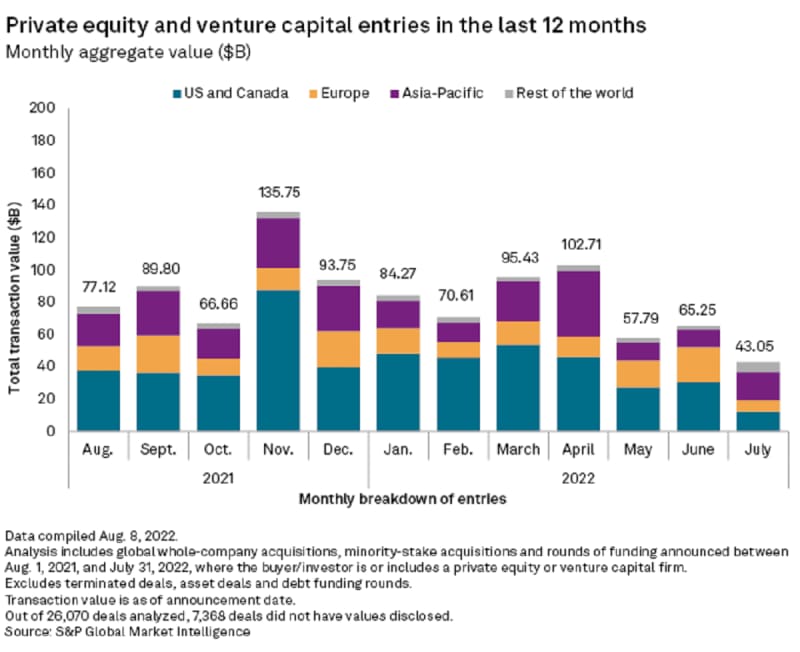

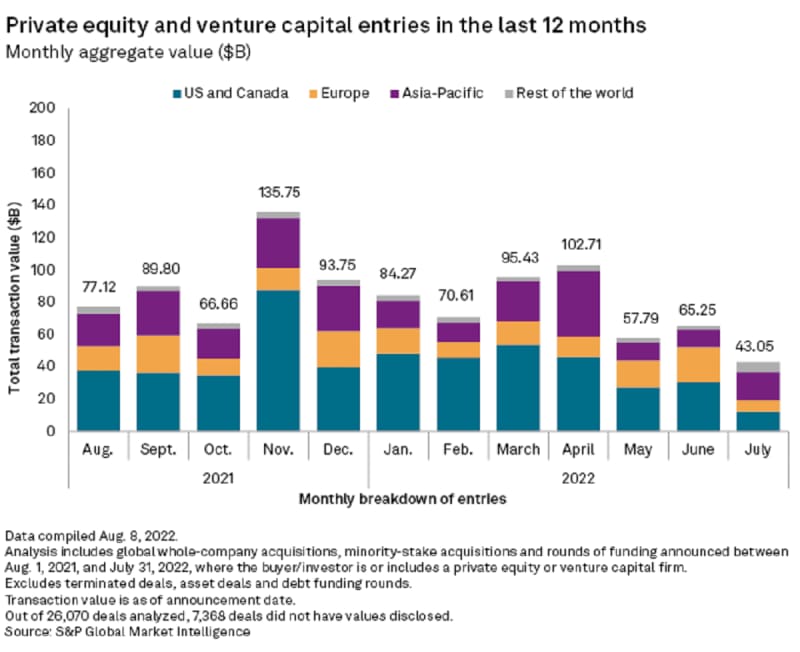

July 2022 saw a total of 1,579 transactions, a 29.2% decline from the 2,231 deals booked in July 2021.

Q2 2022 hedge fund letters, conferences and more

Key highlights from the analysis include:

- The total transaction value year-to-date was $519.12 billion, down 25.7% year over year. The number of deals announced in 2022 also fell behind the pace set in the previous year, with 14,411 entries recorded between Jan. 1 and July 31, compared to 14,946 transactions in the same period in 2021.

- Asia-Pacific accounted for most of the deals in July, leading with 554 deals worth a combined $17.28 billion. The U.S. and Canada came in next with 516 deals totaling $12.34 billion. Firms in Europe tallied 432 deals with a total value of $7.14 billion.

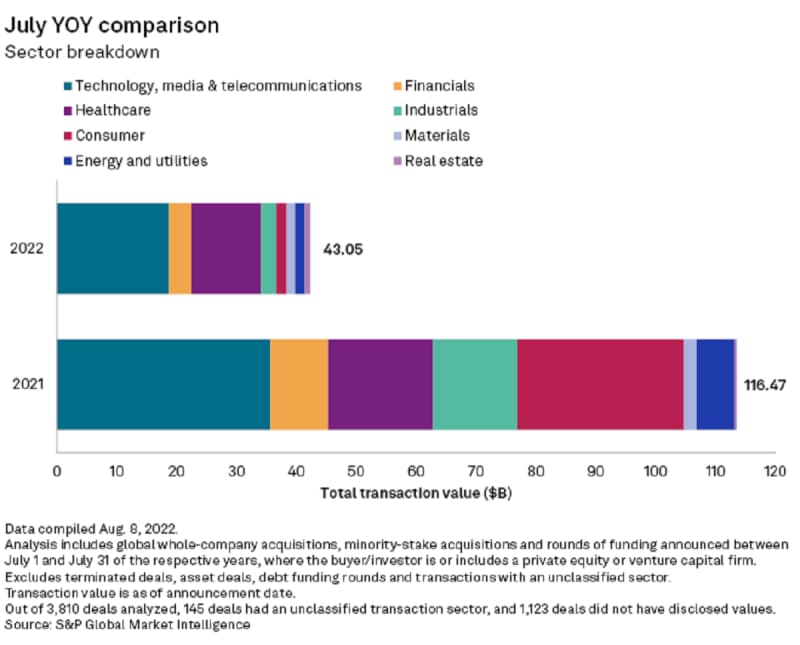

- The consumer sector saw the greatest year-over-year decline in terms of private equity investment, with companies accruing $1.78 billion in total deal value, a 93.6% decrease from July 2021.

- The technology, media and telecommunications sector attracted the most capital from private equity and venture capital firms during the month, pulling in $18.71 billion in total transaction value, but that figure was down more than 47% from the $35.69 billion recorded in July 2021.

- Companies in the healthcare industry garnered $11.67 billion in July, down 33.5% from the same month a year ago.

- Financial companies collected $3.79 billion, compared to $9.6 billion worth of deals announced in July 2021.

Updated on