While announcing no signed deal, the company said it received an offer for one unit and remains committed to continue process.

The company said it received “a preliminary, nonbinding proposal to acquire an approximately $200 million revenue business unit of Exela” XELA also confirmed it’s in active talks with several counterparties about more acquisition proposals.

Q2 2022 hedge fund letters, conferences and more

Exela said on June 6 that it would shop its noncore assets to focus on increasing shareholder value. If successful, the company can pay down debt and buy back shares. Both those moves generate cost savings that the company uses to buy its shares, supporting stable demand and decreasing the public float. In theory, the move will boost the share price.

The company's strategic decision to divest the assets follows a one-year, roughly 97%, 52-week share price collapse. While there's no agreed transaction, management is proving serious about addressing investor concerns.

Since Fintel analysts last wrote about Exela, the company said it renewed a five year, $19 million contract with an Irish bank and long time customer and inked a new three year, $136 million contract with XBP.

Exela reported that the year-to-date total contract value stood is $175 million on June 22.

Retail and institutional investors accumulated XELA shares this year as their value neared zero, Fintel research shows.

Institutional ownership remains above average at 64.46; not highly bullish, but above average.

Eighty institutions own 19.9 percent of the company's float or about 88 million shares. Seventy-two of these institutions are long only holders. Two are short only and trade long and short positions.

The graph at the right illustrates the last five years' institutional ownership data.

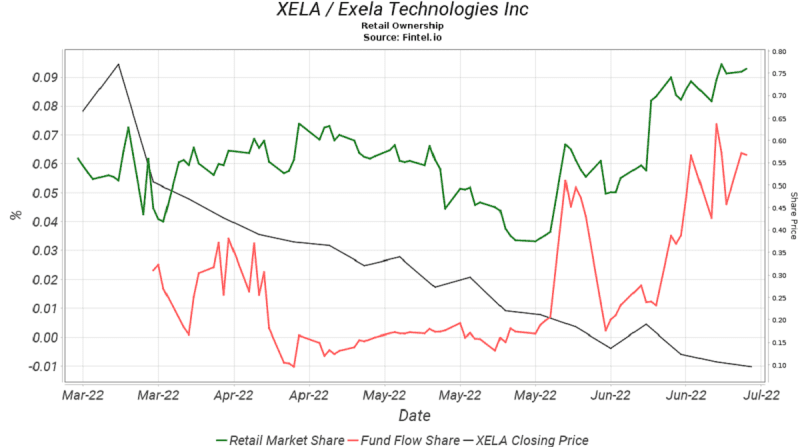

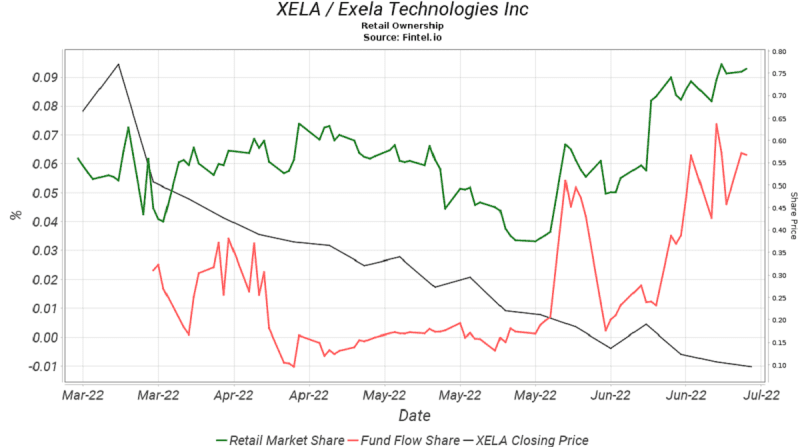

For comparison, the following chart reveals the retail market share of investors that have linked their portfolio for free with the Fintel platform.

The graph shows rising retail ownership and fund flows in late June and July as the company's reorganization becomes clearer.

Article by Ben Ward, Fintel

Updated on