By Mohammed Kudrati

Viral social media posts claiming that Goods and Services Tax (GST) would be levied at a rate of 18% on crematorium services, are misleading. BOOM found that while a recent increase in the GST rates by the GST Council did cover contract work for several infrastructure projects including crematoriums, from 12% to 18%, it did not cover the services provided by the crematorium itself.

The services provided by the crematorium to the deceased persons is neither considered to be a good or a service from GST according to the GST Act.

The claim is being made satirically, implying to show how unpopular the policies of the government are.

The context behind this claim is a recent change by the GST Council to levy GST on several commonly used goods and services which earlier excluded from it like pre-packaged and pre-labelled foods and hospital beds. The GST Council is the inter-governmental common platform consisting of the union government and the states (and union territories with legislature) to frame the rules on GST.

Examples of claim on social media mentioned above can be seen below.

FactCheck

The Council's hike to 18% from 12% covers contract works undertaken for infrastructure items, including crematoriums and not the crematorium service itself.

1. The GST Council's rate changes

One of the categories was work contracts for infrastructure items, with the GST Council's release stating the examples for them as bridges, roads, metros, effluent treatment plants and crematorium.

The GST levied on them is 18%, effective July 18, compared to the 12% levied on them earlier. It was done to rationalise an 'inverted duty structure' - when taxes on the input products is greater than that on the finished product.

The list with those categories facing a rate rationalisation to correct an inverted duty structure can be seen below.

It can be found here.

2. Crematorium, moratorium and services for the deceased

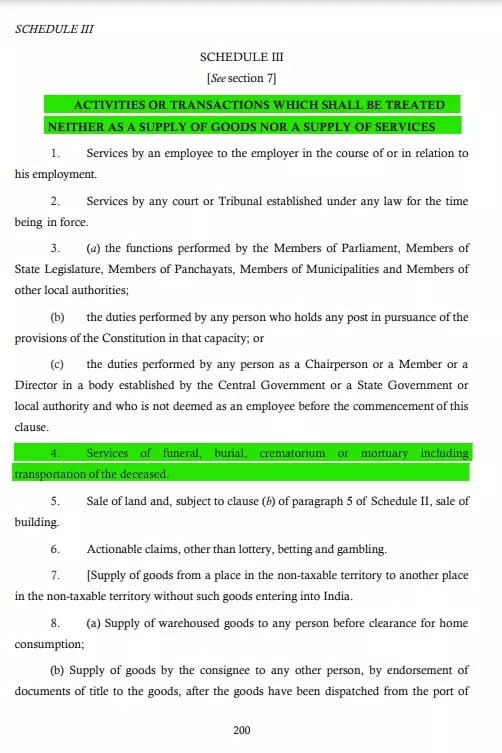

The GST Act, 2017, the governing act for the GST ecosystem in India, does not consider the services provided for the deceased: moratorium, crematorium services and services in transporting the dead as either a good or a service on which tax is be levied.

The GST Act, 2017, has this provision in the third schedule.

Here a screenshot of the provision as presented in the Act (amended as of January 1 this year).

The Act can be found here.

The government too has denied these claims through the Press Information Bureau's factchecking unit.

Also Read: Is India No More World's 3rd Largest Economy? A FactCheck