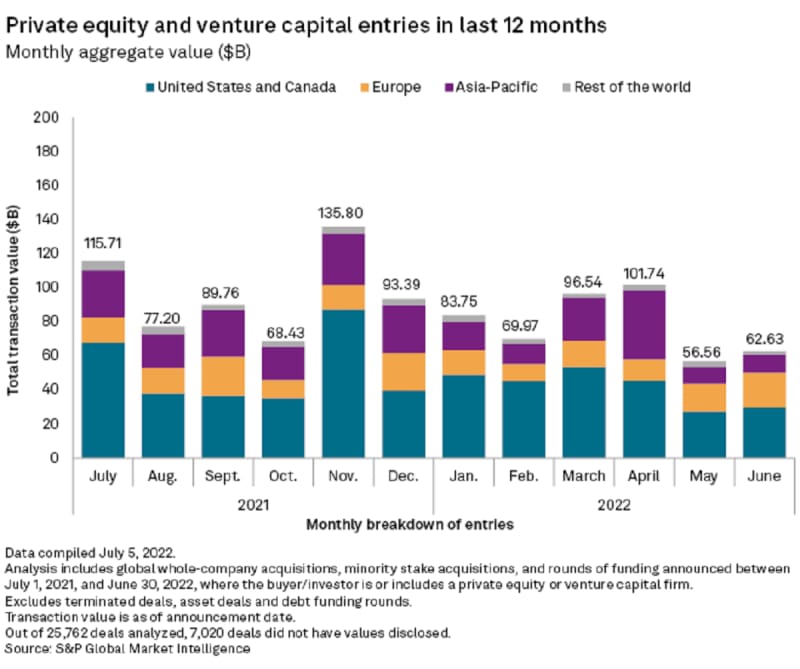

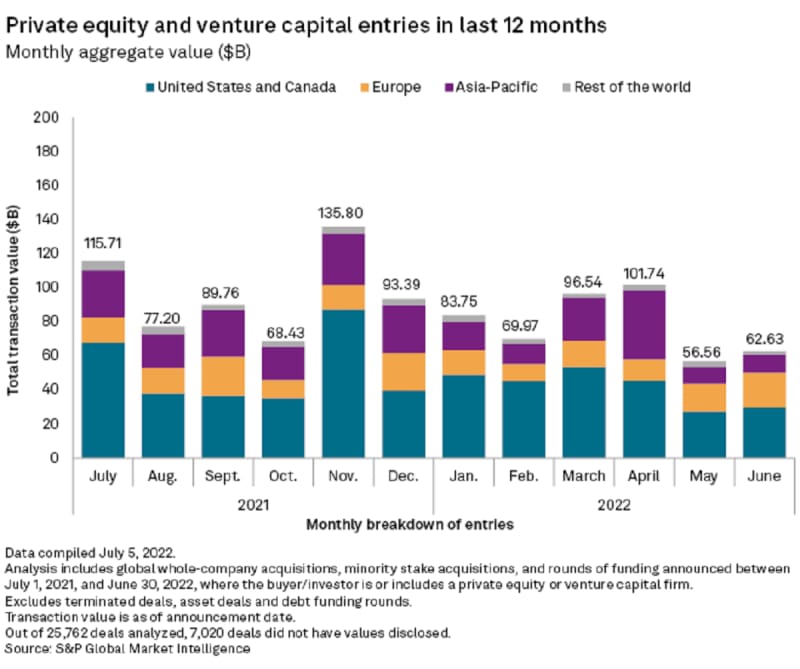

There were 1,813 deals announced during the month, a 32.6% decline from 2,691 transactions year over year.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Private Equity And Venture Capital Deal Value Shrinks

Key highlights from the analysis include:

- The U.S. and Canada accounted for most of the deals in June with 590 transactions at an aggregate valuation of $29.92 billion. Asia-Pacific came in next with 567 deals totaling $10.51 billion, followed by Europe, which saw 525 transactions worth $20.26 billion.

- For the second quarter, total transaction value slipped 29.4% to $220.92 billion from the same quarter the previous year, while the number of announced deals fell about 20.5% to 5,393.

- The technology, media and telecommunications sector pulled in $28.04 billion from private equity and venture capital firms in June, the biggest transaction value among all industries, although it was way down from the $48.13 billion booked in the year-ago period.

- Companies in the healthcare industry received $9.06 billion, a significant decline from $42.57 billion a year ago. Investment in the industrial sector grew to $8.07 billion from $7.85 billion.

Updated on