesses we own. In times when the market dips, our CEOs know how to buy back their stock and make quality deals on behalf of the shareholders. I will continue to invest our capital with a long-term view and in a concentrated manner to focus on our best ideas. Please see below for a discussion on our top 5 holdings.

Top 5 Businesses We Own

AutoNation (~14% of AUM at year-end)

AutoNation, Inc. (NYSE:AN) is an example of what can happen when you marry excellent business operations with best-in-class capital allocation. Mike Jackson and his team have been able to reinvest in the business, grow ancillary businesses, acquire new dealerships all while buying back TONS of stock when the opportunity presents itself (27% of the company over trailing 12 months ending 9/30). Other companies should take notice and use AutoNation as a case study in compounding value for shareholders while also being a great corporate citizen.

Auto dealers have been over-earning on car sales due to a lack of inventory from the semiconductor shortage. It seems obvious that when the semiconductor shortage is resolved, more cars will become available and unit profitability will be reduced. In short, their earnings will likely decline in the 12 months following the inventory shortage and then resume their rise. Our longer-term horizon allows us the ability to own the business and not focus on a short-term issue. The semiconductor issue is likely to persist thru 2022 though this is a guess. Ultimately our long-term thesis on the business remains intact. If the business can extend its moat, maintain their pricing power, and remain important to both their customers and suppliers we will do fine.

Over the last 12 months ending September 30, 2021, the company has bought back 27% of the shares at a cost of ~$81.50. Given the stock has been trading at $100+ it has been a good investment on a mark-to-market basis. More importantly, we own 27% more of the company without having to lay out a single dollar of cash. It has a dramatic impact on my estimates of free-cashflow on a per-share basis.

Looking forward the Company should be able to generate $10-$14 per year in free-cash flow which means we likely own it somewhere between an 8-12% yield. Additionally, if AutoNation achieves modest levels of success with AutoNation USA (new used-car supercenters) it could add another $6-$12 of per share value to the business. Note that at current prices, very little in the way of AutoNation USA success is priced in.

Green Brick Partners (~11% of AUM at year-end) – previous unnamed homebuilder

Green Brick Partners Inc (NYSE:GRBK) is a residential land developer and homebuilder. Most of their operations are in Texas, Georgia, and Florida. GRBK was formerly a private partnership between Jim Brickman and entities related to Greenlight Capital (managed by David Einhorn). David is currently the Chairman of the Board.

There is a long-term fundamental supply/demand imbalance in housing inventory. This is a direct result of underproduction of new homes amid a challenging mortgage financing environment over the last 10+ years since the Great Financial Crisis. Looking forward we should have increased housing demand from millennials as they enter the family-phase of life and desire more space. Rates are still near historic lows and people are desiring more personal space as remote work becomes more acceptable.

It is rare to be able to partner with an excellent operator and an excellent capital allocator. As evidenced by our investment in AutoNation, when you marry those 2 concepts you can wind up with a wonderful result. GRBK has been reinvesting their cashflow in additional lots/land inventory. This masks the earnings power of the company. The company is valued somewhere between 6-10x steady-state earnings and potentially even cheaper than that. I tend to be more conservative given the potential for rate rises and inflationary increases in development costs. We have high-quality stewards at both the operating and Board level.

Seritage Growth Properties (~11% of AUM at year-end)

Seritage Growth Properties (NYSE:SRG) is the real estate formerly associated with Sears/Kmart. Most of the properties are in some form of redevelopment or sale. The stock screens terribly as the business is burning cash on an operating basis. This investment requires a longer-term view and understanding the quality of the real estate, the changing dynamics of their balance sheet/cash burn and longer-term earnings potential.

The real estate is bifurcated with some properties located at main/main with promising redevelopment opportunities. The company has been thoughtful in partnering with JV partners to lighten the financial burden on their redevelopment. At the same time management has been working on selling non-core assets both to raise cash and to focus on the projects that will move the needle. Historically it was unclear to investors what the 5–10-year focus would be, and it seemed like properties were only sold on an as-need basis. The new CEO has prioritized exiting these non-core assets and will benefit both their team and the shareholders with renewed focus on the remaining assets.

Currently the company has a $1.6BB term loan provided by Berkshire Hathaway. The loan bears interest at 7%. Recently Berkshire amended the loan to allow the company to repay the debt early as they sell properties and/or find alternate sources of debt. SRG is already taking advantage of this by paying down the debt from recent sales. Additionally, as their projects begin producing cashflow they can get mortgages at far lower cost further reducing the cash burn.

If I am being coy on what I think the potential earnings power and asset-value is, you’re correct! This has been a stock that has been selling off dramatically in 2022 and I am more interested in keeping some of that work in-house as I contemplate our investment in the business. Roughly speaking I think the downside is fairly limited and can see outcomes that result in us making 2-3x over a 5–7-year period.

Berkshire Hathaway (~10% of AUM at year-end)

Please see Q1 2021 letter for our Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B) on a Napkin investment exercise. We have written on it extensively and will save your eyeballs from extraneous reading.

Berkshire is cheap for owning such high-quality businesses and will continue to grind higher and compound value for us.

Builders FirstSource (~9% of AUM at year-end) – previously unnamed homebuilder related investment

Builders FirstSource, Inc. (NYSE:BLDR) is a supplier and manufacturer of building materials for professional homebuilders, subcontractors, remodelers, and consumers. Their products include factory-built roof and floor trusses, wall panels and stairs, vinyl windows and custom millwork.

Please refer to some of the discussion on GRBK above. The fundamental discussion about homebuilders applies to BLDR. As more homes are built across the country, there will be an increased need for scaled sourcing of products to homebuilders. There is a large amount of fragmentation in the supply chain which provides BLDR a long runway for acquisitions and realistic synergies.

The management team has de-levered the business from above 5x to 1-2x and has been using their prodigious free cash flow to both acquire new businesses and buy in their stock. While I historically always liked their business, their historic high-debt levels gave me pause. They have right sized their balance sheet and are taking a very thoughtful view on capital allocation on behalf of shareholders.

BLDR should be able to generate $7-$10 a share in cash in the medium term with significant upside if they can scale through acquisition and/or further penetrate existing markets. We own it at a 10-14% free-cash flow yield so little growth is needed for us to compound value at high rates.

In Closing

Thank you to our terrific service providers: BTIG (prime broker), EisnerAmper (tax/audit), Kleinberg Kaplan (legal), Opus Fund Services (fund administration). They have been great partners for the last 5 years and help me keep the business humming.

Looking for ideas in a vertical market is not as much fun as when people are more circumspect. Our prospects looking forward are promising and I am optimistic we are entering a period where fundamental analysis and judgement can be more properly rewarded.

Wishing everyone a happy and healthy 2022.

Thank you for your trust and support.

Black Bear Value Partners, LP

Updated on